- Yesterday, the euro zone's ZEW economic sentiment indicators for April were disappointing. The index plunged from 39.8 in March to -18.5, far below the forecast of 13.2. We believe

Autor: Laurie Bailey

05:12 2025-04-16 UTC+2

7

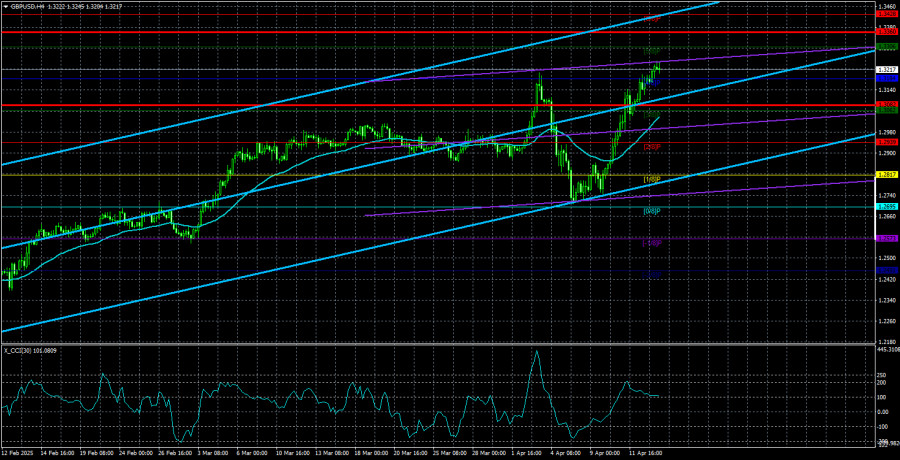

The British pound continues to rise according to our previously outlined scenario (see reference), heading toward the magnetic point at 1.3311, which is the intersection with the upper boundaryAutor: Laurie Bailey

05:12 2025-04-16 UTC+2

9

On the daily chart, the price has formed a small triangle around the 143.45 level and consolidated below it. Since the nearest target at 141.70 is close, the priceAutor: Laurie Bailey

05:12 2025-04-16 UTC+2

7

- On Tuesday, the GBP/USD currency pair continued its upward movement. Although this rally was not as strong as last week's surge, the British pound kept rising steadily, with barely

Autor: Paolo Greco

03:35 2025-04-16 UTC+2

11

The EUR/USD currency pair mostly remained flat throughout Tuesday. Although both pairs are in an upward trend, the euro and the British pound have recently not been trading in syncAutor: Paolo Greco

03:35 2025-04-16 UTC+2

15

Trading planTrading Recommendations and Analysis for GBP/USD on April 16: The Pound Isn't the Euro — It Doesn't Show Weakness

On Tuesday, the GBP/USD currency pair continued its upward movement for most of the day. There were no significant reasons or fundamental grounds for this, but the entire currency marketAutor: Paolo Greco

03:35 2025-04-16 UTC+2

13

- Trading plan

Trading Recommendations and Analysis for EUR/USD on April 16: The Dollar Took Advantage of the Tariff Pause

The EUR/USD currency pair began a long-awaited decline on Tuesday, although it didn't fall very far or for very long. It's worth noting that there were no fundamental reasonsAutor: Paolo Greco

03:35 2025-04-16 UTC+2

13

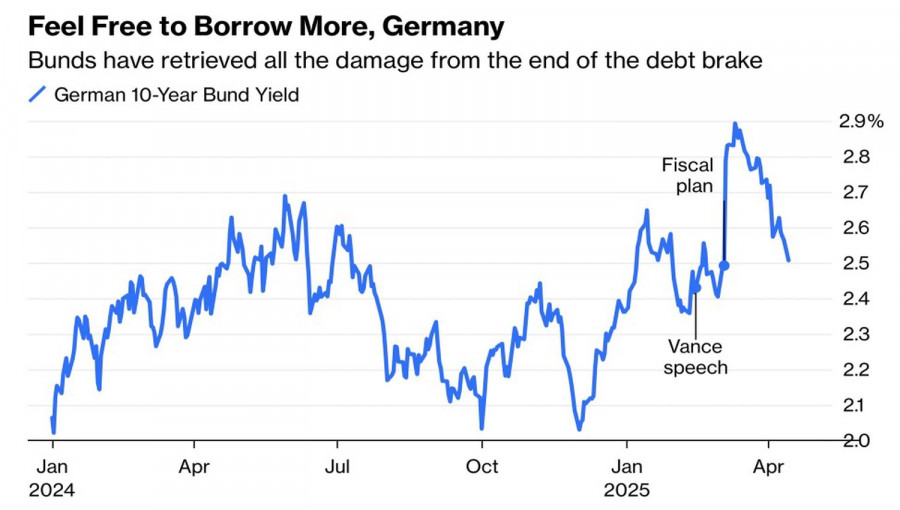

The euro reacted negatively to the ZEW indices released on Tuesday, which reflected growing pessimism in the European business environment. The key indicators dropped into negative territory for the firstAutor: Irina Manzenko

01:08 2025-04-16 UTC+2

13

The euro's surge to the area of three-year highs became possible thanks to Germany's fiscal stimulus, Donald Trump's trade policy, and a capital outflow from North America into Europe. WhenAutor: Marek Petkovich

01:08 2025-04-16 UTC+2

11