Outlook on August 12:

Analytical overview of popular currency pairs on the H1:

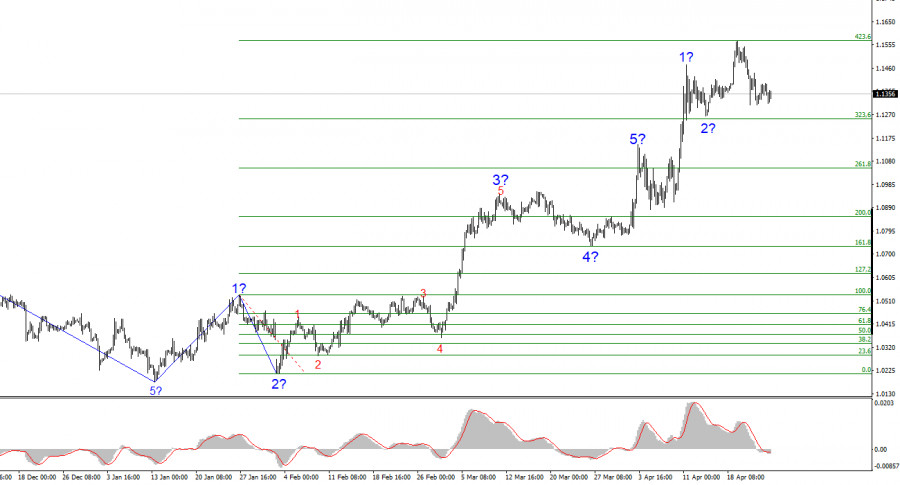

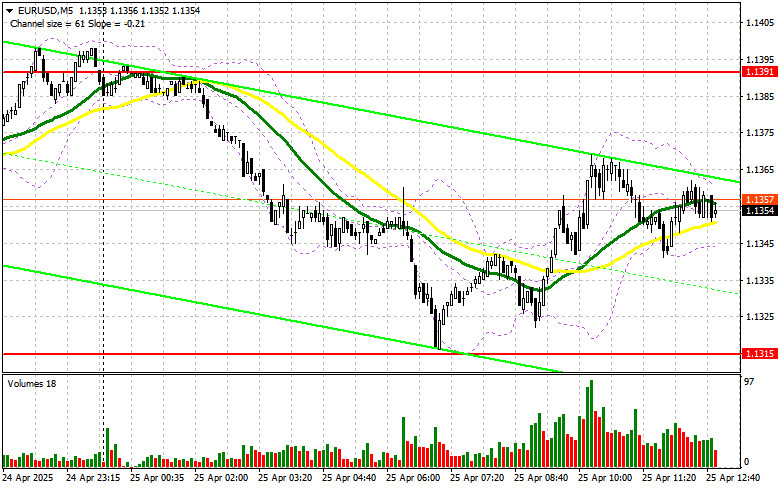

The key levels for the EUR/USD pair are 1.1773, 1.1761, 1.1741, 1.1729, 1.1705, 1.1694, and 1.1671. The price has been moving in a downward trend since July 30. Here, we expect a short-term decline in the range of 1.1705 - 1.1694, hence a key upward reversal is expected. The final potential downward target is 1.1671, which is the limit value for the downward trend from July 30.

The price is likely to consolidate in the range of 1.1729 - 1.1741. If the latter is broken, a deep correction will occur. The target is set at 1.1761. The key support for the downward trend is the range of 1.1761 - 1.1773. We expect the formation of an upward trend up to the level of 1.1773.

The main trend is the downward trend from July 30, approaching the limit values.

Key levels of structure development:

Upward resistance: 1.1743 Target: 1.1760

Upward resistance: 1.1762 Target: 1.1773

Downward resistance: 1.1705 Target: 1.1696

Downward resistance: 1.1692 Target: 1.1680

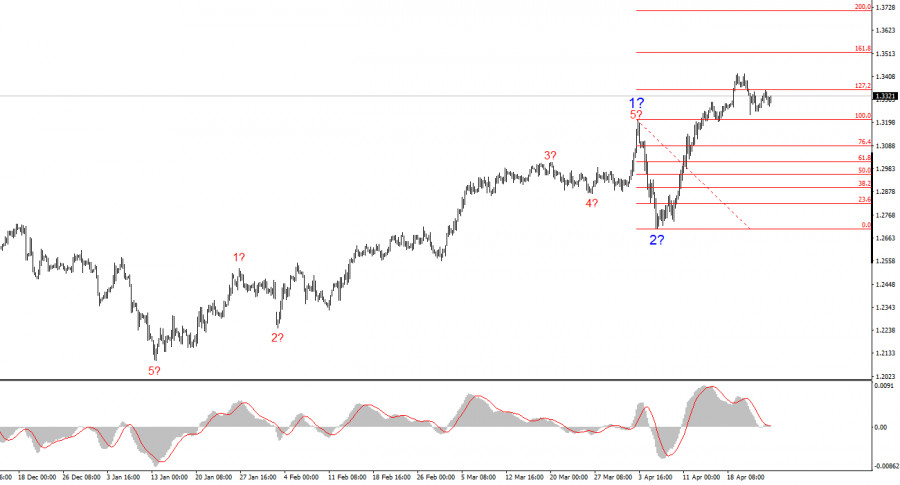

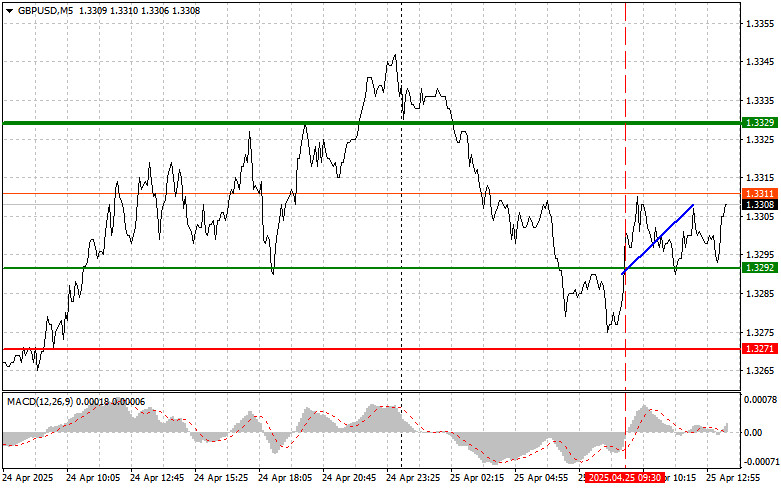

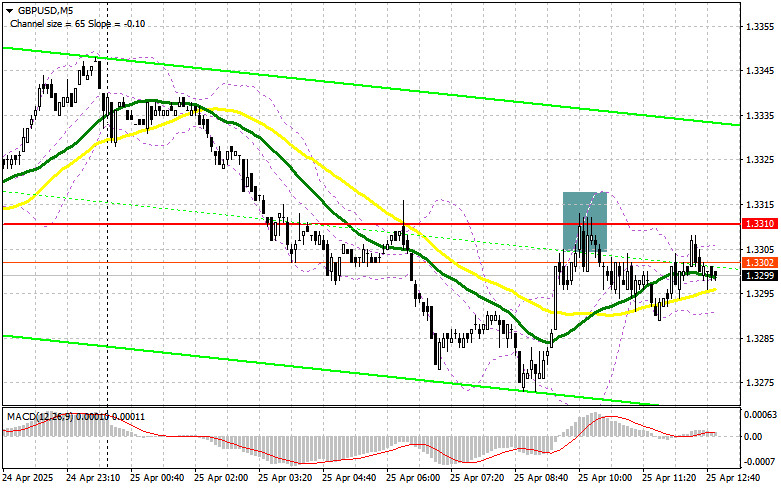

The key levels for the GBP/USD pair are 1.3934, 1.3897, 1.3870, 1.3831, 1.3813, 1.3781, 1.3749, 1.3728 and 1.3683. The downward trend from July 29 is expected to further develop after the price breaks through the noise range of 1.3831 - 1.3813. The target is set at 1.3781 and the price may consolidate near it. If the indicated target is broken, a strong decline will resume to the next target of 1.3749. After that, the price may consolidate in the range of 1.3749 - 1.3728. The ultimate potential downward target is 1.3683. After reaching it, an upward pullback can be expected.

A short-term growth, in turn, is expected in the range of 1.3870 - 1.3897. If the latter is broken, a deep correction will occur. The target is set at 1.3934, which is also the key support level.

The main trend is the downward trend from July 29.

Key levels of structure development:

Upward resistance: 1.3870 Target: 1.3895

Upward resistance: 1.3899 Target: 1.3934

Downward resistance: 1.3813 Target: 1.3781

Downward resistance: 1.3779 Target: 1.3750

The key levels for the USD/CHF pair are 0.9271, 0.9244, 0.9232, 0.9213, 0.9200 and 0.9174. The price has been moving in a bullish trend since August 4. Now, we expect a short-term growth in the range of 0.9232 - 0.9244, from which a downward reversal is expected. The final potential upward target is 0.9271, which is the limit value.

A short-term decline is likely in the range of 0.9213 - 0.9200. If the latter is broken, a deep correction will occur. The target is set at 0.9174, which is also the key support level.

The main trend is the upward trend from August 4.

Key levels of structure development:

Upward resistance: 0.9246 Target: 0.9270

Rising Resistance: Target:

Downward resistance: 0.9213 Target: 0.9201

Downward resistance: 0.9198 Target: 0.9176

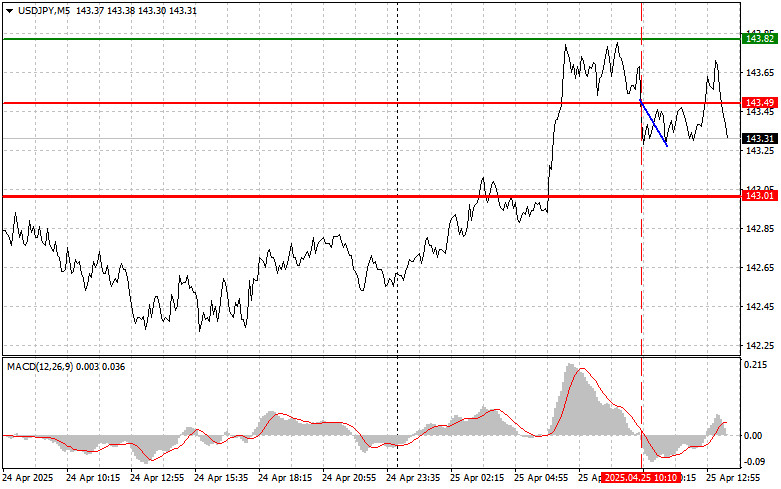

The key levels for the USD/JPY pair are 111.70, 111.24, 111.04, 110.73, 110.48, 110.29, 110.08, and 109.92. The price has been moving in an upward trend since August 4. We expect this trend to continue after the level of 110.75 is broken. The target is set at 111.04. After that, short-term growth and consolidation can be expected in the range of 111.04 - 111.24. The ultimate potential upward target is 111.70. After reaching it, a downward pullback can be expected.

A short-term decline is possible in the 110.48 - 110.29 range. If the latter is broken, a deep correction will occur. The target is set at 110.08 and the key support is in the range of 110.08 - 109.92. We expect the formation of a downward potential up to the level of 109.92.

The main trend is the upward trend from August 4.

Key levels of structure development:

Upward resistance: 110.75 Target: 111.04

Upward resistance: 111.06 Target: 111.24

Downward resistance: 110.48 Target: 110.31

Downward resistance: 110.27 Target: 110.08

The key levels for the USD/CAD pair are 1.2741, 1.2691, 1.2631, 1.2594, 1.2495, 1.2459, 1.2420, 1.2364, 1.2327 and 1.2240. The formation of the upward trend from July 30 is being followed. We expect this trend to develop after the level of 1.2594 is broken. The first target is set at 1.2631 and the price may consolidate near it. If the first target is broken, it should be accompanied by strong growth to the next target of 1.2691. The final potential upward target is 1.2741. After reaching it, a downward pullback can be expected.

Meanwhile, a short-term decline is possible in the range of 1.2495 - 1.2459. If the last value is broken, it will dispose to the subsequent development of the downward trend from July 19. The first target is 1.2420.

The main trend is the upward trend from July 30.

Key levels of structure development:

Upward resistance: 1.2594 Movement target: 1.2630

Upward resistance: 1.2632 Movement target: 1.2690

Downward resistance: 1.2495 Movement target: 1.2462

Downward resistance: 1.2457 Movement target: 1.2365

The key levels for the AUD/USD pair are 0.7428, 0.7407, 0.7382, 0.7367, 0.7329, 0.7291, 0.7254, 0.7237 and 0.7192. The price has been moving in a downward trend since August 4. We expect this trend to extend after the level of 0.7329 is broken. The target is set at 0.7291 and the price may consolidate near it. If this target is broken, a strong decline will develop to the target of 0.7254. After that, a short-term decline can be expected in the 0.7254 - 0.7237 range. The ultimate potential downward target is 0.7192. After reaching it, an upward pullback can be expected.

On the other hand, short-term growth is expected in the 0.7367 - 0.7382 range. If the latter is broken, a deep correction will occur. The target is 0.7407, which is also the key support level.

The main trend is the formation of a downward trend from August 4.

Key levels of structure development:

Upward resistance: 0.7367 Movement target: 0.7380

Upward resistance: 0.7384 Movement target: 0.7407

Downward resistance: 0.7327 Target of movement: 0.7293

Downward resistance: 0.7289 Target of movement: 0.7256

The key levels for the EUR/JPY pair are 130.51, 130.28, 129.93, 129.67, 129.39, 129.15, 128.82, 128.52, and 128.21. The price has been moving in a downward trend since July 29, but it is currently in a correction. We expect this trend to resume after the breakdown of 129.39. The first target is set at 129.15. Its breakdown will continue the development of the main downward trend from July 29. Here, the target is 128.82, whose breakdown will allow us to move to the next target of 128.52. The price may consolidate near it. The final potential downward target is 128.21. After reaching it, an upward pullback will occur.

Alternatively, short-term growth is possible in the range of 129.67 - 129.93. If the last value is broken, it will encourage the formation of an upward trend. The first potential target is 130.28. We expect a short-term growth and consolidation in the range of 130.28 - 120.51.

The main trend is the downward trend from July 29, correction stage.

Key levels of structure development:

Upward resistance: 129.68 Movement target: 129.91

Upward resistance: 129.95 Movement target: 130.28

Downward resistance: 129.37 Target of movement: 129.16

Downward resistance: 129.13 Movement target: 128.84

The key levels for the GBP/JPY pair are 154.34, 153.89, 153.31, 153.03, 152.46, 152.16, 151.66, and 151.14. We are following the development of the local bullish trend from August 3. In this case, we expect a short-term growth in the range of 153.03 - 153.31. If the latter is broken, strong growth will resume to the target of 153.89. The ultimate potential upward target is 154.34. After reaching it, the price may consolidate and pull back downwards.

In turn, a short-term decline is possible in the 152.46 - 152.16 range. If the last value is broken, a deep correction will occur. The target is set at 151.66, which is also the key support level.

The main trend is the mid-term upward trend from July 20, deep correction stage.

Key levels of structure development:

Upward resistance: 153.03 Movement target: 153.30

Upward resistance: 153.36 Movement target: 153.89

Downward resistance: 152.45 Target of movement: 152.17

Downward resistance: 152.12 Movement target: 151.70