- Today, gold is rising, trading near the all-time high reached the previous day, amid growing uncertainty surrounding the US-China trade wars. Gold is gaining ground today, remaining close

Autor: Irina Yanina

12:18 2025-04-15 UTC+2

19

Today, the Japanese yen is struggling to extend its gains due to optimistic developments regarding trade negotiations and the postponement of tariffs. President Trump's statement about possible exemptionsAutor: Irina Yanina

12:08 2025-04-15 UTC+2

10

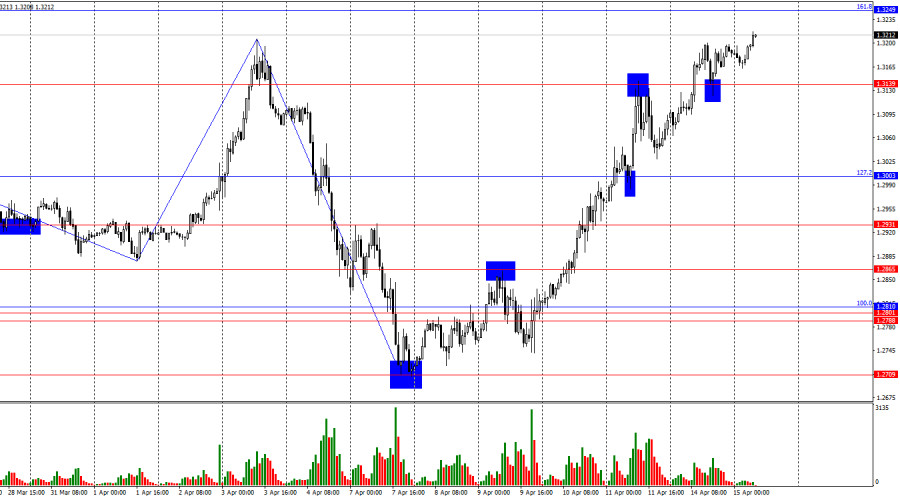

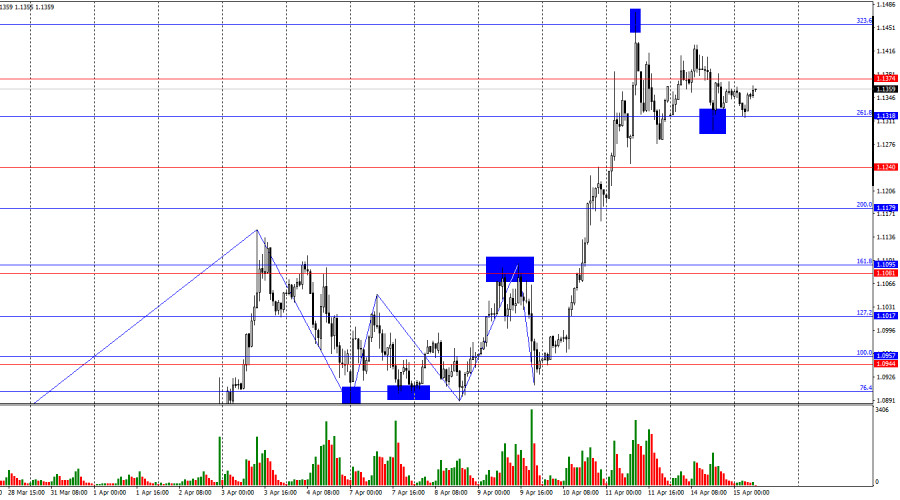

On the hourly chart, the GBP/USD pair continued rising on Monday and secured a position above the 1.3139 level. Thus, the upward movement may continue toward the next Fibonacci correctiveAutor: Samir Klishi

11:59 2025-04-15 UTC+2

8

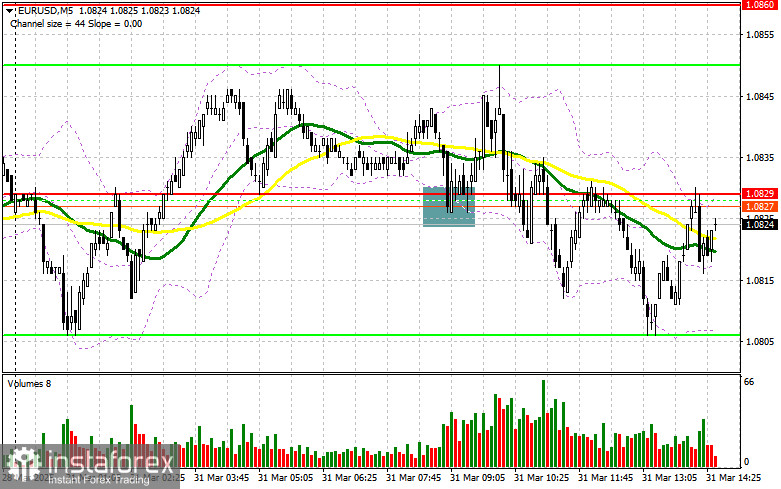

- On Monday, the EUR/USD pair continued to rise but returned by the end of the day to the 261.8% Fibonacci retracement level at 1.1318. A double rebound from this level

Autor: Samir Klishi

11:55 2025-04-15 UTC+2

11

Tuesday's premarket opens with uncertainty, a state that often precedes a storm rather than calm on Wall Street. The S&P 500 futures are sliding toward 5,420 after a strong MondayAutor: Anna Zotova

11:52 2025-04-15 UTC+2

4

At the close of the previous regular session, US stock indices ended in positive territory. The S&P 500 rose by 0.79%, while the Nasdaq 100 gained 0.64%. The Dow JonesAutor: Jakub Novak

11:34 2025-04-15 UTC+2

5

- The Trump administration has made concessions: tariffs on electronics have been temporarily lifted, and looser conditions for the auto industry are under consideration. These moves triggered a positive reaction —

Autor: Ekaterina Kiseleva

11:29 2025-04-15 UTC+2

6

Analytical NewsApple surges, market freezes in anticipation of Netflix: what's happening in the US stock market

US stocks show modest gains as tariffs on some electronics are delayed Tech stocks outperform European and Asian ones, Apple shares jump Goldman Sachs rises after results More earnings expectedAutor: Thomas Frank

09:50 2025-04-15 UTC+2

11

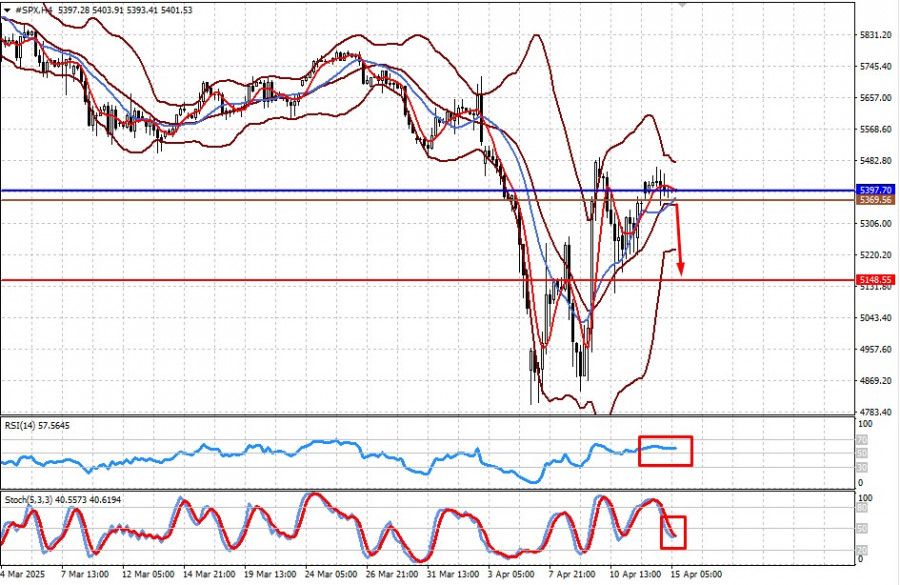

Fundamental analysisTrump Will Either Win or Lose. Is There No Middle Ground? (Potential Renewed Decline in #SPX and Bitcoin)

On Monday, markets calmed slightly amid Donald Trump's apparent backpedaling on the trade barriers he had imposed on America's trading partners. It gives the impression that the U.S. presidentAutor: Pati Gani

09:46 2025-04-15 UTC+2

7