Minor operational scale (Daily)

How will the main currency pairs interact with each other? Options for the development of the movement of EUR/JPY & GBP/JPY (H4) on September 11, 2020.

____________________

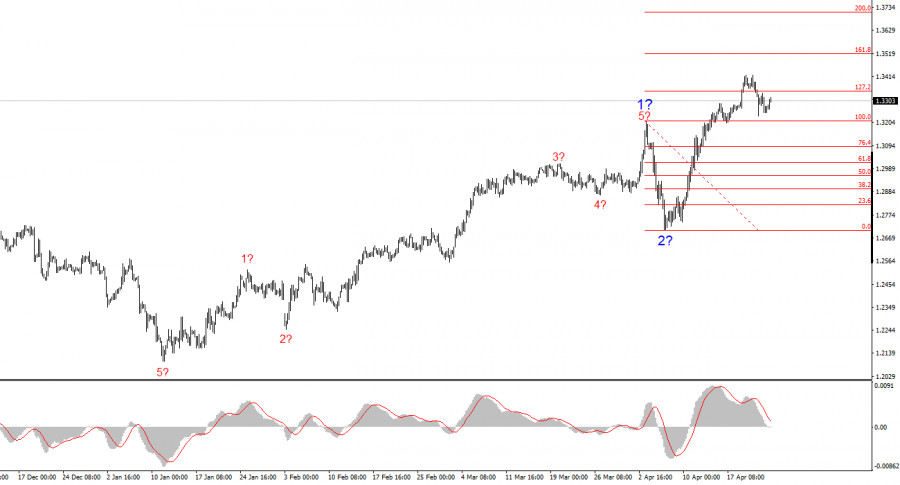

Euro vs Great Britain pound

The movement of the "main" cross-instrument EUR/GBP from September 11, 2020 will occur depending on the development and direction of the breakdown of the boundaries of the equilibrium zone (0.9115 - 0.9185 - 0.9260) of the Minute operational scale fork - details of working out the specified levels of the equilibrium zone are shown on the animated chart.

A breakdown of the resistance level of 0.9260 at the upper border of the ISL61.8 balance zone of the Minute operational scale forks will make it relevant to continue the development of the EUR/GBP movement to the warning line UWL61.8 (0.9320) of the Minor operational scale forks and it will be possible to update the local maximum of 0.9498 if it breaks through.

If the lower boundary of ISL38.2 is broken through the equilibrium zone of the Minute operational scale fork - support level of 0.9115 - a downward movement of the "main" cross-instrument may develop towards the targets:

- 1/2 Median Line Minor (0.9065);

- initial line SSL (0.9045) of the Minor operational scale fork;

- lower border of the channel 1/2 Median Line Minor (0.8935);

- initial line SSL Minute (0.8905);

- control line LTL Minute (0.8885);

- local minimum 0.8865;

- with the prospect of reaching the level of 0.8670.

Details of the EUR/GBP movement since September 11, 2020 are shown on the animated chart.

___________________

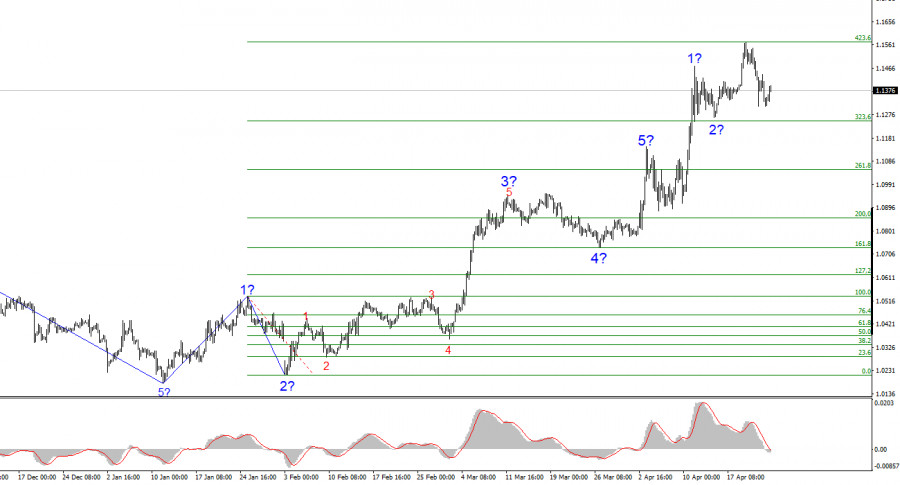

Euro vs Japanese yen

The development of the movement of the EUR/JPY cross-instrument from September 11, 2020 will proceed taking into account the development and direction of the breakdown of a fairly wide range:

- resistance level of 126.35 - the final FSL line of the Minor operational scale fork;

- support level of 125.20 - the upper border of the channel 1/2 Median Line of the Minute operational scale fork.

In case of breakdown of the resistance level 126.35 on the final FSL line of the Minor operational scale fork, the movement of EUR/JPY will be directed to the levels:

- 126.75 - SSL Minute initial line;

- 127.04 - local maximum;

- 127.45 - UTL Minute control line;

- with the prospect of reaching the warning lines - UWL38.2 (128.35) and UWL61.8 (129.60) - of the Minor operational scale fork.

The breakdown of the support level of 125.20 will determine the development of the movement of this cross-instrument in the 1/2 Median Line channel (125.20 - 124.63 - 124.00) of the Minute operational scale fork, and in case of a breakdown of the lower boundary (124.00) of this channel, the downward movement can be continued to the boundaries of the equilibrium zones of the operational scales - Minute (123.10 - 121.95 - 120.80) and Minor (122.60 - 121.45 - 120.25).

We look at the EUR/JPY movement options from September 11, 2020 on an animated chart.

____________________

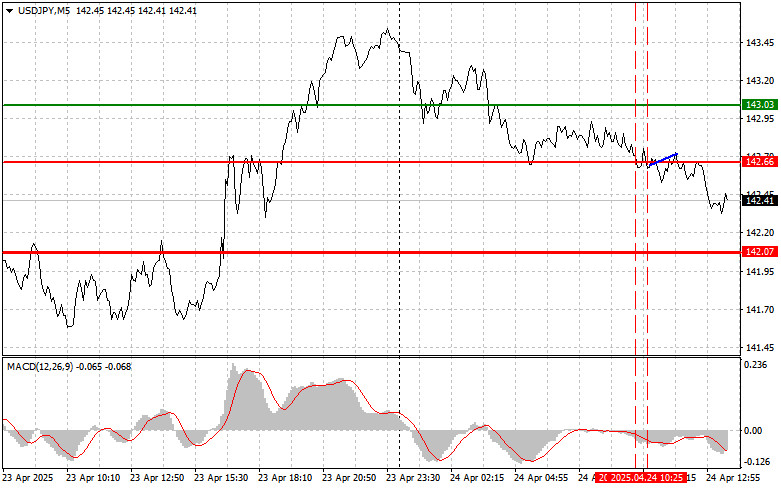

Great Britain pound vs Japanese yen

From September 11, 2020, the movement of the GBP/JPY cross-instrument will also develop depending on the development and direction of the range breakdown:

- resistance level of 137.75 - the lower border of the channel 1/2 Median Line of the Minute operational scale fork;

- support level of 136.70 - the upper border of ISL38.2 of the equilibrium zone of the Minute operational scale fork.

In case of a breakdown of the resistance level of 137.75, the movement of GBP/JPY will continue in the 1/2 Median Line channel (137.75 - 138.90 - 139.95) of the Minute operational scale fork, the breakdown of the upper border (139.95) of this channel will make the continuation of the upward movement of this cross-instrument to the targets:

- SSL Minute initial line (141.95);

- local maximum 142.69;

- control line UTL Minute (143.25);

- with the prospect of reaching the final Shiff Line Minor (144.77) and the lower boundary ISL38.2 (145.30) of the balance zone of the Minor operational scale.

The breakdown of ISL38.2 Minute - support level of 136.70 - followed by breakdown of level 136.15 - a variant of the development of the GBP/JPY movement within the equilibrium zone (136.70 - 134.85 - 133.05) of the Minute operational scale fork and the 1/2 Median Line channel (136.15 - 133.50 - 130.70 ) of the Minor operational scale fork with the prospect of reaching the warning line LWL38.2 Minor (128.95).

For details of the development of the GBP/JPY movement from September 11, 2020, see the animated chart.

____________________

The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders).