- On the hourly chart, GBP/USD rebounded from the 1.2931 level on Monday and resumed its upward movement toward the 127.2% Fibonacci level at 1.3003. A rejection from this level would

Autor: Samir Klishi

11:03 2025-03-18 UTC+2

2

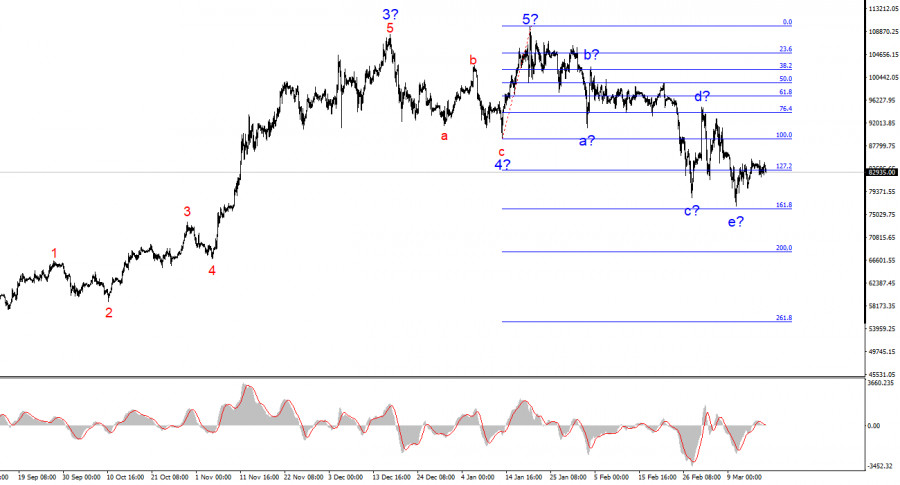

Crypto-currenciesBTC/USD Analysis – March 18th: Bitcoin Prepares for Growth, but the Risk of Collapse Remains

The 4-hour wave structure for BTC/USD appears clear and well-defined. After completing a five-wave bullish trend, a bearish phase began, which currently resembles a corrective pattern. Based on thisAutor: Chin Zhao

10:47 2025-03-18 UTC+2

1

Fundamental analysisNo Major Surprises Expected from the Fed Meeting (Anticipating a Sharp Drop in EUR/USD and Continued Cautious Gold Price Growth)

Markets are experiencing turmoil due to the risk of a U.S. economic recession. Although Treasury Secretary Bessent attempts to reassure investors by calling the market "correction" a healthy process, theseAutor: Pati Gani

09:48 2025-03-18 UTC+2

10

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday March 18, 2025.

In the 4-hour chart of the Gold commodity instrument, Convergence is visible, which confirms that in the near future Gold has the potential to strengthen even though because the StochasticAutor: Arief Makmur

09:17 2025-03-18 UTC+2

12

Technical analysisTechnical Analysis of Intraday Price Movement of EUR/JPY Cross Currency Pairs, Tuesday March 18, 2025

If we look at the 4-hour chart, the EUR/JPY cross currency pair appears to be moving harmoniously in the Bullish Pitchfork channel, which indicates that the bias of EUR/JPYAutor: Arief Makmur

09:01 2025-03-18 UTC+2

7

Bitcoin and Ethereum buyers attempted to achieve more significant growth, and for a moment, the bullish market might gain hope for a return. However, they could not hold the achievedAutor: Miroslaw Bawulski

09:00 2025-03-18 UTC+2

6

- Forecast

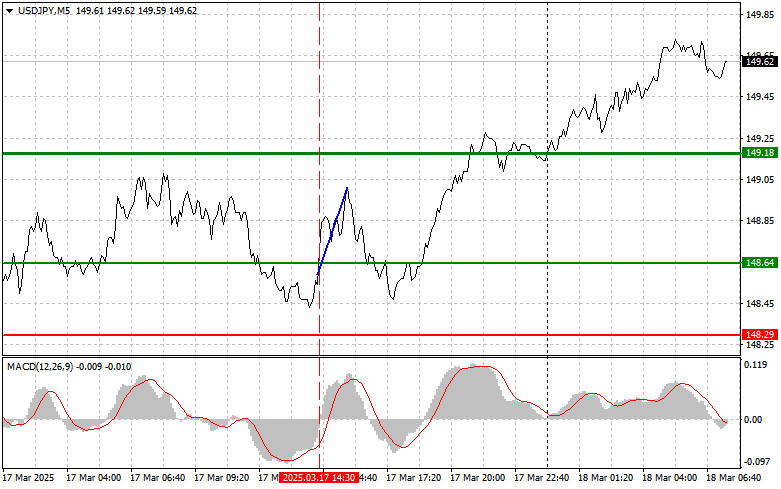

USD/JPY: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

The price test at 148.64 came when the MACD indicator started moving upward from the zero mark, confirming the correct entry point to buy the dollar. As a resultAutor: Jakub Novak

09:00 2025-03-18 UTC+2

8

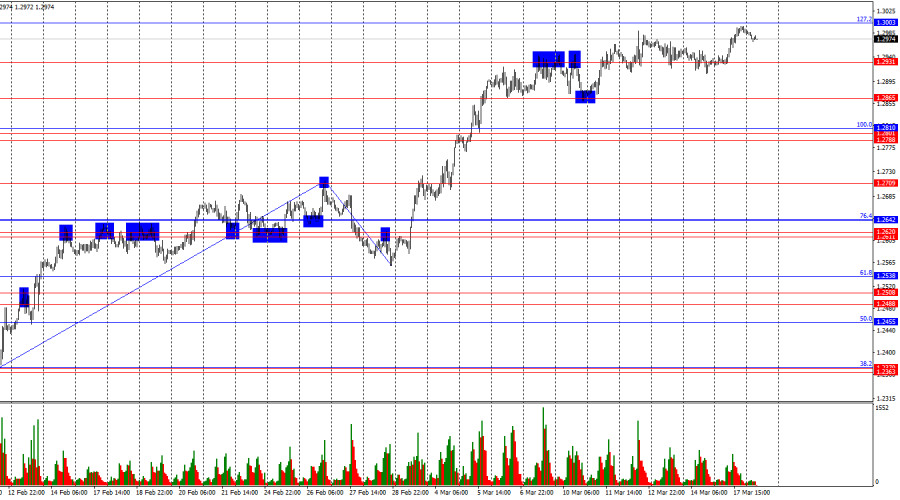

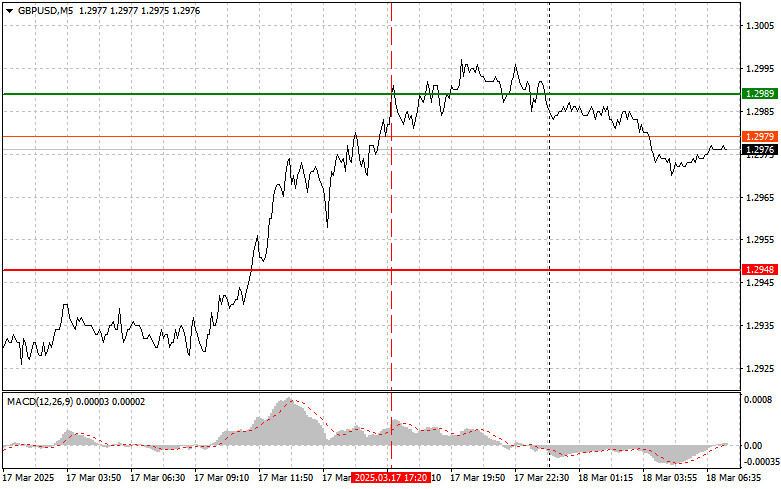

ForecastGBP/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

The price test at 1.2989 came when the MACD indicator had already moved significantly from the zero mark, limiting the pair's upward potential. For this reasonAutor: Jakub Novak

09:00 2025-03-18 UTC+2

6

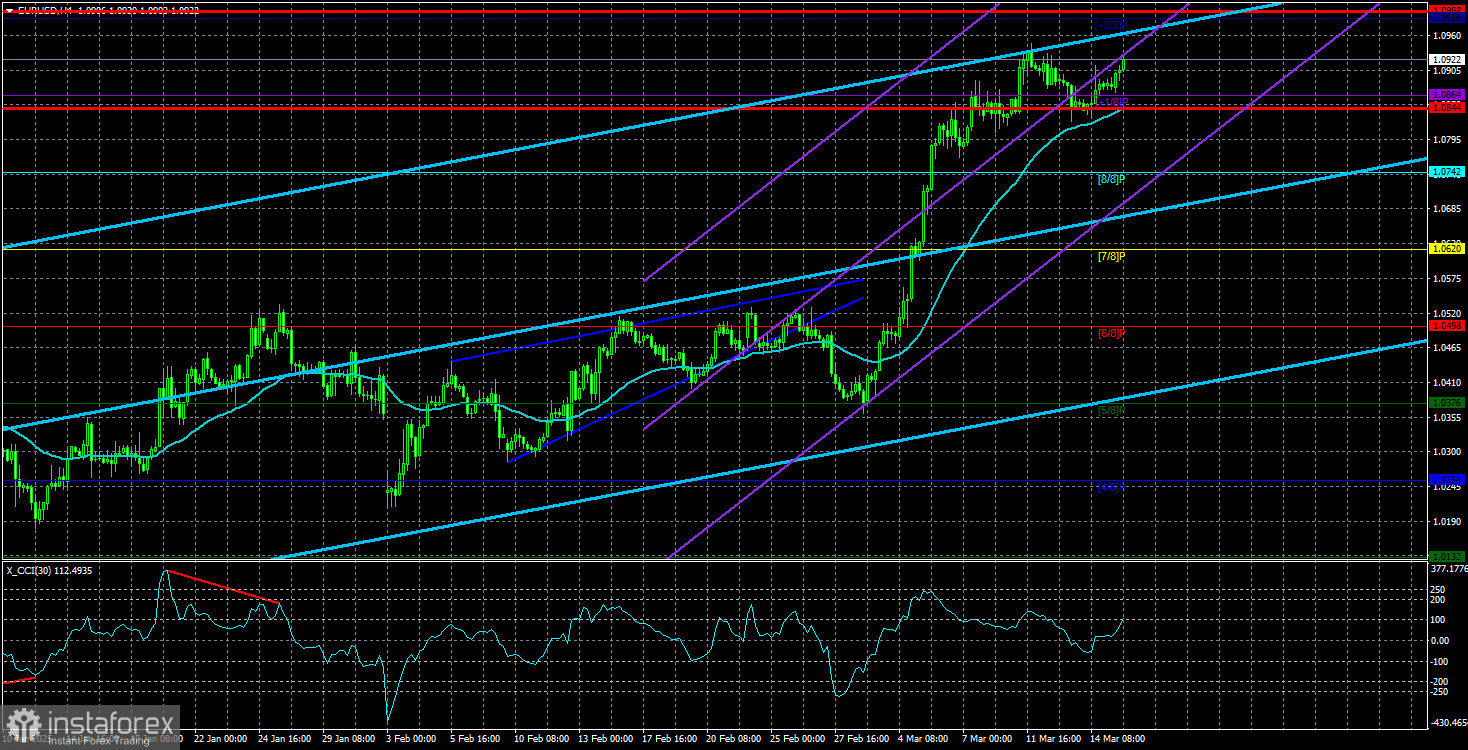

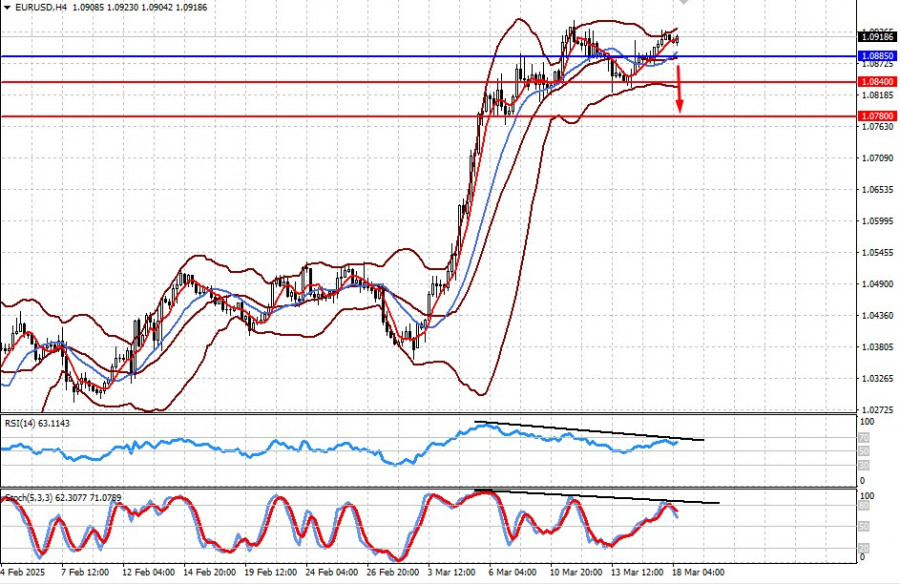

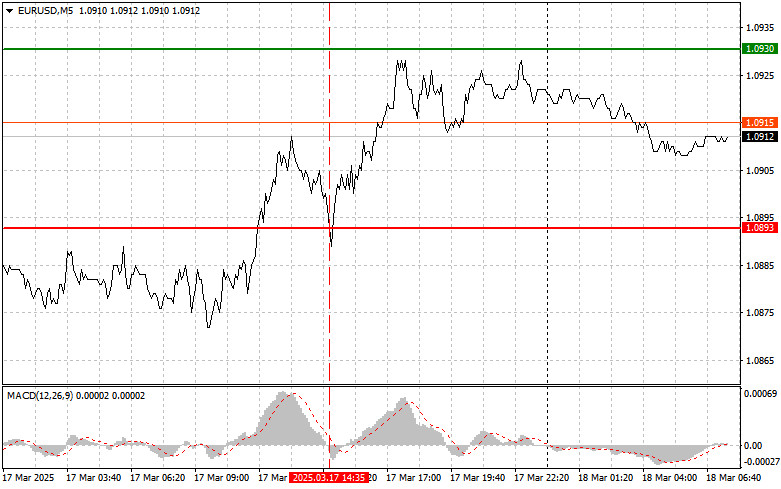

ForecastEUR/USD: Simple Trading Tips for Beginner Traders on March 18. Review of Yesterday's Forex Trades

The price test at 1.0893 occurred when the MACD indicator began moving down from the zero mark, confirming a valid entry point for selling the euro. However, losses were recordedAutor: Jakub Novak

09:00 2025-03-18 UTC+2

9