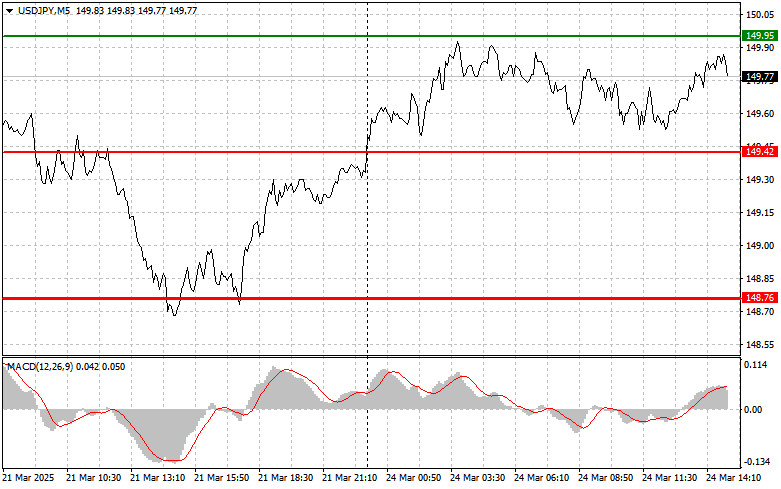

- Trade Analysis and Tips for Trading the Japanese Yen The levels I outlined were not tested during the first half of the day. The volatility seen immediately after the release

Autor: Jakub Novak

17:13 2025-03-24 UTC+2

24

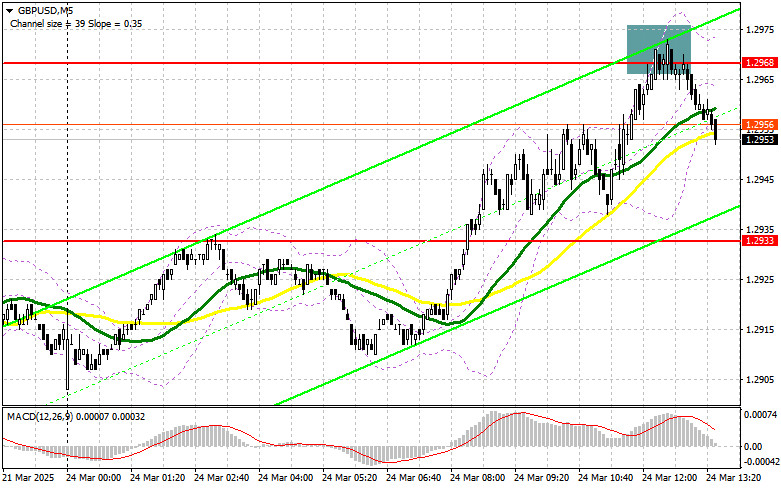

Trade Analysis and Tips for the British Pound The test of the 1.2935 level occurred when the MACD indicator had already moved significantly above the zero line, which limitedAutor: Jakub Novak

17:10 2025-03-24 UTC+2

12

Trade Analysis and Tips for the Euro The test of the 1.0842 level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair'sAutor: Jakub Novak

17:07 2025-03-24 UTC+2

10

- In my morning forecast, I highlighted the level of 1.2968 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happened

Autor: Miroslaw Bawulski

17:05 2025-03-24 UTC+2

16

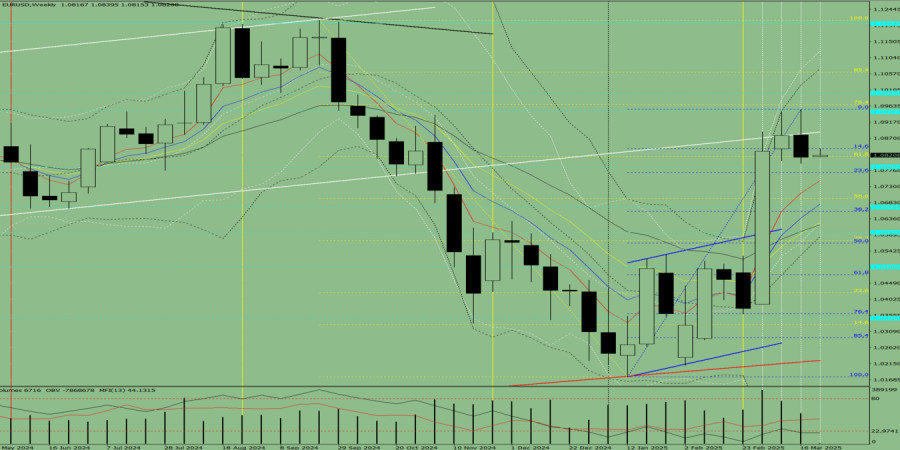

In my morning forecast, I highlighted the level of 1.0856 and planned to make trading decisions based on it. Let's take a look at the 5-minute chart and see whatAutor: Miroslaw Bawulski

17:01 2025-03-24 UTC+2

5

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAutor: Sebastian Seliga

15:34 2025-03-24 UTC+2

24

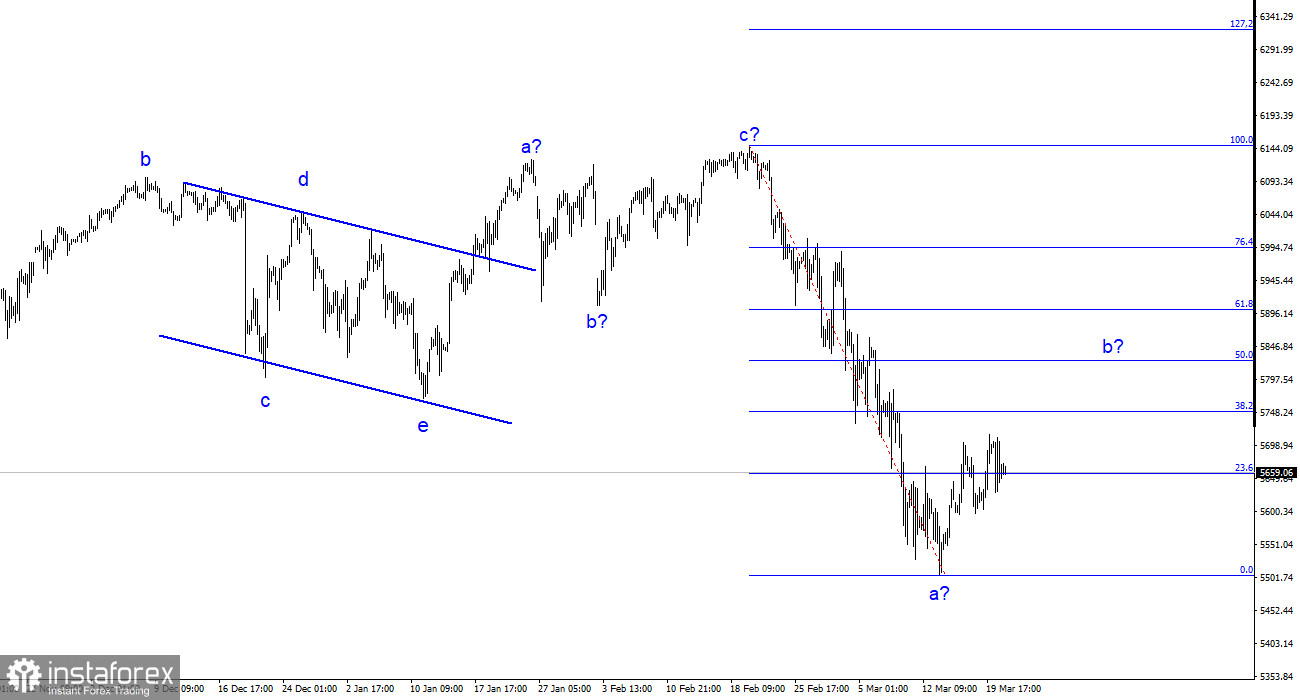

- The wave of optimism that swept through US stock markets following Donald Trump's re-election turned out to be short-lived. Euphoria quickly gave way to a deep correction amid escalating trade

Autor: Anna Zotova

14:55 2025-03-24 UTC+2

12

Last week, the pair moved downward and tested the 14.6% retracement level at 1.2879 (red dashed line), closing the weekly candle at 1.2915. In the upcoming week, the priceAutor: Stefan Doll

14:24 2025-03-24 UTC+2

43

Last week, the pair moved downward and tested the historical resistance level of 1.0948 (light blue dashed line), after which the price declined and closed the weekly candle at 1.0815Autor: Stefan Doll

14:22 2025-03-24 UTC+2

14