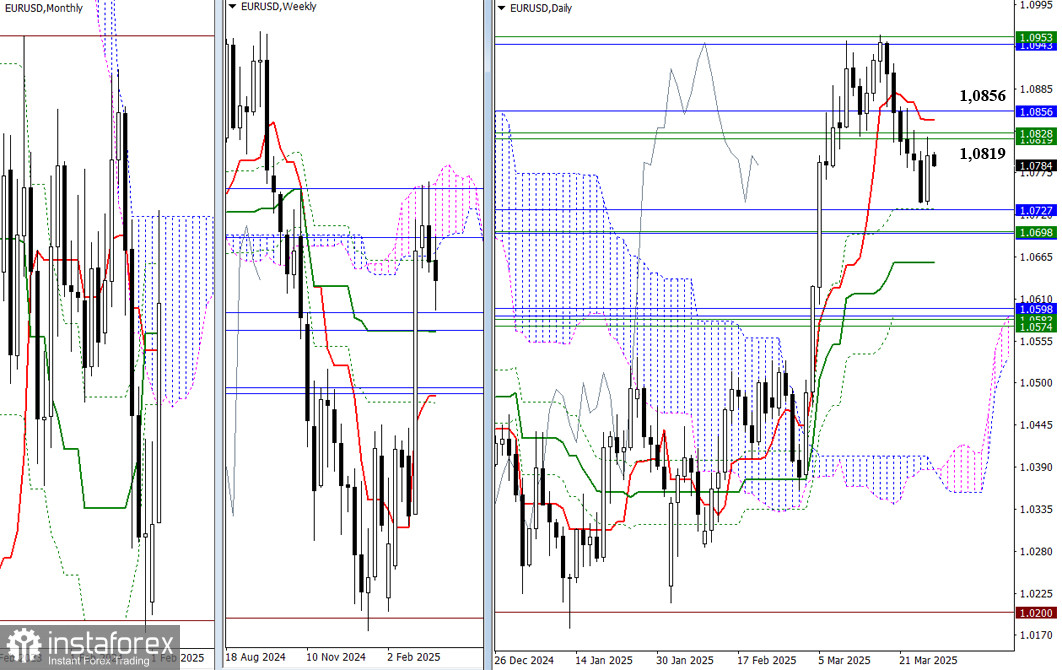

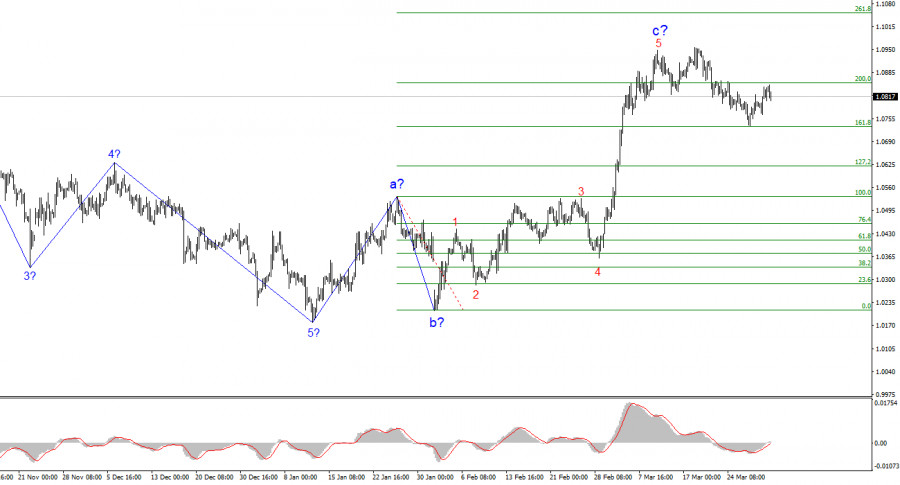

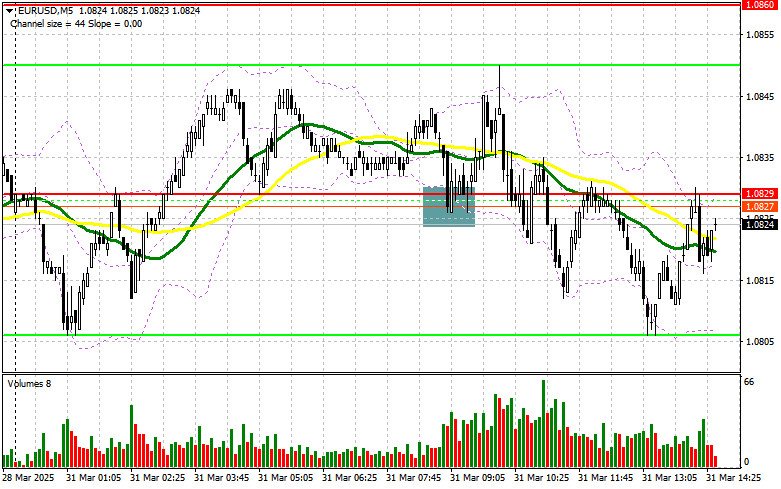

- The wave structure on the 4-hour EUR/USD chart is at risk of transforming into a more complex formation. On September 25 of last year, a new downward structure began forming

Autor: Chin Zhao

20:10 2025-03-31 UTC+2

8

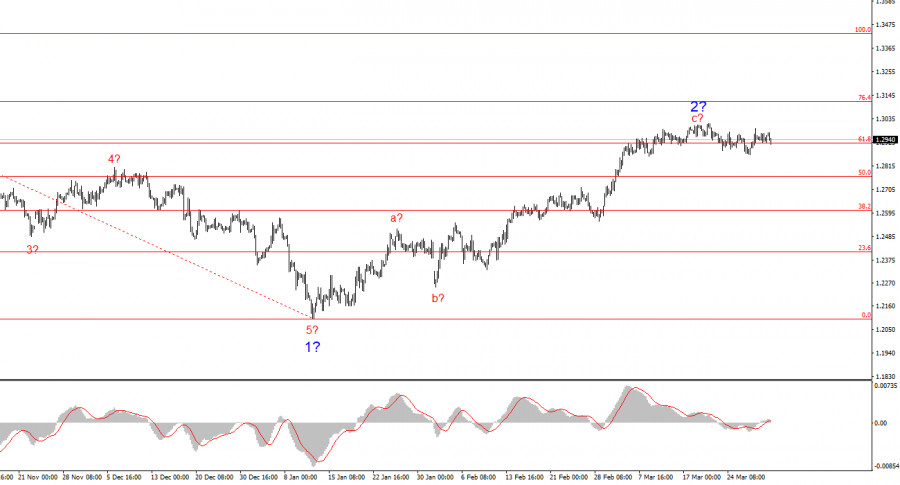

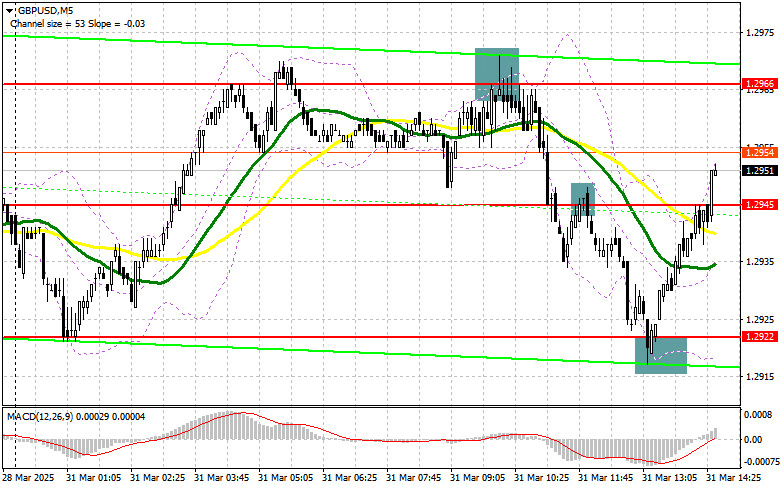

The wave structure for GBP/USD remains somewhat ambiguous, though overall acceptable. Currently, there is still a high probability of a long-term downward trend formation. Wave 5 has taken a convincingAutor: Chin Zhao

20:08 2025-03-31 UTC+2

5

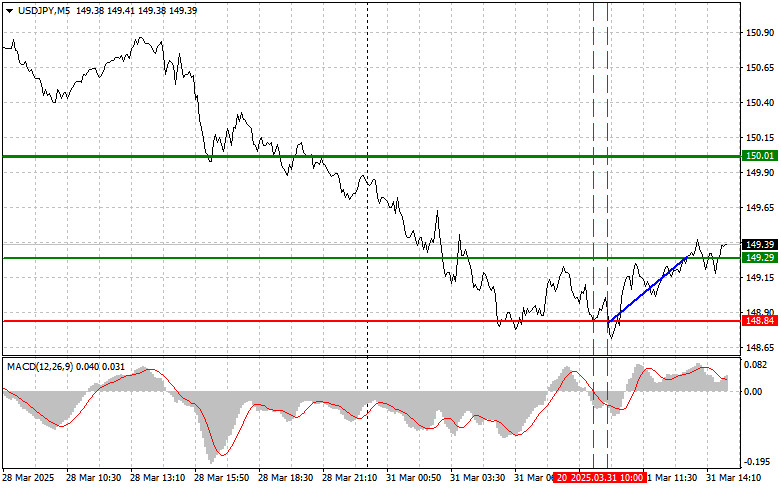

Trade Breakdown and Tips for Trading the Japanese Yen The price test at 148.84 occurred when the MACD had already moved significantly below the zero mark, limiting the pair's downwardAutor: Jakub Novak

20:01 2025-03-31 UTC+2

5

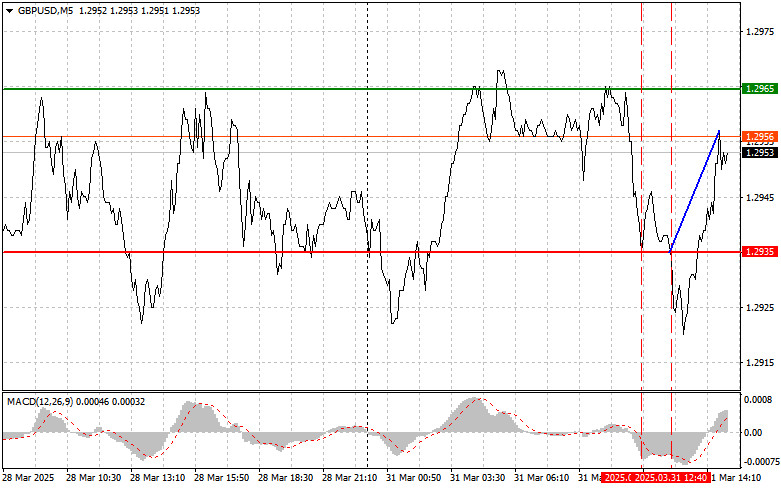

- Trade Breakdown and Tips for Trading the British Pound The price test at 1.2935 occurred when the MACD had already moved significantly below the zero mark, which limited the pair's

Autor: Jakub Novak

19:58 2025-03-31 UTC+2

4

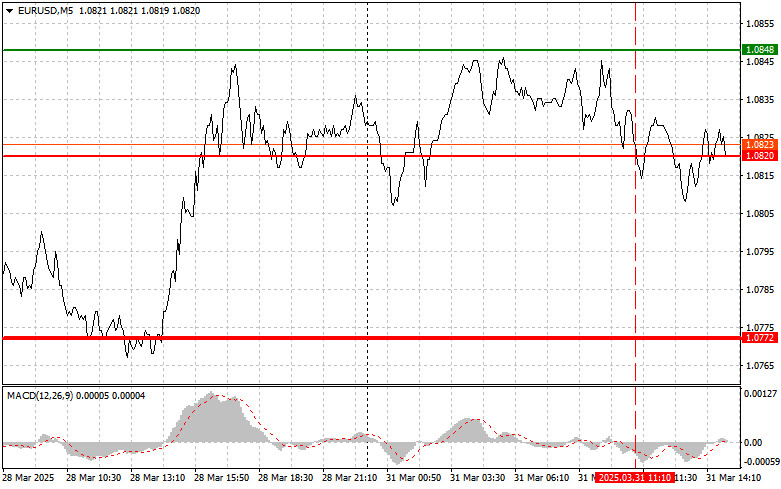

Trade Breakdown and Tips for Trading the Euro The price test of 1.0820 occurred at a time when the MACD indicator had already moved significantly below the zero line, whichAutor: Jakub Novak

19:55 2025-03-31 UTC+2

3

In my morning forecast, I focused on the 1.2966 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happenedAutor: Miroslaw Bawulski

19:52 2025-03-31 UTC+2

5

- In my morning forecast, I highlighted the 1.0829 level and planned to make trading decisions based on it. Let's look at the 5-minute chart to see what happened. A decline

Autor: Miroslaw Bawulski

19:50 2025-03-31 UTC+2

4

Europe's gas sector is entering a critical phase, as the end of the heating season sets the stage for refilling storage facilities, which are now two-thirds empty after the winterAutor: Miroslaw Bawulski

13:01 2025-03-31 UTC+2

5

The Nikkei drops 4% and Nasdaq futures fall 1.4%. Trump signals US tariffs will target all countries. Gold posts its best quarter since 1986, while the dollar headsAutor:

12:51 2025-03-31 UTC+2

7