Analysis of Trades and Trading Tips for the Euro

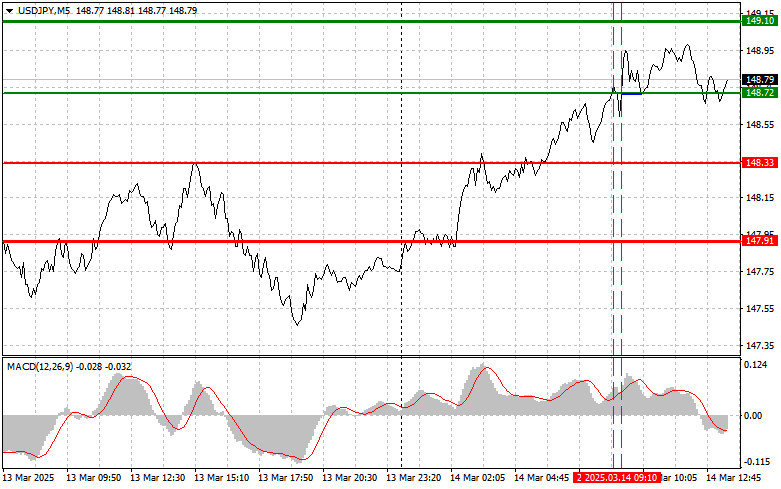

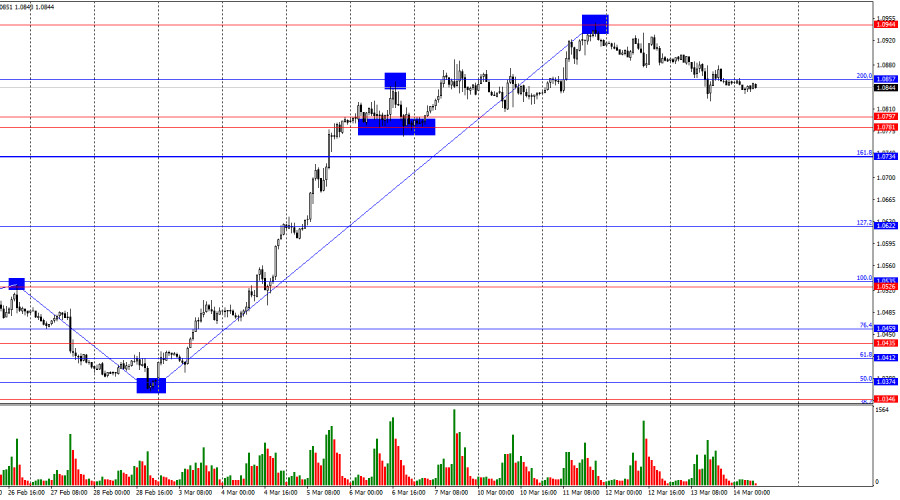

The 1.0861 price test occurred when the MACD indicator had already risen significantly above the zero level, limiting the pair's upward potential. For this reason, I did not buy the euro, resulting in no trades or movements.

The actual inflation data from Germany and France matched economists' preliminary estimates, leading to a modest rise in the euro during the first half of the day. However, this increase was short-lived and minor, as market participants remained cautious ahead of the weekend, seeking further clarity on the European Central Bank's future monetary policy decisions.

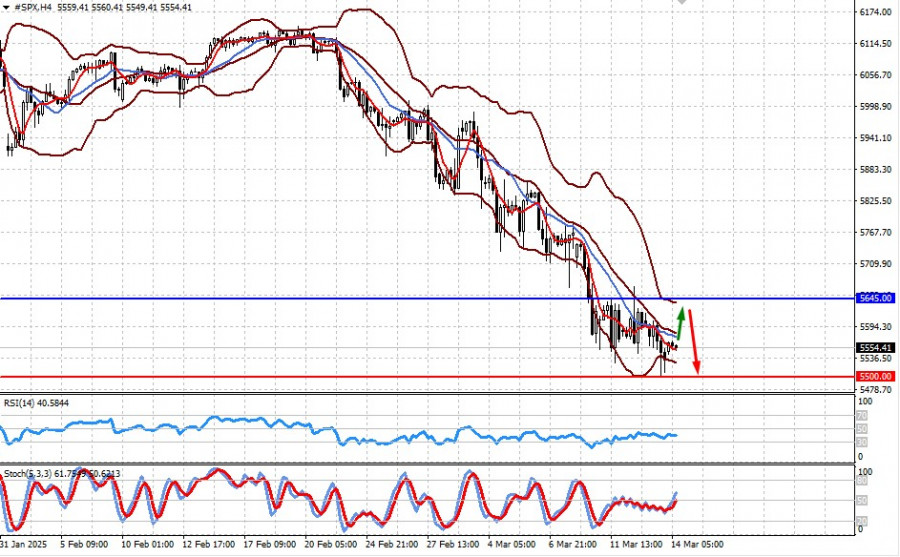

Clearly, the euro's future trajectory will be influenced by a combination of factors, including ECB policy, geopolitical developments, and the global economic outlook. In the medium term, the pair is likely to fluctuate and continue its growth, but long-term stability will depend on the Eurozone's ability to sustain steady economic expansion.

Today's University of Michigan Consumer Sentiment Index and inflation expectations report are expected to cause a brief spike in market volatility, but nothing more. The consumer sentiment index measures public optimism or pessimism about the economy—a rising index suggests confidence and a willingness to spend, while a decline signals concerns and a tendency to save. Inflation expectations, on the other hand, reflect consumers' views on future price growth.

For intraday trading, I will focus on Scenario #1 and Scenario #2.

Buy Signal

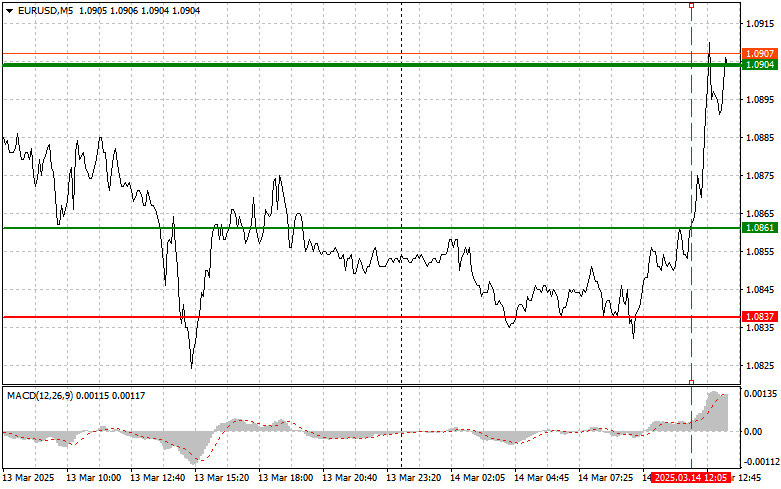

Scenario #1: Buying the euro is possible if the price reaches 1.0922 (green line on the chart), with a target of 1.0960. At 1.0960, I plan to exit the market and open short positions in the opposite direction, aiming for a 30-35 point retracement. A continuation of the uptrend supports further euro growth today.

Important! Before buying, make sure the MACD indicator is above the zero level and just beginning to rise.

Scenario #2: Another buying opportunity will arise if the price tests 1.0887 twice, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and trigger a reversal to the upside. Potential targets: 1.0922 and 1.0960.

Sell Signal

Scenario #1: Selling the euro is an option after the price reaches 1.0887 (red line on the chart), with a target of 1.0852, where I plan to exit short positions and buy in the opposite direction, aiming for a 20-25 point retracement. Selling pressure on the pair may return if U.S. data comes in stronger than expected.

Important! Before selling, make sure the MACD indicator is below the zero level and just beginning to decline.

Scenario #2: Another selling opportunity will arise if the price tests 1.0922 twice, while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a reversal to the downside. Potential targets: 1.0887 and 1.0852.

Chart Breakdown

- Thin green line – Entry price for buy positions

- Thick green line – Expected price level for Take Profit or manual profit-taking, as further growth beyond this point is unlikely

- Thin red line – Entry price for sell positions

- Thick red line – Expected price level for Take Profit or manual profit-taking, as further decline beyond this point is unlikely

- MACD Indicator: It is crucial to follow overbought and oversold zones when entering the market

Important Notes for Beginner Traders

Beginner Forex traders should exercise caution when entering the market. Before the release of key economic reports, it is best to stay out of the market to avoid being caught in sharp price swings.

If you decide to trade during news releases, always use stop-loss orders to minimize potential losses. Without stop-loss protection, you can quickly deplete your account balance, especially if you trade large volumes without proper risk management.

Remember: Successful trading requires a clear trading plan, similar to the one outlined above. Making impulsive trading decisions based on current market movements is a losing strategy for intraday traders.