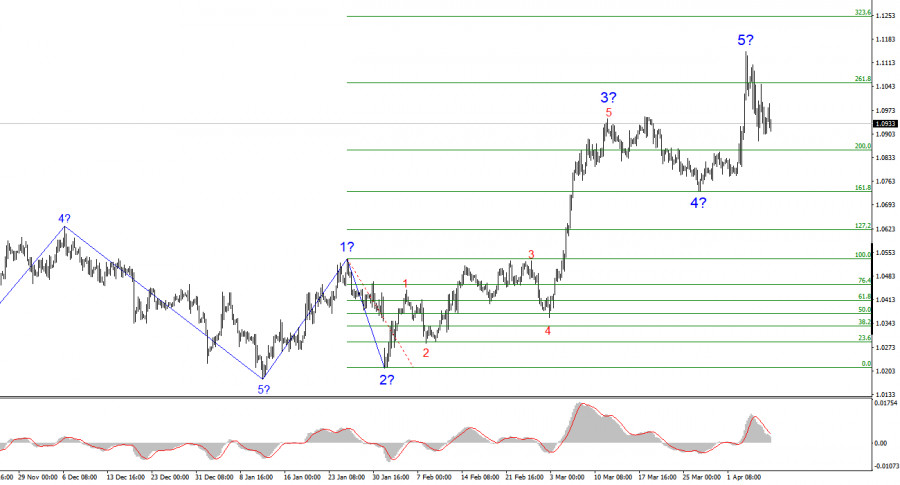

- The wave pattern on the 4-hour chart for EUR/USD has transformed into a bullish one. I believe there is little doubt that this transformation is entirely

Autor: Chin Zhao

19:51 2025-04-08 UTC+2

2

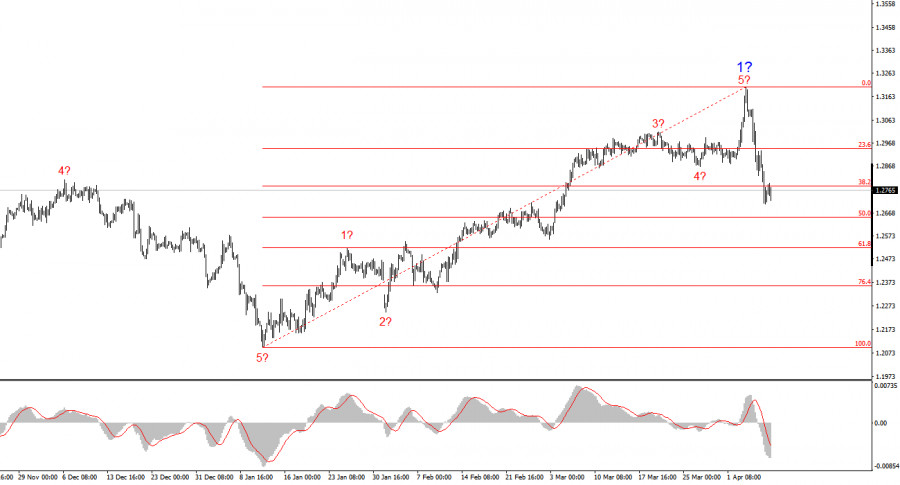

The wave pattern for GBP/USD has also transformed into a bullish, impulsive structure — "thanks" to Donald Trump. The wave formation is nearly identical to that of EUR/USD. Until FebruaryAutor: Chin Zhao

19:48 2025-04-08 UTC+2

5

The NZD/USD pair is attempting to regain positive momentum, supported by renewed US dollar selling. However, given the underlying fundamentals, bullish traders are advised to proceed with caution. Investors appearAutor: Irina Yanina

19:45 2025-04-08 UTC+2

4

- The EUR/USD pair has been trying to regain positive momentum for the second consecutive day, halting the recent pullback from the monthly high levels last seen in September. From

Autor: Irina Yanina

19:44 2025-04-08 UTC+2

4

Trade breakdown and trading tips for the Japanese yen The test of the 147.47 level occurred when the MACD indicator had just begun to move downward from the zero lineAutor: Jakub Novak

19:42 2025-04-08 UTC+2

3

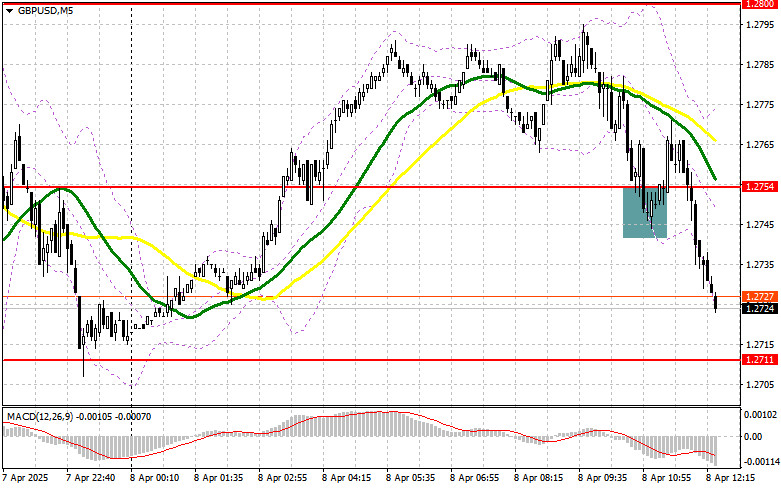

Trade breakdown and trading tips for the British pound The test of the 1.2792 level occurred at a moment when the MACD indicator had already moved far above the zeroAutor: Jakub Novak

19:39 2025-04-08 UTC+2

3

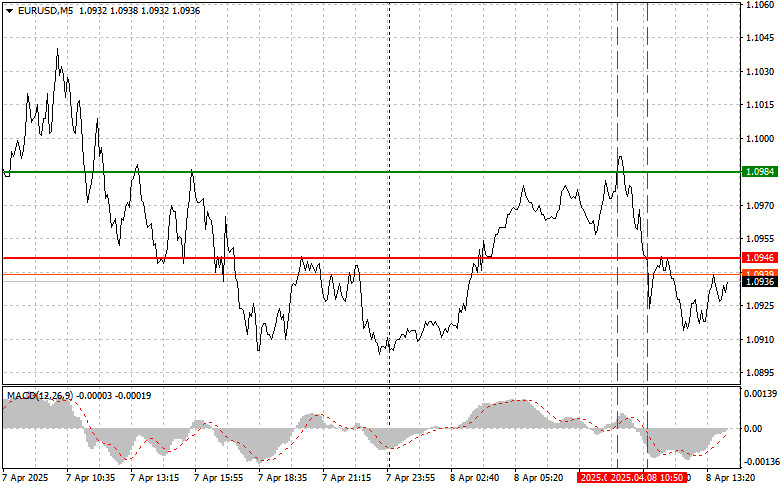

- Trade breakdown and tips for trading the euro The test of the 1.0984 level coincided with the moment when the MACD indicator had already moved far above the zero line

Autor: Jakub Novak

19:37 2025-04-08 UTC+2

4

Trading planGBP/USD: Trading plan for the U.S. session on April 8th (analysis of the morning trades)

In my morning forecast, I focused on the 1.2754 level and planned to make trading decisions from it. Let's look at the 5-minute chart and examine what happened thereAutor: Miroslaw Bawulski

19:33 2025-04-08 UTC+2

4

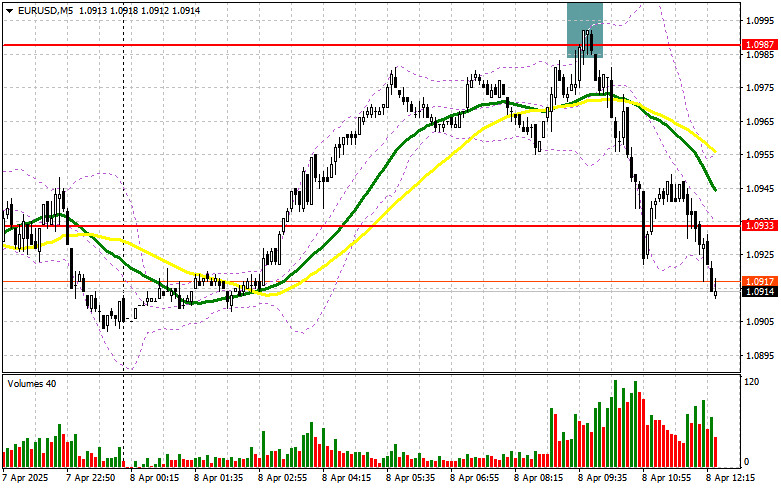

Trading planEUR/USD: Trading plan for the U.S. session on April 8th (analysis of the morning trades)

In my morning forecast, I focused on the 1.0987 level and planned to make trading decisions from it. Let's look at the 5-minute chart and see what happened thereAutor: Miroslaw Bawulski

19:29 2025-04-08 UTC+2

4