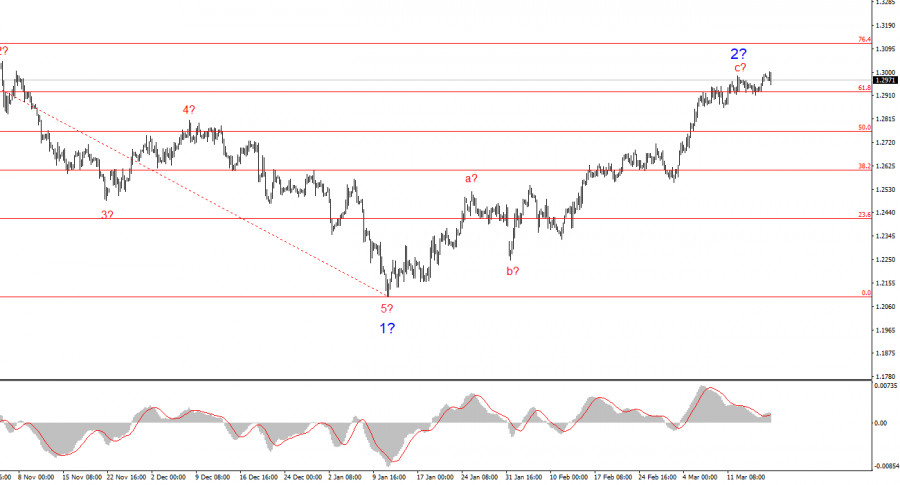

- The wave structure for GBP/USD remains somewhat ambiguous yet generally clear. At present, there is a high probability that a long-term downward trend is forming. Wave 5 has taken

Autor: Chin Zhao

19:45 2025-03-18 UTC+2

33

The wave structure on the four-hour chart is at risk of transforming into a more complex formation. A new downward wave structure began forming on September 25, taking the shapeAutor: Chin Zhao

19:43 2025-03-18 UTC+2

36

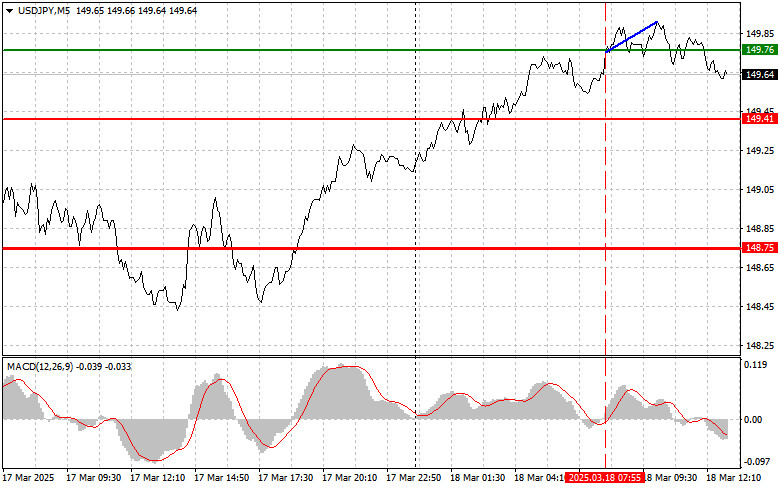

The test of the 149.76 price level occurred when the MACD indicator had just started moving up from the zero mark, confirming a valid buy entry for the dollarAutor: Jakub Novak

19:40 2025-03-18 UTC+2

30

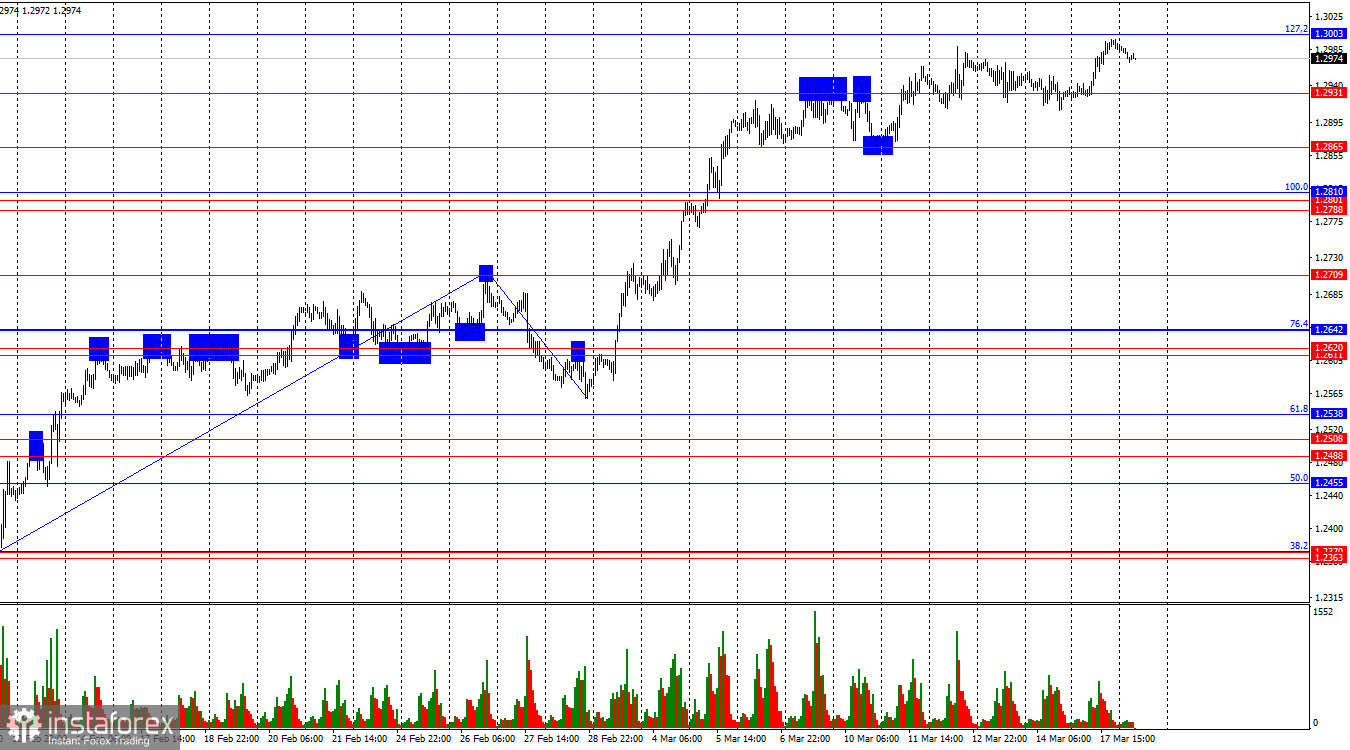

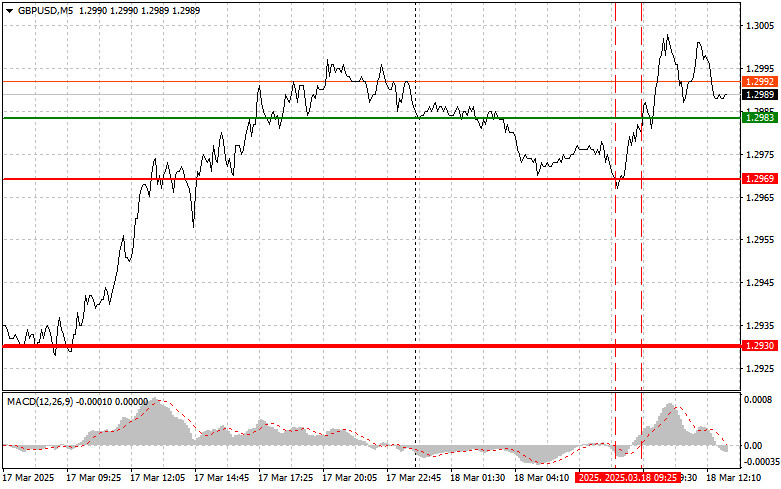

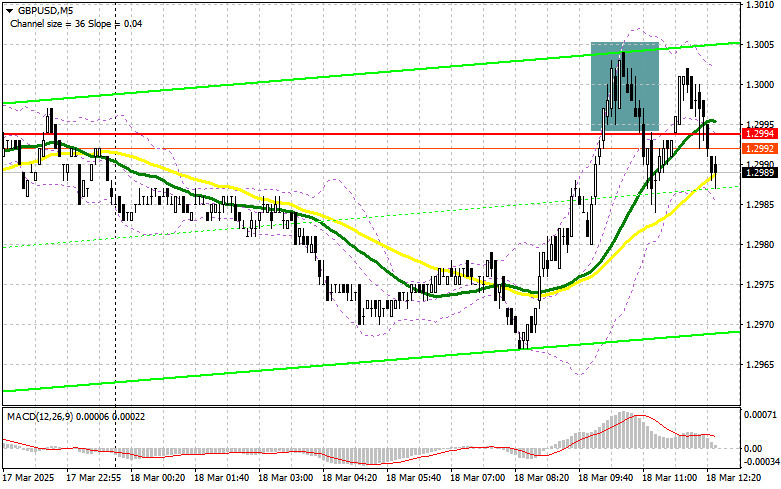

- The test of the 1.2983 price level occurred when the MACD indicator had already moved significantly upward from the zero mark, limiting the pair's upward potential. For this reason

Autor: Jakub Novak

19:36 2025-03-18 UTC+2

31

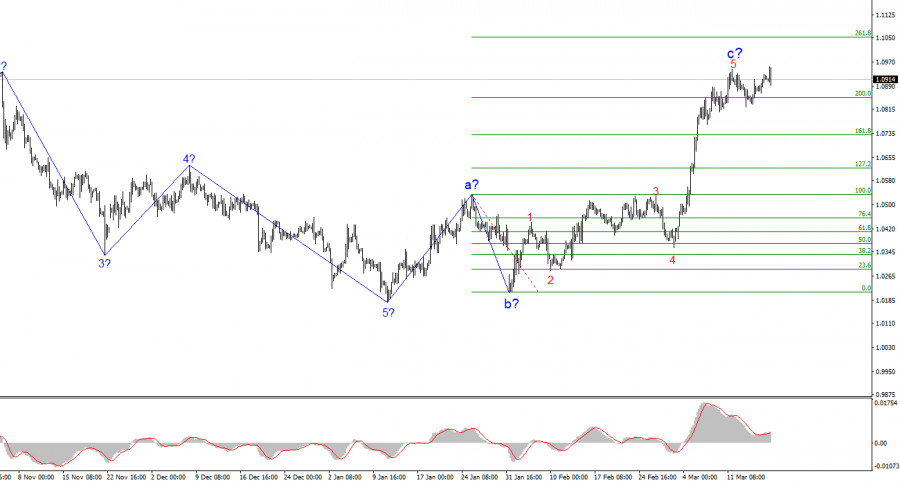

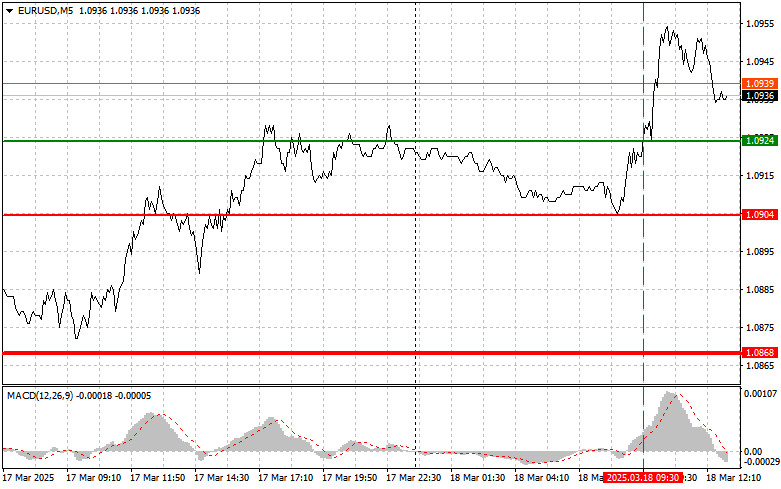

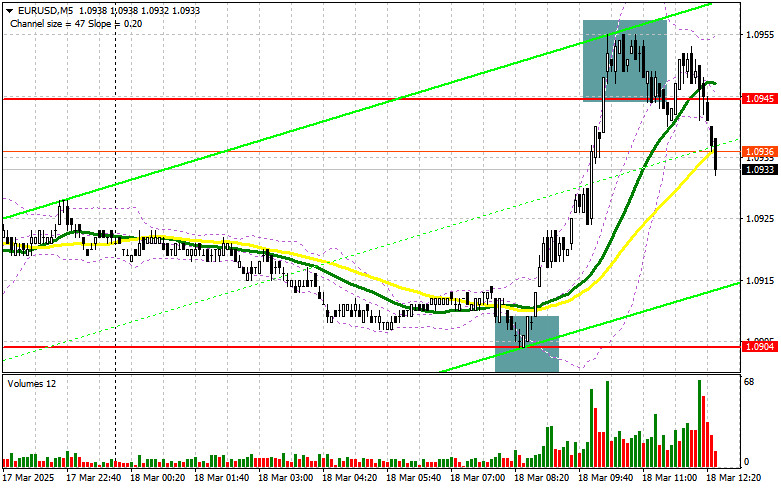

The test of the 1.0924 price level occurred when the MACD indicator had already moved significantly upward from the zero mark, limiting the pair's upward potential. For this reasonAutor: Jakub Novak

19:32 2025-03-18 UTC+2

33

In my morning forecast, I focused on the 1.2994 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happenedAutor: Miroslaw Bawulski

19:30 2025-03-18 UTC+2

30

- In my morning forecast, I focused on the 1.0904 level and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened

Autor: Miroslaw Bawulski

19:25 2025-03-18 UTC+2

29

For the third consecutive day, West Texas Intermediate (WTI) crude oil is attracting buyers. Currently, the commodity is trading slightly above the key psychological level of $68.00, having gained overAutor: Irina Yanina

19:24 2025-03-18 UTC+2

32

Today, the Japanese yen continues to decline intraday, pushing USD/JPY close to the key psychological level of 150.00, with the pair setting a new two-day high around 149.87. Global marketAutor: Irina Yanina

19:21 2025-03-18 UTC+2

28