- Forecast

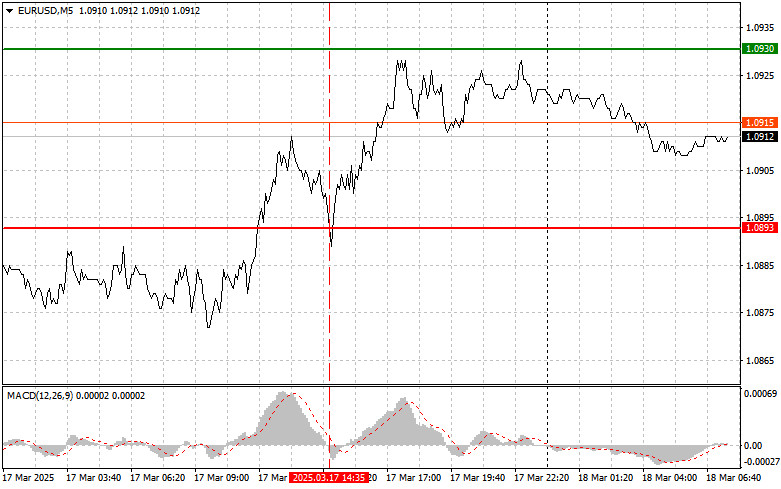

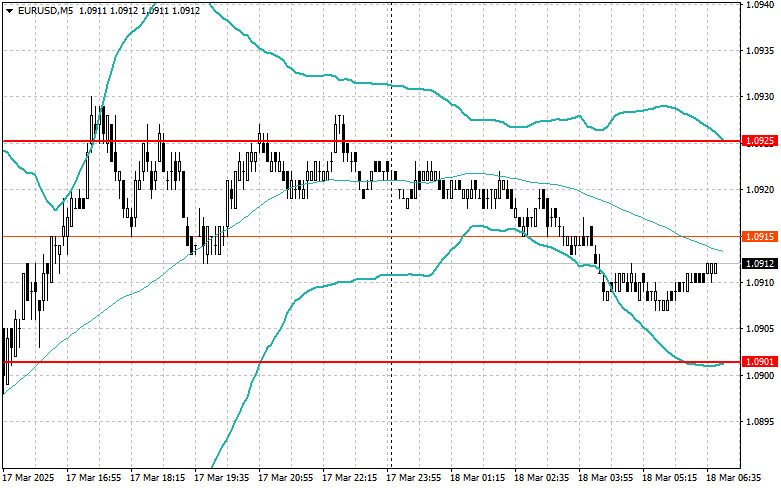

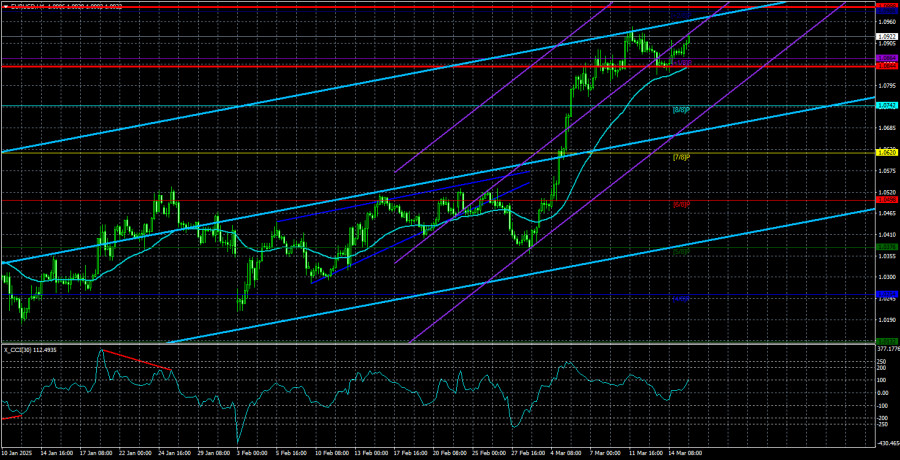

EUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

The price test at 1.0893 occurred when the MACD indicator began moving down from the zero mark, confirming a valid entry point for selling the euro. However, losses were recordedAutor: Jakub Novak

09:00 2025-03-18 UTC+2

0

The euro and the pound continue to rise despite all the desperate attempts by sellers of risk assets to achieve at least some reasonable correction at the beginningAutor: Miroslaw Bawulski

07:52 2025-03-18 UTC+2

5

Fundamental analysisWhat to Pay Attention to on March 18? A Breakdown of Fundamental Events for Beginners

A large number of macroeconomic events are scheduled for Tuesday, but none of them are significant. For example, the Eurozone and Germany will publish ZEW economic sentiment indices, whichAutor: Paolo Greco

07:08 2025-03-18 UTC+2

5

- Trading plan

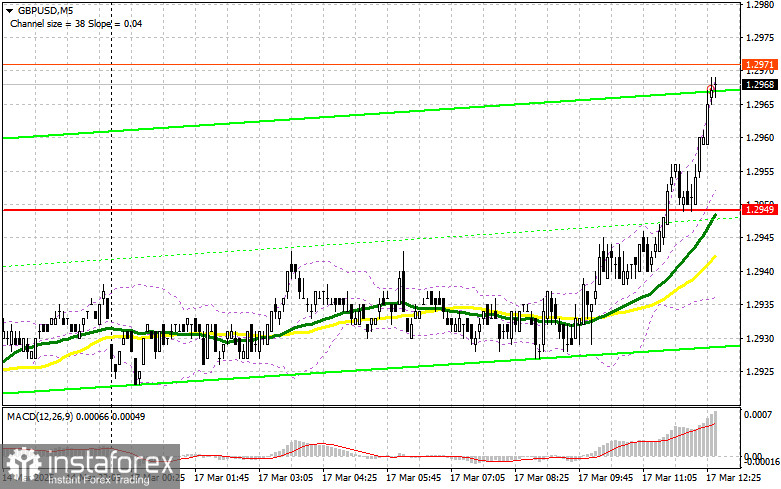

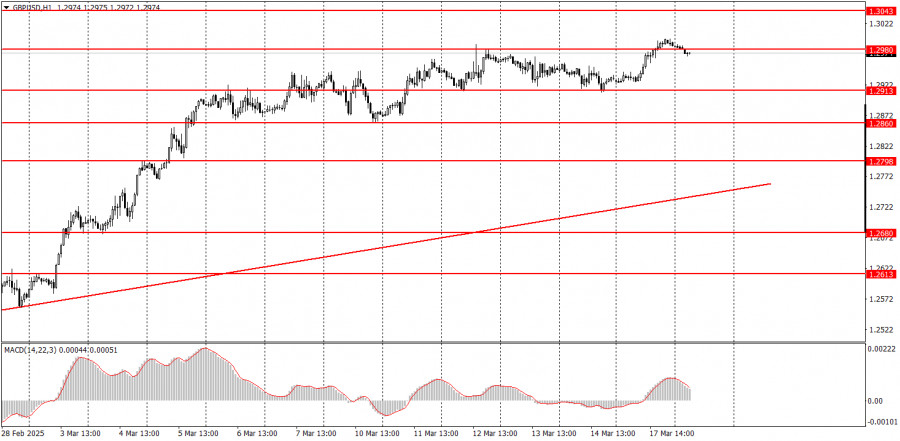

How to Trade the GBP/USD Pair on March 18? Simple Tips and Trade Analysis for Beginners

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair also attempted to resume its upward movement and even broke through the latest local high withinAutor: Paolo Greco

07:08 2025-03-18 UTC+2

4

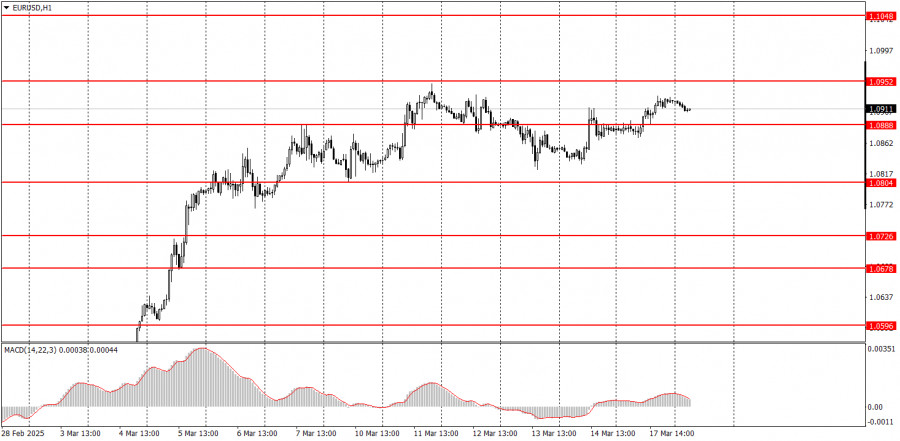

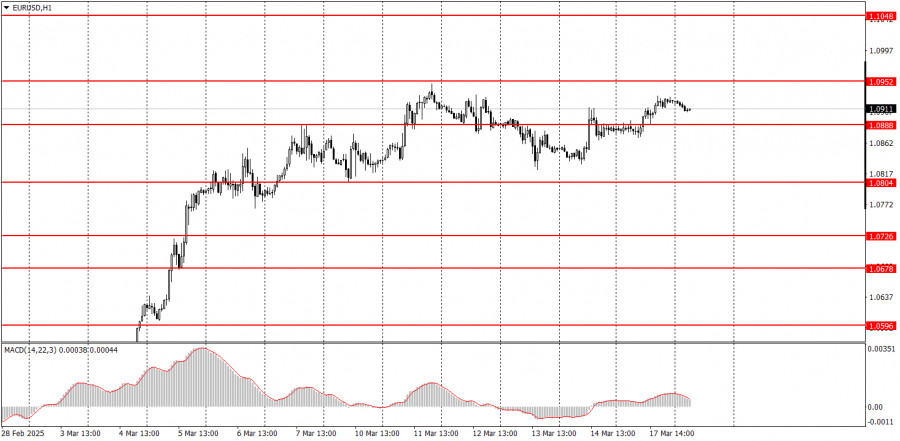

Trading planHow to Trade the EUR/USD Pair on March 18? Simple Tips and Trade Analysis for Beginners

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair resumed its upward movement but remained within a sideways channel between the levels of 1.0804Autor: Paolo Greco

07:08 2025-03-18 UTC+2

6

Intel rises after a report that the new CEO plans to reorganize manufacturing and artificial intelligence operations. February retail sales rise 0.2%. New York manufacturing activity fell in March. HongAutor:

06:16 2025-03-18 UTC+2

10

- Intel Gains After New CEO Plans AI Manufacturing and Operations Overhaul February Retail Sales Up 0.2% New York Manufacturing Activity Falls in March Hong Kong Stocks, Kiwis Gain on China

Autor: Thomas Frank

05:59 2025-03-18 UTC+2

8

On Monday, the GBP/USD currency pair continued to lean toward growth. There were no significant events in the UK throughout the day, while in the U.S., only one reportAutor: Paolo Greco

05:04 2025-03-18 UTC+2

10

The EUR/USD currency pair has resumed its upward movement. Since there was very little news on this day, and none of it was significant, volatility remained quite low, preventingAutor: Paolo Greco

05:04 2025-03-18 UTC+2

12