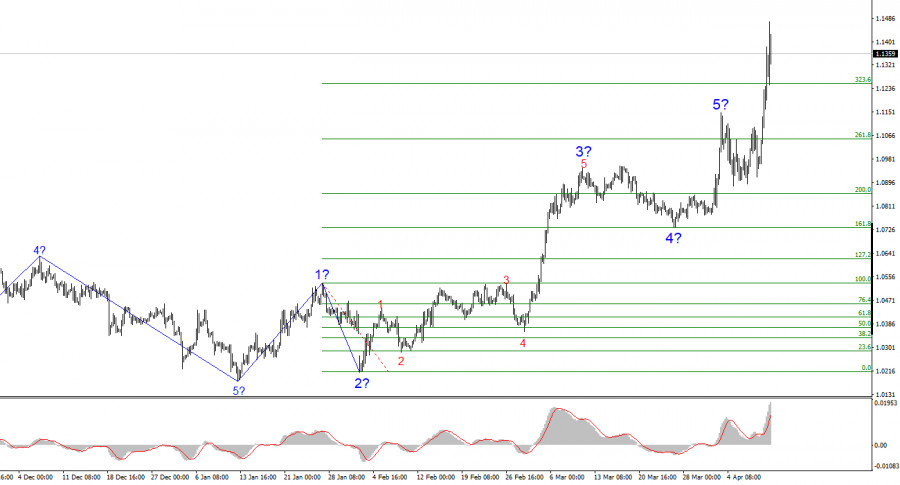

- The wave structure on the 4-hour EUR/USD chart has transformed into a bullish one. I believe there's no doubt that this transformation occurred solely due to the United States'

Autor: Chin Zhao

18:33 2025-04-11 UTC+2

56

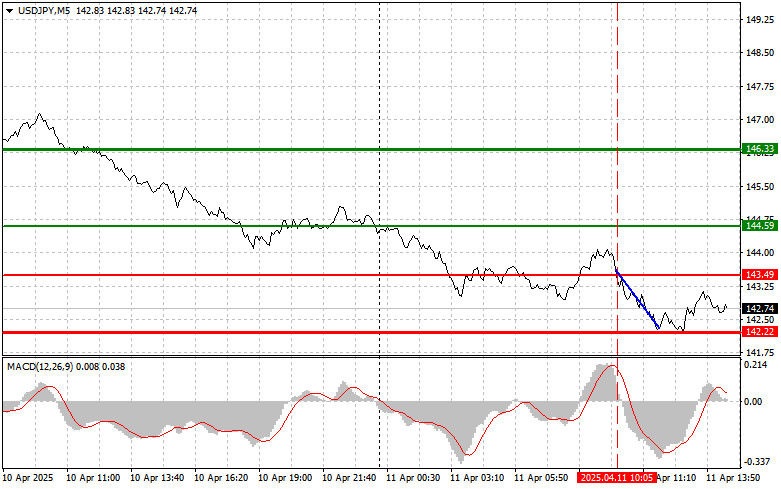

Trade Analysis and Advice for Trading the Japanese Yen The test of the 143.49 price level coincided with the moment the MACD indicator had just started moving downward fromAutor: Jakub Novak

18:26 2025-04-11 UTC+2

36

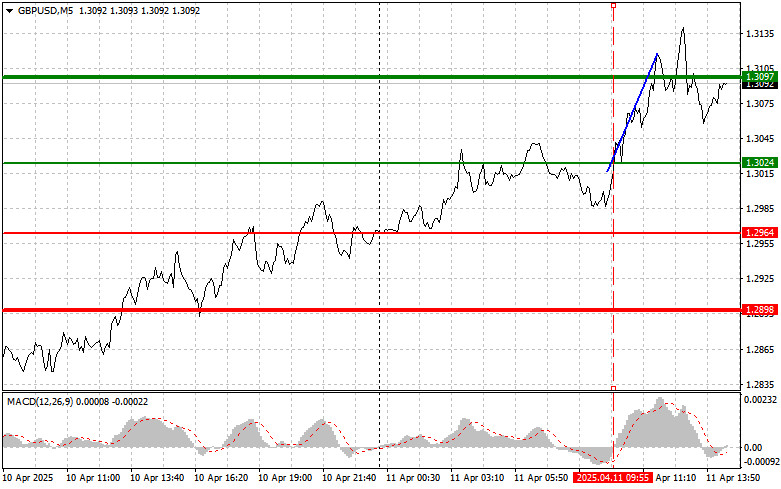

Trade Breakdown and Tips for Trading the British Pound The test of the 1.3024 price level occurred just as the MACD indicator was beginning to move upward from the zeroAutor: Jakub Novak

18:22 2025-04-11 UTC+2

37

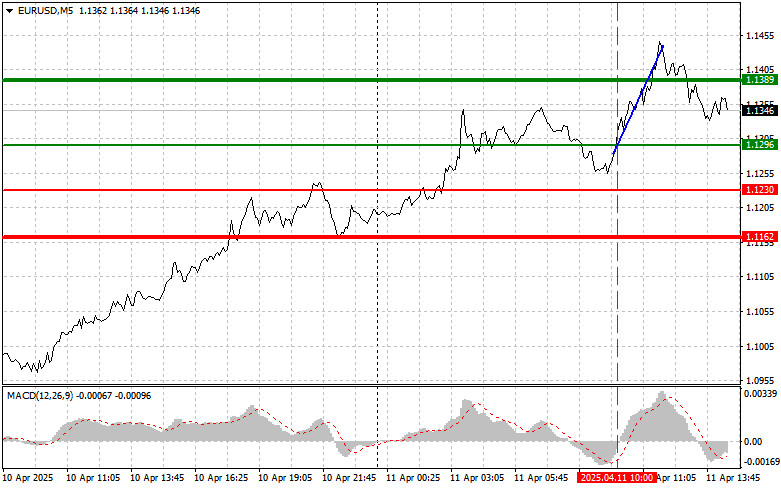

- Trade Analysis and Tips for the Euro The test of the 1.1296 price level occurred when the MACD indicator was just starting to move upward from the zero mark, which

Autor: Jakub Novak

18:20 2025-04-11 UTC+2

35

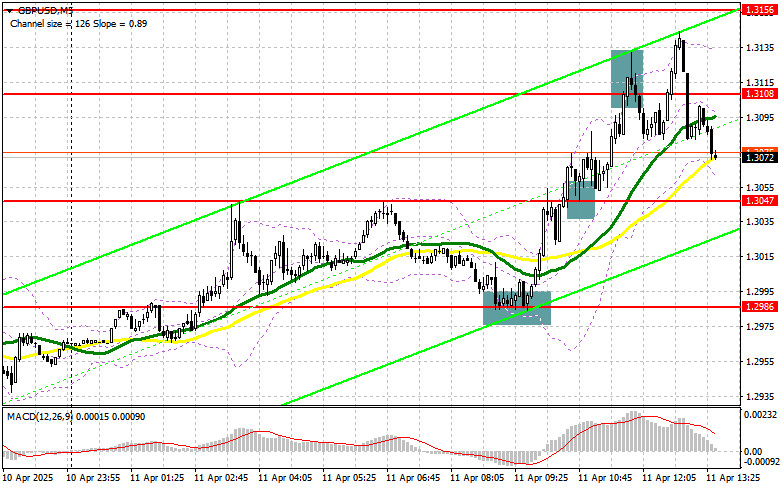

Trading planGBP/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)

In my morning forecast, I highlighted the level of 1.2986 and planned to make market entry decisions from that point. Let's take a look at the 5-minute chart and breakAutor: Miroslaw Bawulski

18:18 2025-04-11 UTC+2

29

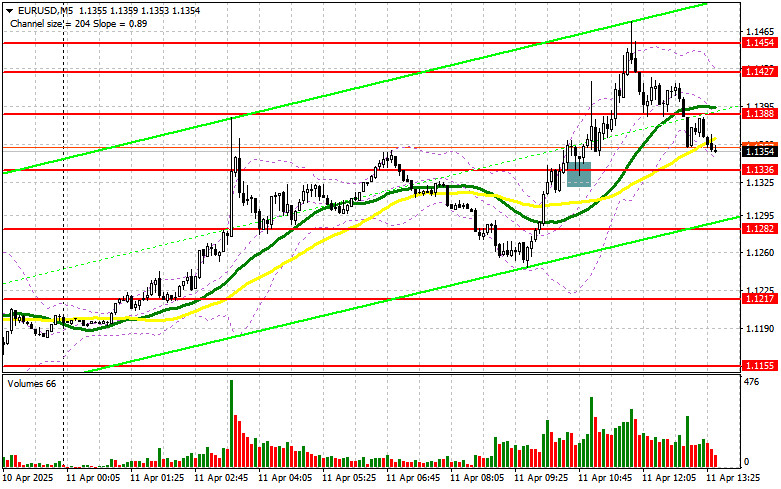

Trading planEUR/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)

In my morning forecast, I focused on the 1.1336 level and planned to make market entry decisions based on it. Let's take a look at the 5-minute chart and analyzeAutor: Miroslaw Bawulski

18:15 2025-04-11 UTC+2

24

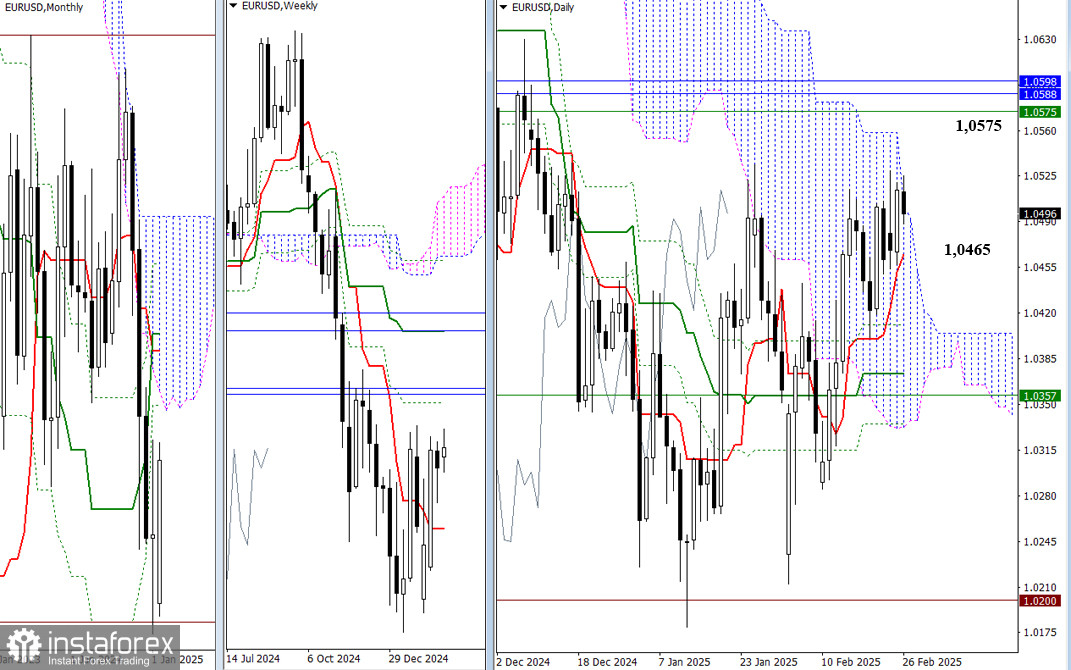

- Technical analysis

Trading Signals for EUR/USD for April 11-15, 2025: sell below 1.1470 (+2/8 Murray - overbought)

During the European session, the euro reached a new high around +2/8 Murray, located at 1.1473. This movement in EUR/USD occurred after the announcement by China's Ministry of Finance thatAutor: Dimitrios Zappas

16:44 2025-04-11 UTC+2

48

Bitcoin and Ethereum plunged late yesterday but then managed to recover their positions. For now, the bears still have more strength than the buyers, but this may only be temporaryAutor: Jakub Novak

16:38 2025-04-11 UTC+2

22

Technical analysisTrading Signals for GOLD (XAU/USD) for April 11-13, 2025: sell below $3,235 (+1/8 Murray - overbought)

Early in the American session, gold is undergoing a strong technical correction after reaching a new high around 3,237.69 for now. Economic data from the United States will be releasedAutor: Dimitrios Zappas

16:04 2025-04-11 UTC+2

71