Yesterday, the greenback lost almost 0.6% against its main rivals, including the euro.

On Monday, the US dollar stopped its four-day winning streak, giving away profits received in the previous session and rolling back to Friday's levels.

The recent jump in USD was driven by the US Personal Consumption Expenditure Price Index (PCE), which rose by 0.6% last month after increasing by 0.2% in December. In annual terms, the indicator accelerated by 5.4% after rising by 5.3% a month earlier.

"Inflation remains too high and the latest data reinforces my view that we still have a long way to go to bring inflation down to our 2% target," Boston Fed President Susan Collins said in a statement.

"The PCE price index report indicates that more effort will be needed from the Fed to put inflation on a sustained path down to 2%," Cleveland Fed President Loretta Mester said.

The latest data cast doubt on the assertions of Fed Chairman Jerome Powell about the start of a disinflationary process in the United States.

This sentiment seemed to be shared by most FOMC members and justified the central bank's decision to raise interest rates by 25 basis points at its monetary policy meeting on January 31-February 1 after a string of larger moves in 2022.

"If the Fed had received this data at the last meeting, it would probably have raised rates by 50 basis points, and Jerome Powell's stance at the press conference would have been very different," strategists at Cetera Investment Management said.

Fed officials speaking on Friday did not push for a return to last year's massive rate hikes, suggesting the central bank is content with a gradual tightening for now, despite signs that inflation is not declining as they had hoped.

It is expected that the Fed will increase the cost of borrowing by another 25 basis points at its next meeting on March 21-22.

However, some analysts see the possibility of raising rates by 50 basis points if inflation remains high and US economic growth is strong.

"We now believe that the likelihood of a 50 basis point Fed rate hike in March is much higher. We estimate the chances of such an outcome at about 60%," NatWest experts noted.

Barclays experts also do not rule out an increase in the cost of borrowing in the US next month by 50 basis points at once.

According to the CME Group, 76% of traders expect the Fed to hike the key rate in March of 25 basis points, while 24% predict a rise by 50 basis points.

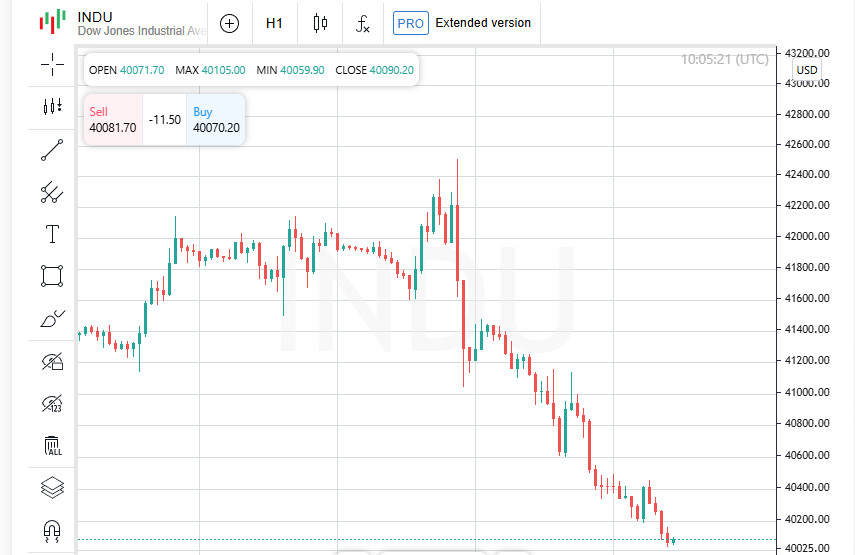

The prospect of more robust US inflation, which requires more consistent monetary tightening from the Fed, saw Wall Street's key indicators suffer their biggest weekly losses of the year on Friday.

Over the past week, major US stock indices have lost an average of 3%.

"We have learned that US inflation is proving to be much more stubborn and US activity more resilient than we anticipated in December and January. It is clear that investors are now more serious about the statements of the Fed hawks and have priced in three more rate hikes of 25 basis points in March, May, and June," ING strategists said.

The derivatives market expects the Fed's key rate to peak at 5.4% this year, although a month ago the maximum rate was estimated at 5%.

Traditionally, the Fed raises the rate to support the US currency.

While the US stock market was knocked out by the PCE price index, the dollar hit seven-week highs at 105.30 on Friday and posted its biggest weekly gain since late September 2022, gaining more than 1.3%.

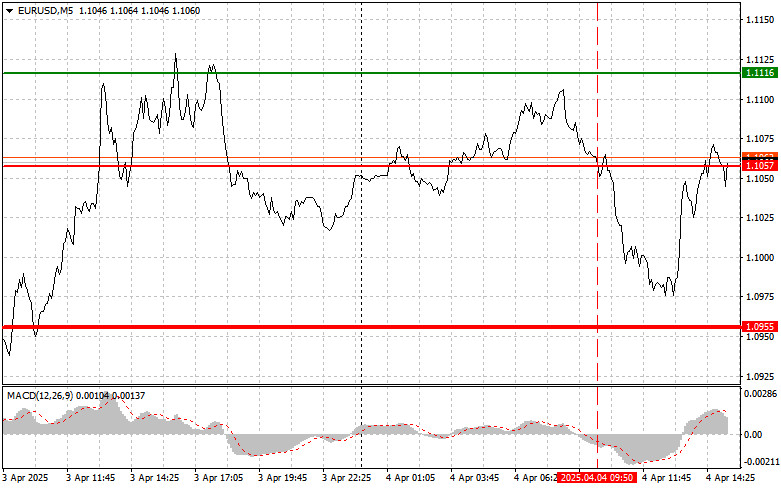

Meanwhile, EUR/USD came under bearish pressure on Friday and went down by about 0.5% to close the day near 1.0545. As a result, the pair lost about 150 pips.

On Monday, the greenback retested multi-week highs and approached 105.40 but failed to hold on to these levels and retreated, following the decline in US Treasury yields.

The demand for USD weakened after the release of disappointing data on US durable goods orders for January.

Last month, the indicator fell by 4.5% compared to December when it jumped by 5.1%.

In addition, renewed risk appetite has left USD on the sidelines.

American stock indices finished yesterday's trading with a moderate rise, recovering by 0.2-0.6% after a sharp decline in the previous week.

Taking advantage of the general weakening of the dollar, EUR/USD managed to recover from multi-week lows in the range of 1.0535-1.0530. The pair gained over 60 pips on Monday and closed in positive territory for the first time in five days, hitting 1.0610.

On Tuesday, the greenback sank to its lowest level since Thursday, reaching the area of 104.40. Later, it managed to win back all the daily losses, rising by about 0.2% from the previous close near 104.60.

The resumption of growth in Treasury yields on Tuesday after a modest retreat on Monday served as a tailwind for USD.

Deteriorating risk sentiment also helped the US dollar to recover.

The "rally of relief" after the correction in equity markets on Friday caused by a negative surprise in the US PCE price index turned out to be short-lived.

Wall Street's key indices were down again on Tuesday.

Traders continue to assess the risks of further tightening of the monetary policy by major central banks in the context of stubbornly high inflation.

Back in January, investors were confident that a slowdown in economic growth would prompt Fed officials to pause the cycle of aggressive rate hikes but strong data has since changed this view.

As a result, investors are reconsidering their soft-landing scenario and are worried that major central banks could tighten monetary conditions too much in response to positive data, triggering a deep recession.

"The market is aware that inflationary pressures in developed countries, namely in the US and the eurozone, are more stable than previously thought," Commerzbank said.

"This is a positive factor for the US dollar because the Fed is seen as being more proactive compared to the ECB. Thus, the EUR/USD levels near 1.1000 have not proved sustainable yet. The pair may struggle to stay above 1.0600 in the coming months," they said.

Nordea strategists expect EUR/USD to drop occasionally to 1.0300 until the summer.

"We assume that the Fed and other central banks will continue to raise rates more than previously expected to tighten financial conditions and reduce inflation. Thus, a rate hike by the Fed would support the dollar, and risk-free market conditions associated with higher interest rates could put pressure on equity markets, further boosting interest in the safe-haven greenback," they said.

Societe Generale believes that the EUR/USD pair will remain under downward pressure.

"The problem facing the ECB, as well as the Fed, is that it may have to extend the tightening cycle and thereby force a harder downturn in the economy. This could lead to a fall in stocks and credit markets. Since the beginning of the year, European securities have been outperforming their American counterparts, and the re-convergence will be a test of the prerequisites for the strengthening of the EUR/USD pair," bank economists said.

"The major currency pair has recently dropped by five figures over the past month on the back of a possible 60-basis-point rate hike implied Fed tightening. If the markets revise the rate forecast to 6%, it would be unwise to rule out further selling," they added.

Stronger-than-expected data from the United States boosted yields in the US more than anywhere else and pushed the dollar higher against most currencies for the first time since it hit a cyclical peak last September, analysts at Capital Economics said.

"While the resilience of the US economy will allow the dollar to remain strong in the near term, we hold the view that recessions in most advanced economies and reduced risk appetite will eventually be the factor that returns USD to its cyclical high later this year," they said.

Despite a recent bout of weakness, the greenback has gained 2.5% since early February and is close to posting its first monthly rise since last September.

The 10-year US Treasury yield could rise by about 40 basis points in a month.

The S&P 500 was down by more than 2% in February after a 6% jump in January.

The market is now waiting for data on the US consumer price index which will be released on March 14.

The data will have an impact on the Fed's policy on interest rates, as well as show whether the efforts of the central bank to slow inflation to the target level are bearing fruit.

If fresh numbers point to accelerating US disinflation, stock markets could turn bullish again, thus triggering a return to the dollar's downtrend.

"But if instead the data released during March confirm the worst-case inflationary no-landing scenario, the resulting March madness could send the 10-year Treasury bond yield above its most recent high of 4.25% on October 24 and the S&P 500 tumbling toward its bear-market low of 3,577.03 on October 12," Yardeni Research said.

In such a scenario, USD is sure to continue the uptrend and EUR/USD is set to decline.

"The repricing of the higher interest rate and reduced expectations of interest rate cuts later this year has breathed new life into last year's strong US dollar trading," MUFG Bank economists said.

They believe that the recent greenback bounce has room for further development in the near term.

"After a break above 105.00, USD could retest its yearly high of 105.63 and then the 200-day moving average in the area just below 106.50," MUFG Bank strategists said.

MUFG believes that the US dollar is the main driver of the EUR/USD exchange rate.

"We expect the pair to fall back to the support at 1.0330 near which the 200-day moving average runs," the experts said.

Meanwhile, analysts at Pantheon Macroeconomics believe that data on the consumer price index, which should be published before the next FOMC meeting, will dispel some of the market's fears.

However, investors are unlikely to willingly sell the US currency until they become familiar with the next consumer price index data.

In addition, the market admits that the path of inflation returning to the Fed's target of 2% may be longer and more tortuous.

"Inflation is likely to mean stability and upside potential for the US dollar in the near term, given the low unemployment rate. However, we expect this upside to be more limited, with EUR/USD targeting 1.0500 for the first half of this year," Bank of America said.

"We maintain our overall view on the currency market and believe that the overvaluation of the US dollar determines the long-term outlook, including our forecast of 1.1000 for the EUR/USD pair at the end of the year," they added.

On Tuesday, the major currency pair tried to extend the growth recorded on Monday but failed to maintain positive momentum amid deteriorating market sentiment.

The immediate obstacle for EUR/USD is seen at 1.0620 (the 50-day moving average), followed by 1.0660 (the 23.6% Fibonacci retracement level of the recent downtrend) and the psychological level of 1.0700.

On the other hand, a close below 1.0600 would trigger a drop to 1.0560 (20-day moving average) and then to 1.0520.