- Gold continues to rise as investors remain concerned about U.S. President Donald Trump's aggressive trade policy and its impact on the global economy. In addition, ongoing geopolitical tensions serve

Autor: Irina Yanina

13:22 2025-04-02 UTC+2

20

Today, the AUD/USD pair is showing positive momentum, rebounding from nearly a four-week low. Support has come from the Reserve Bank of Australia's less "dovish" stance, with the central bankAutor: Irina Yanina

12:25 2025-04-02 UTC+2

17

Today, the USD/CAD pair is trying to stop its previous fall, attempting to anchor above the 1.4300 level. The anticipated announcement on tariffs from U.S. President Donald Trump, expected duringAutor: Irina Yanina

12:22 2025-04-02 UTC+2

14

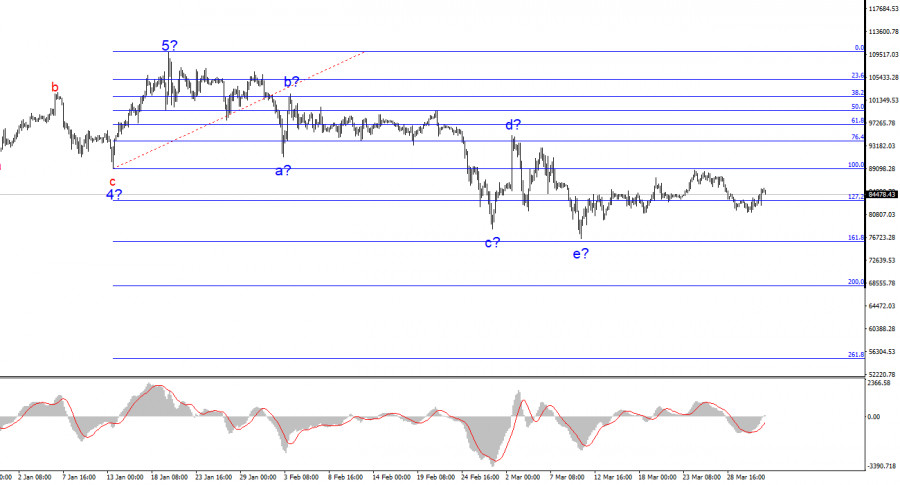

- The wave pattern on the 4-hour BTC/USD chart is clear. After completing a bullish trend composed of five full waves, a downward corrective phase began, which is still in progress

Autor: Chin Zhao

12:17 2025-04-02 UTC+2

10

S&P 500 The US stock markets paused ahead of President Trump's anticipated tariff announcements. The major indices ended the session mixed: the Dow Jones closed flat, the Nasdaq gained 0.9%Autor: Jozef Kovach

12:15 2025-04-02 UTC+2

11

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAutor: Sebastian Seliga

11:34 2025-04-02 UTC+2

15

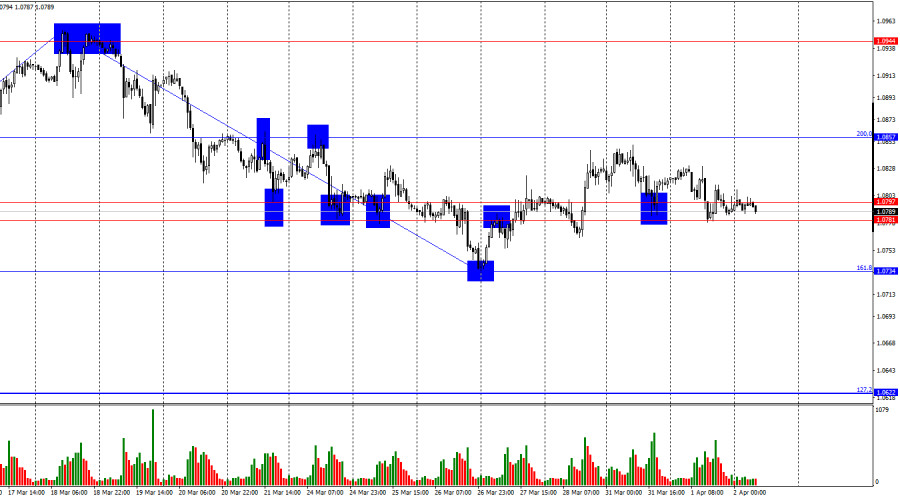

- On Tuesday, the EUR/USD pair rebounded from the support zone at 1.0781–1.0797 but failed to rise to the 200.0% Fibonacci level at 1.0857. On Wednesday morning, the pair returned

Autor: Samir Klishi

11:23 2025-04-02 UTC+2

20

Stock MarketsUpdate on US stock market on April 2: SP500 and NASDAQ regain their footing before crucial event

Following yesterday's regular session, US stock indices closed mixed. The S&P 500 rose by 0.38%, while the Nasdaq 100 gained 0.87%. The industrial Dow Jones dipped by 0.04%. Asian indicesAutor: Jakub Novak

11:19 2025-04-02 UTC+2

9

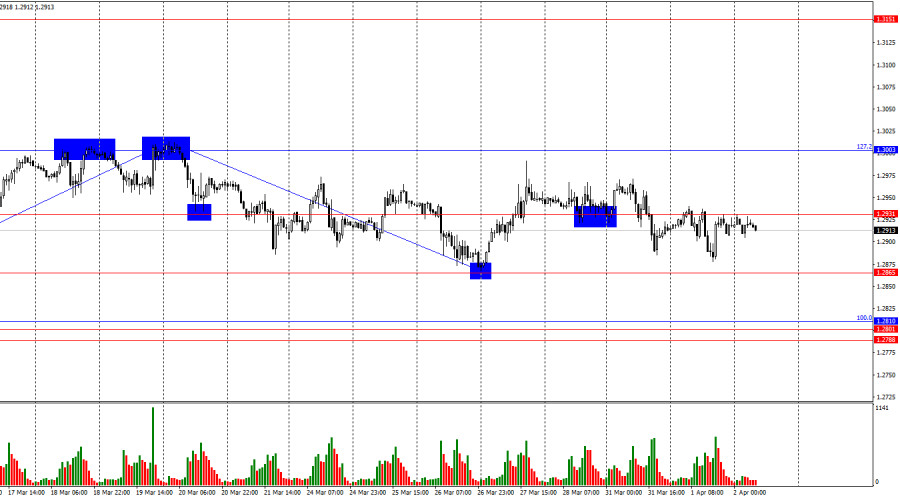

On the hourly chart, the GBP/USD pair continued to move sideways on Tuesday. There is currently no dominance of either bulls or bears in the market—and this has beenAutor: Samir Klishi

11:17 2025-04-02 UTC+2

8