The beginning of the week was quiet in the foreign exchange market as Memorial Day was observed in the United States and some European countries celebrated Pentecost.

As a result, there were no macroeconomic events on both sides of the Atlantic.

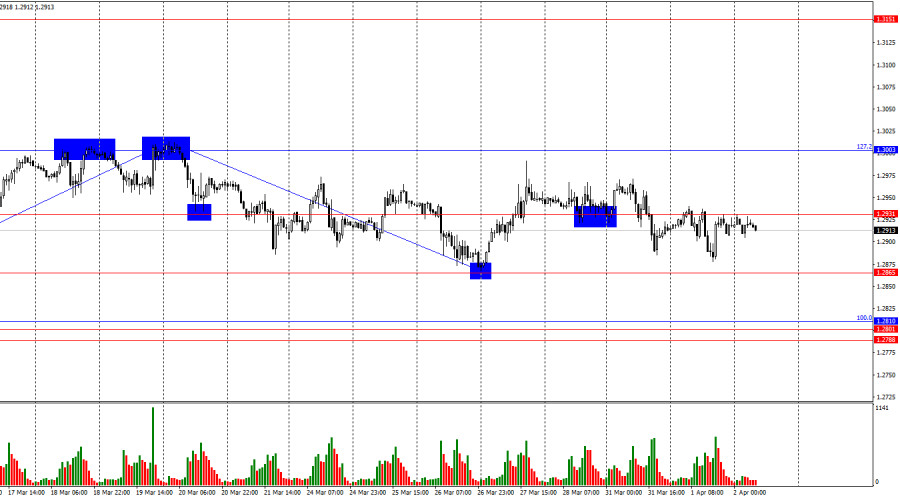

However, even in thin trading conditions, the US dollar managed to rise.

On Monday, the US currency closed with a modest gain of 0.05%, which proved to be enough to mark its highest closing in two months above 104.20.

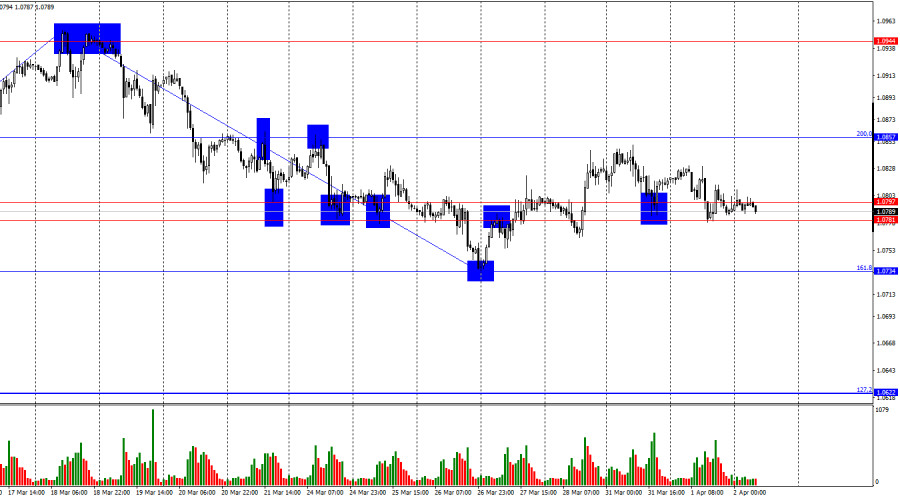

As the US dollar maintained its strength, EUR/USD continued to suffer losses. It declined by more than 0.1% in yesterday's trading, finishing around 1.0710.

The threat of a US default still looms over the market.

On Tuesday, the greenback reached new highs since mid-March and hit 104.50, while EUR/USD dropped below 1.0700, its lowest levels in the past ten weeks..

Market participants are still focused on the situation surrounding the US debt ceiling increase.

There is only one week left until June 5th - the date that US Treasury Secretary Janet Yellen has designated as the deadline for raising the borrowing limit of the federal government.

Over the weekend, President Joe Biden announced that he had reached a budget agreement with House Speaker Kevin McCarthy.

Biden called the deal a compromise and stated that it prevented what could have been a catastrophic default. Such a default would lead to a recession and the loss of millions of jobs in the country.

However, according to strategists at the Commonwealth Bank of Australia, the uncertainty surrounding the US default is likely to persist until Congress votes in favor of the agreement.

The vote in the House of Representatives on the agreement reached by Joe Biden and Kevin McCarthy is scheduled for Wednesday. The agreement will then proceed to a vote in the Senate.

The agreement may encounter difficulties in passing through Congress, Reuters reported.

Some lawmakers, both Democrats and Republicans, have already stated that they intend to vote against the document.

In particular, House Democratic leader Hakeem Jeffries expressed doubts about whether the bill will receive sufficient support among his fellow Democrat representatives.

Since Republicans control the House of Representatives while Democrats hold the majority of seats in the Senate, any deal to raise the debt ceiling depends on bipartisan support.

Disagreements among politicians in Washington regarding government spending plans have led many to speculate in recent weeks that an agreement on the budget and borrowing limit will not be reached before the US Treasury runs out of funds.

As concerns persist, the dollar continues to receive support as a safe haven asset.

Speculation regarding the possibility of the US interest rate hike cycle US ending later than previously anticipated as soon as expected is also contributing to dollar upsurge.

According to CME Group data, 60% of traders predict a 25 basis point rate hike at the June meeting of the Federal Reserve (Fed), while the remaining 40% expect rates to remain unchanged.

Brown Brothers Harriman analysts believe that the Fed will raise the key rate by 25 basis points at its next meeting.

In their opinion, the deal reached by Joe Biden and Kevin McCarthy guaranteed an increase in borrowing costs in the US next month.

Analysts at Brown Brothers Harriman observed that the crisis in the banking sector is losing strength, and the only factor that could have prevented the Federal Reserve from raising rates next month was a potential US default.

According to ING analysts, assuming that there are no delays in the approval of the debt ceiling deal, the focus in currency markets can shift back to the persistent issue of high inflation and the policy moves planned by central banks. Therefore, it is expected that the recent growth of the dollar will be sustained, at least until the June Federal Open Market Committee (FOMC) meeting.

They further highlighted this week's data releases in the US: the JOLTS job openings report on Wednesday, the ADP employment data on Thursday, and the Non-Farm Payroll (NFP) report on Friday. If these reports do not turn out to be negative, the market will continue to factor in another 25 basis point rate hike by the Federal Reserve, thereby giving support to the US dollar.

ING analysts believe that the greenback may extend its recent rally to 104.65 or even 105.30 this week.

They added that EUR/USD may head towards March lows around 1.0515-1.0530 , after breaking through the key support area of 1.0700-1.0720.

Pyrrhic victory for the dollar

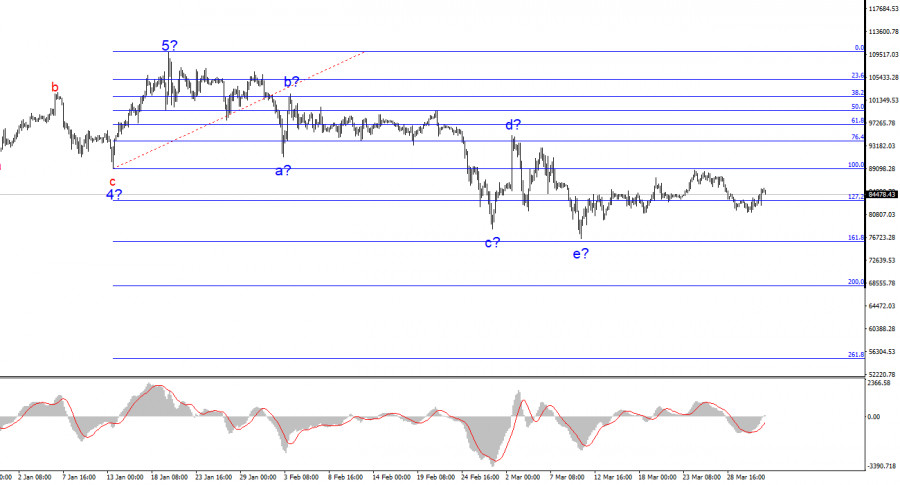

Since the beginning of May, the greenback has gained over 2%, while the EUR/USD pair has lost about 300 pips.

According to several experts, the current upward trend of the US currency is not sustainable. This means that the EUR/USD pair is not necessarily destined to slump.

Strategists at Commerzbank pointed out that the expectations of the market and the FOMC regarding the future trajectory of interest rates are now largely aligned. This is considered a positive factor for the dollar. However, the fact that it was the market, rather than the FOMC, that adjusted its rate expectations higher increase leads Commerzbank to believe that the current strengthening of the dollar is not sustainable. They maintain their stance of not expecting further rate hikes from the Federal Reserve.

According to estimates from Bank of America, the economic impact of the US debt ceiling deal will be equivalent to a quarter-point Fed rate hike.

This view is also shared by analysts at CIBC Capital Markets.

They further added that this development could slightly relieve the pressure on the Federal Reserve to raise rates once again. Alternatively, it would provide officials with an opportunity to postpone the rate hike until the July meeting in order to obtain a more comprehensive understanding of the economic situation and inflation's trajectory.

Furthermore, analysts believe that outflows from banks that have been reluctant to raise deposit rates into money market funds that directly invest in higher-yielding Treasury bills could be boosted. This could lead to continued withdrawal of deposits from banks, indicating that liquidity problems in US regional banks may not be resolved anytime soon.

While investors are not as concerned by the situation in regional banks as before, market participants are now recognizing the underlying issue rather than just the symptoms.

FOMC officials are likely aware of this situation. In his recent remarks, Federal Reserve Chair Jerome Powell hinted that the ongoing rate hike cycle could be paused.

Analysts suggest that the Fed will need to consider the potential implications of the bipartisan debt ceiling deal in policy decisions and upcoming forecasts for US GDP and inflation.

Experts at various financial institutions have expressed their views on the future trajectory of the US dollar. Some analysts believe that the current strength of the dollar may not be sustainable given the projected slowdown in economic growth and inflation, as well as the already restrictive interest rate levels set by the Federal Reserve.

Wells Fargo economists anticipate the greenback to maintain stability in the short term, while acknowledging that additional Fed policy tightening combined with potential market instability could temporarily support the dollar.

However, they expect the US currency to eventually come under pressure as the Fed initiates an aggressive policy easing cycle starting in early 2024.

According to the bank's forecast, the trade-weighted value of the dollar is projected to decline by 1.5% in 2023 and a further 5% in 2024.

Wells Fargo strategists expect EUR to grow moderately in the medium term. They believe that modest growth in the eurozone will continue, and that the rate cuts by the European Central Bank (ECB) will be significantly slower compared to those that could be implemented by the Federal Reserve in 2024.

Based on their analysis, they predict that the euro will rise to $1.08 by the end of 2023 and strengthen further to $1.14 by the end of 2024.