- The S&P 500 index notched one of its biggest one-day gains in recent months. The upward move slowed near 5,516, but a break above key resistance at 5,669.50 could open

Autor: Irina Maksimova

12:58 2025-04-10 UTC+2

4

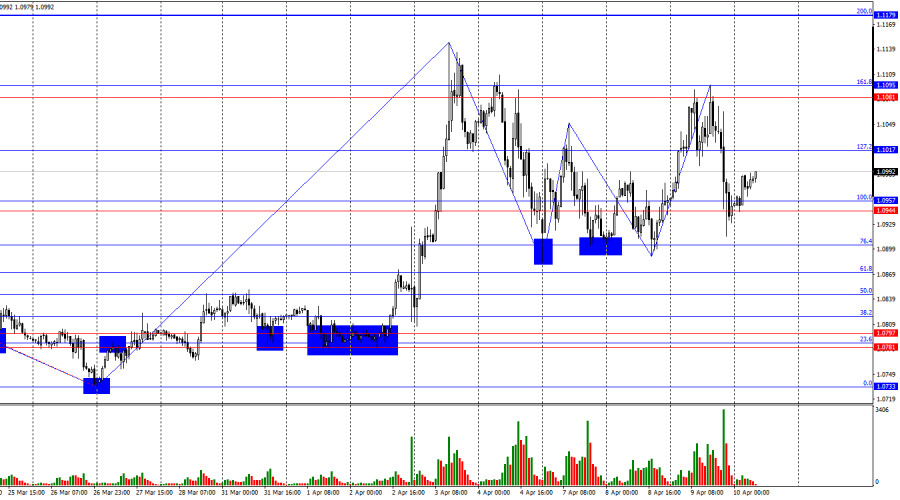

On Wednesday, the EUR/USD pair made two rebounds from the resistance zone of 1.1081–1.1095, turned in favor of the U.S. dollar, and declined toward the support zone of 1.0944–1.0957Autor: Samir Klishi

12:19 2025-04-10 UTC+2

9

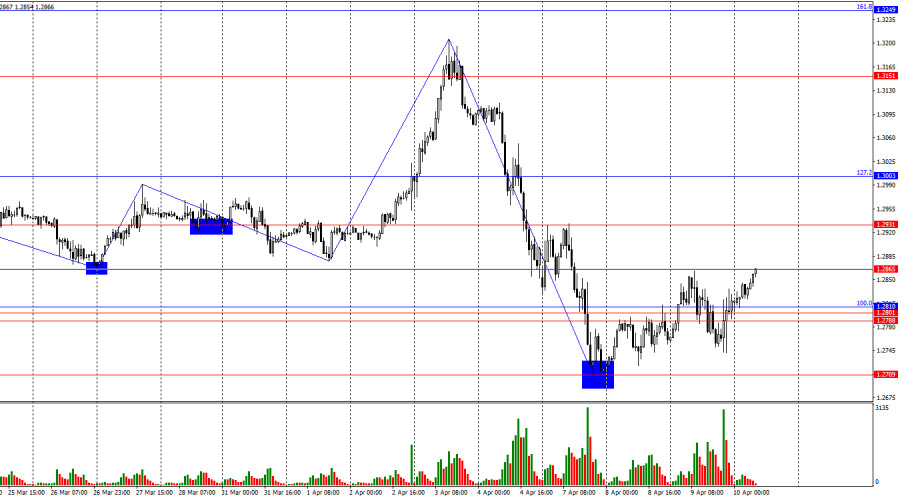

On the hourly chart, the GBP/USD pair rebounded from the 1.2865 level on Wednesday, experienced a slight decline, and today returned to that same level. Another rebound from this levelAutor: Samir Klishi

12:12 2025-04-10 UTC+2

5

- A highly anticipated March inflation report from the U.S. is expected today, with analysts predicting a slowdown, partly due to declining energy prices—which has brought some relief to consumers. According

Autor: Jakub Novak

12:09 2025-04-10 UTC+2

7

According to media reports, China's top leadership is set to hold an emergency meeting today to discuss additional economic stimulus measures following President Donald Trump's announcement of new tariff hikesAutor: Jakub Novak

12:07 2025-04-10 UTC+2

7

President Donald Trump announced yesterday a 90-day suspension of tariff increases that had affected dozens of trade partners, while simultaneously raising tariffs on China to 125%. The president's policy shiftAutor: Jakub Novak

11:57 2025-04-10 UTC+2

7

- S&P 500 Overview for April 10 US market rebounds strongly, but Trump's trade war with China remains unresolved Major US indices on Wednesday: Dow +8%, NASDAQ +12%, S&P 500 +9.5%

Autor: Jozef Kovach

11:45 2025-04-10 UTC+2

2

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAutor: Sebastian Seliga

11:35 2025-04-10 UTC+2

8

At the close of yesterday's regular trading session, US stock indices ended with solid gains. The S&P 500 jumped by 9.52%, while the Nasdaq 100 surged by 12.15%. The industrialAutor: Jakub Novak

11:31 2025-04-10 UTC+2

5