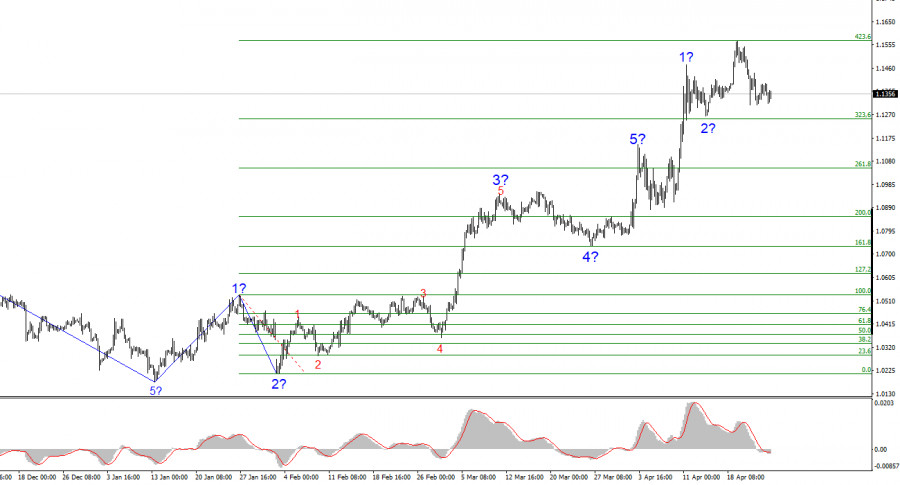

- The wave pattern on the 4-hour EUR/USD chart has shifted into a bullish formation. It's safe to say that this transformation occurred solely due to the new U.S. trade policy

Autor: Chin Zhao

20:26 2025-04-25 UTC+2

16

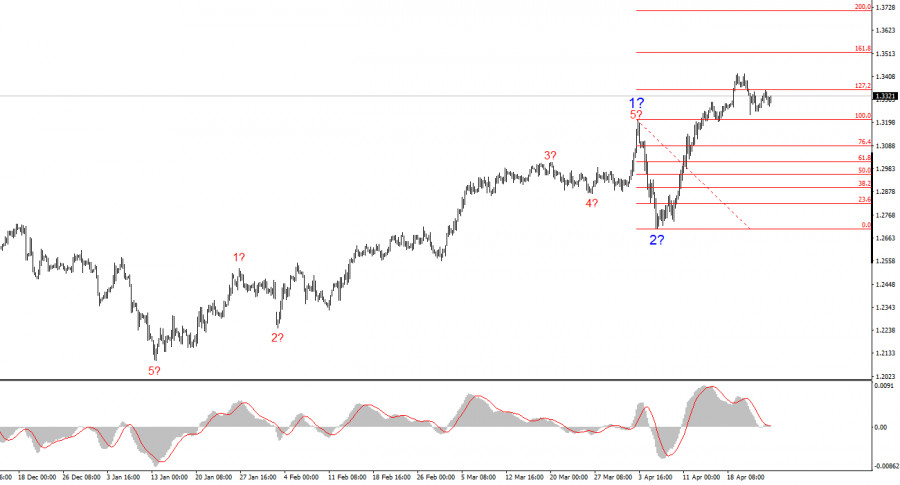

The wave pattern on the GBP/USD chart has also transformed into a bullish, impulsive structure—"thanks" to Donald Trump. The wave picture closely resembles that of the EUR/USD pair. Until FebruaryAutor: Chin Zhao

20:21 2025-04-25 UTC+2

16

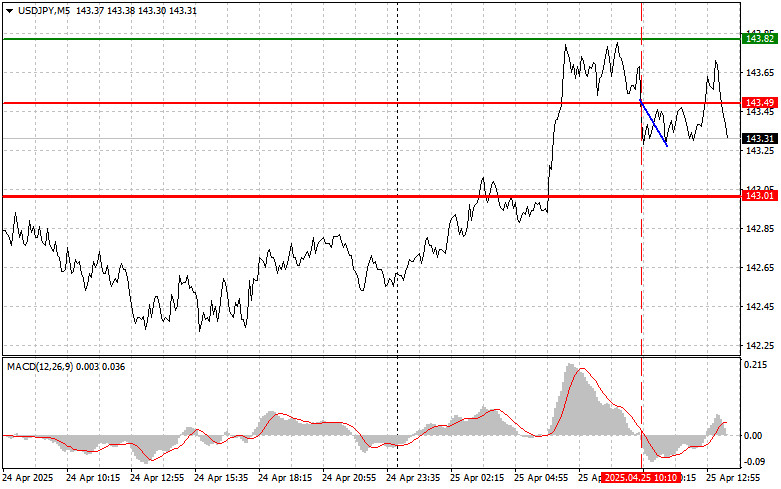

Trade Analysis and Guidance for the Japanese Yen The price test at 143.49 occurred just as the MACD indicator began moving down from the zero line, confirming a valid entryAutor: Jakub Novak

20:09 2025-04-25 UTC+2

19

- Trade Analysis and Guidance for the British Pound The price test at 1.3292 occurred when the MACD indicator had just started to move upward from the zero line, which confirmed

Autor: Jakub Novak

19:22 2025-04-25 UTC+2

18

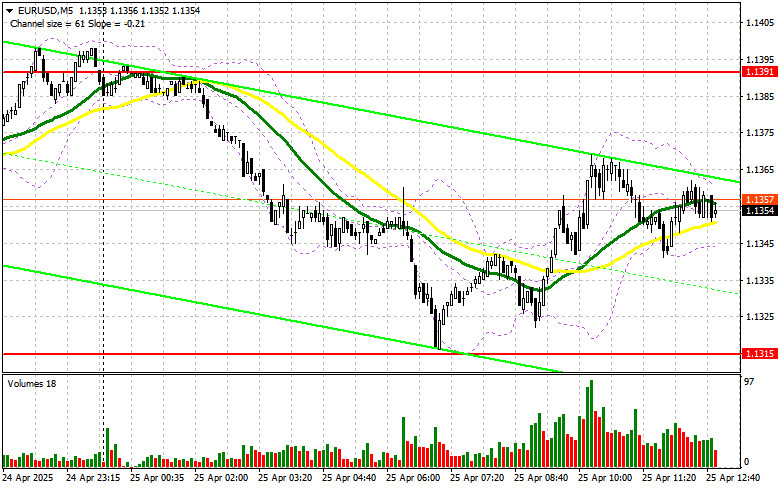

Trade Analysis and Guidance for the Euro The price test at 1.1355 occurred when the MACD indicator had already risen significantly above the zero line, which, in my view, limitedAutor: Jakub Novak

19:17 2025-04-25 UTC+2

18

In my morning forecast, I focused on the 1.3310 level and planned to make trading decisions from there. Let's look at the 5-minute chart and see what happened. A riseAutor: Miroslaw Bawulski

19:05 2025-04-25 UTC+2

15

- In my morning forecast, I focused on the 1.1391 level and planned to make entry decisions around it. Let's take a look at the 5-minute chart and assess what happened

Autor: Miroslaw Bawulski

19:00 2025-04-25 UTC+2

15

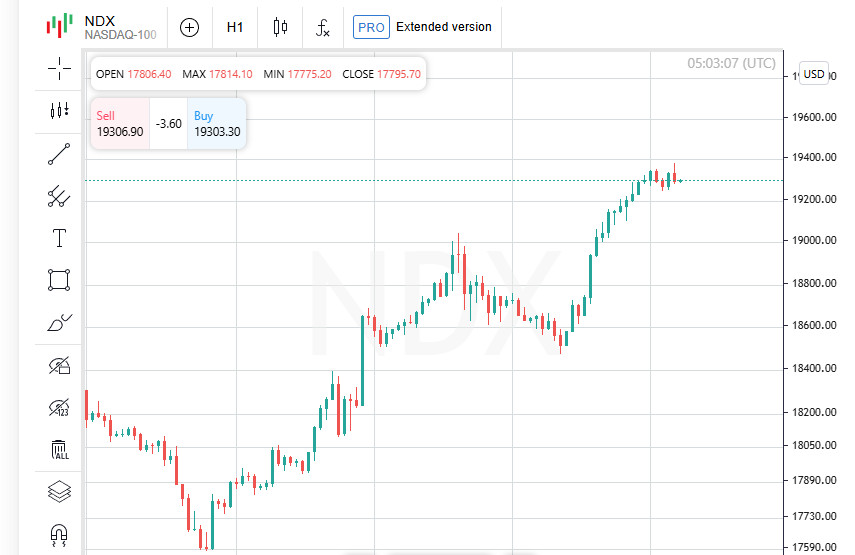

Procter & Gamble and PepsiCo fell after cutting forecasts, while Hasbro and ServiceNow jumped following their earnings reports. March durable goods orders surged more than expected. Alphabet beat revenue expectationsAutor:

12:52 2025-04-25 UTC+2

18

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAutor: Sebastian Seliga

12:25 2025-04-25 UTC+2

26