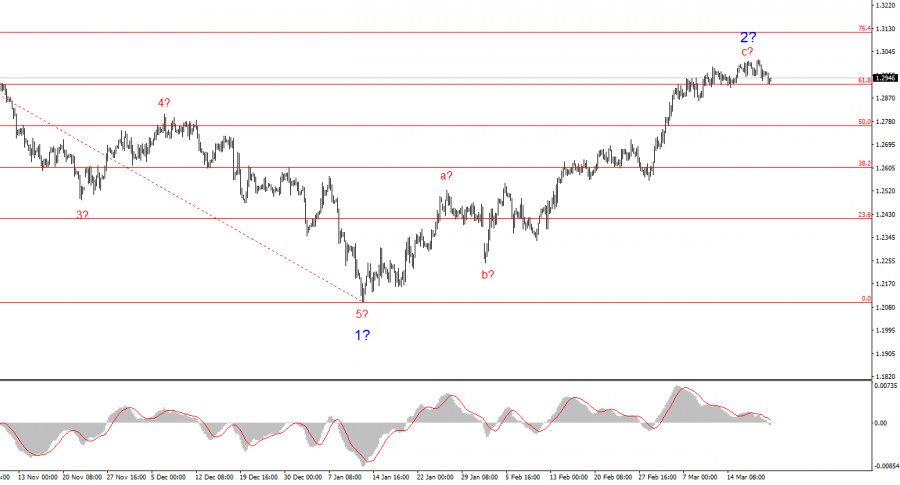

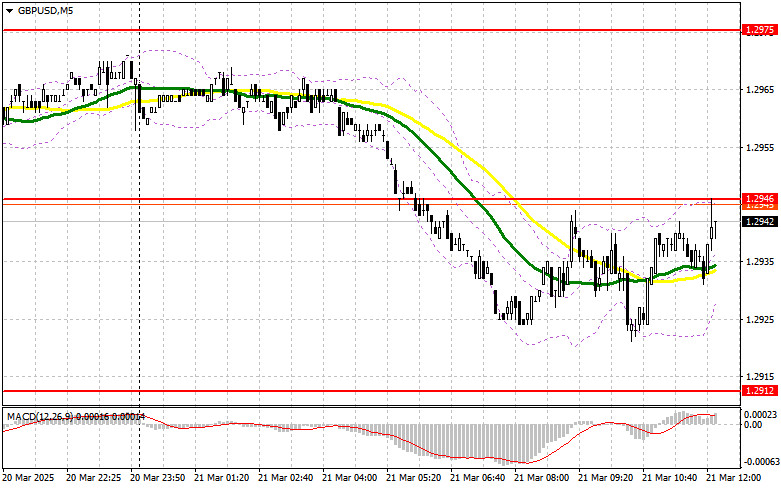

- The wave structure for GBP/USD remains somewhat ambiguous, but overall manageable. At present, there's still a high probability of a long-term downward trend developing. Wave 5 has taken

Autor: Chin Zhao

19:42 2025-03-21 UTC+2

54

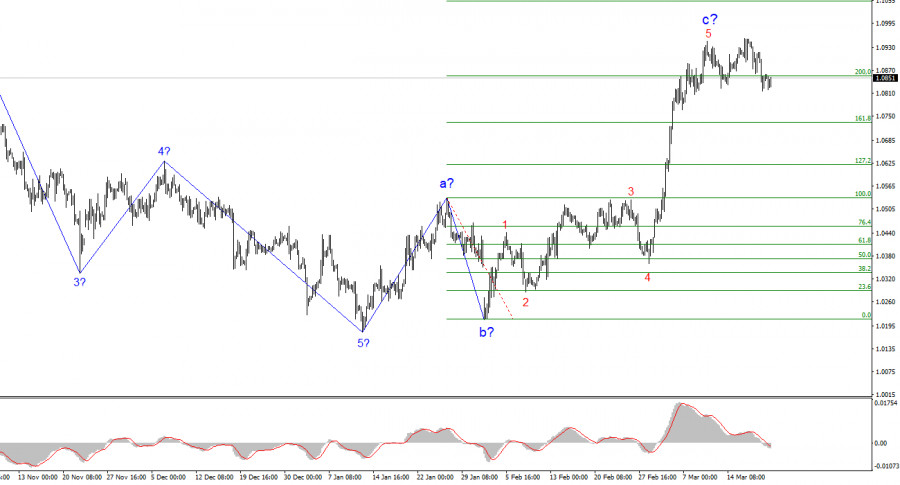

The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respondAutor: Chin Zhao

19:39 2025-03-21 UTC+2

48

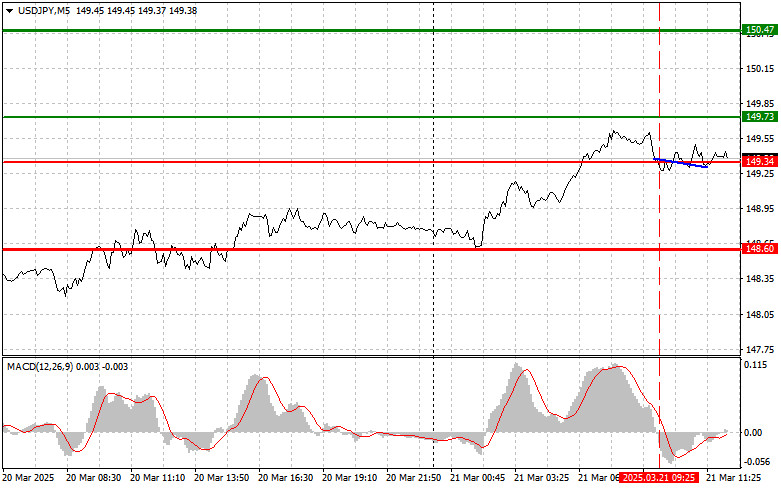

Trade Review and Tips for Trading the Japanese Yen The test of the 149.34 level occurred when the MACD indicator had just started moving downward from the zero line, confirmingAutor: Jakub Novak

19:30 2025-03-21 UTC+2

48

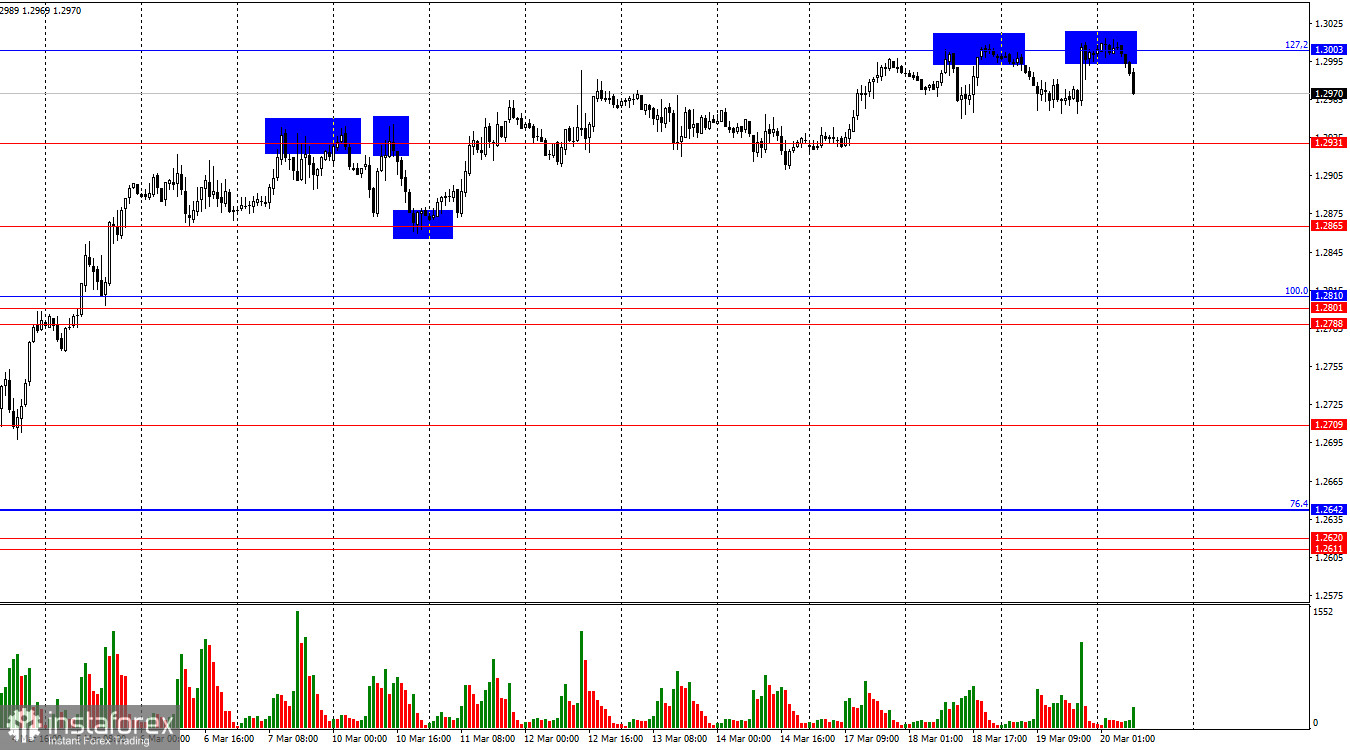

- Trade Review and Tips for Trading the British Pound No tests of the key levels I indicated occurred in the first half of the day. The reason was low market

Autor: Jakub Novak

19:17 2025-03-21 UTC+2

45

Trade Review and Tips for Trading the Euro There were no tests of the key levels I identified earlier today. The reason was low market volatility due to the absenceAutor: Jakub Novak

19:09 2025-03-21 UTC+2

48

In my morning forecast, I focused on the 1.2946 level and planned to make trading decisions from that point. Let's take a look at the 5-minute chart to see whatAutor: Miroslaw Bawulski

19:04 2025-03-21 UTC+2

27

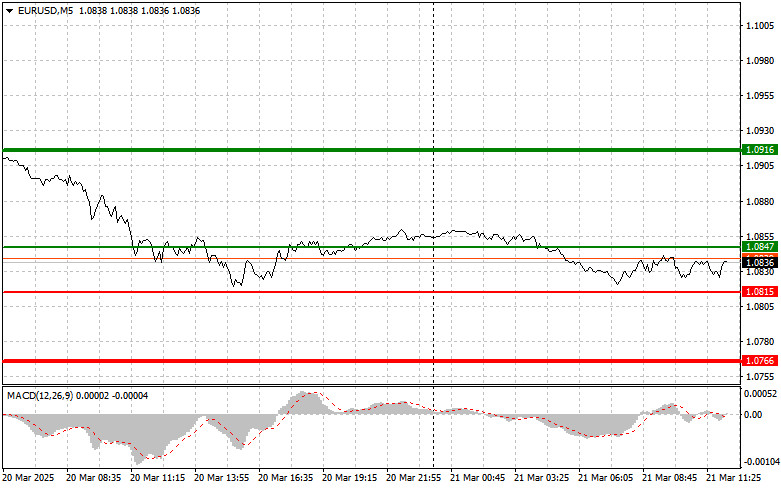

- In my morning forecast, I highlighted the 1.0856 level and planned to make trading decisions around it. Let's take a look at the 5-minute chart and see what happened

Autor: Miroslaw Bawulski

18:59 2025-03-21 UTC+2

22

US stock market in limbo despite positive economic data such as unexpected growth in existing home sales On Thursday, US benchmark stock indices closed in the red: the Dow JonesAutor: Natalia Andreeva

15:48 2025-03-21 UTC+2

59

Technical analysisTrading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument leftAutor: Dimitrios Zappas

14:22 2025-03-21 UTC+2

63