- In an interview yesterday, BlackRock CEO Larry Fink warned that equity markets may still have room to fall, possibly by as much as 20%. However, he also framed the decline

Autor: Jakub Novak

12:27 2025-04-08 UTC+2

8

The Trump administration's latest wave of tariffs is reshaping economic expectations. Goldman Sachs is now forecasting a recession within the next 12 months, while JPMorgan analysts are pricingAutor: Ekaterina Kiseleva

12:14 2025-04-08 UTC+2

7

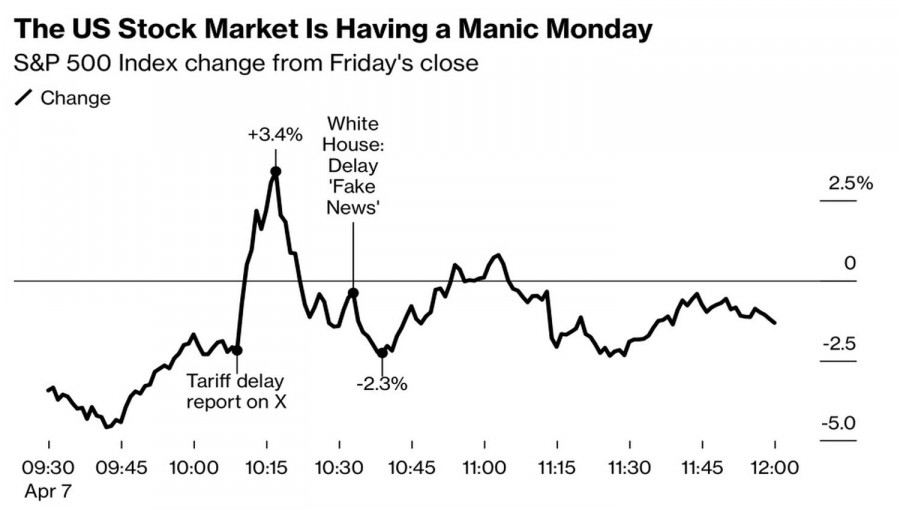

The world is a stage, and people are its actors. Tragicomedies happen every day in financial markets, but what happened at the start of the second week of AprilAutor: Marek Petkovich

11:49 2025-04-08 UTC+2

8

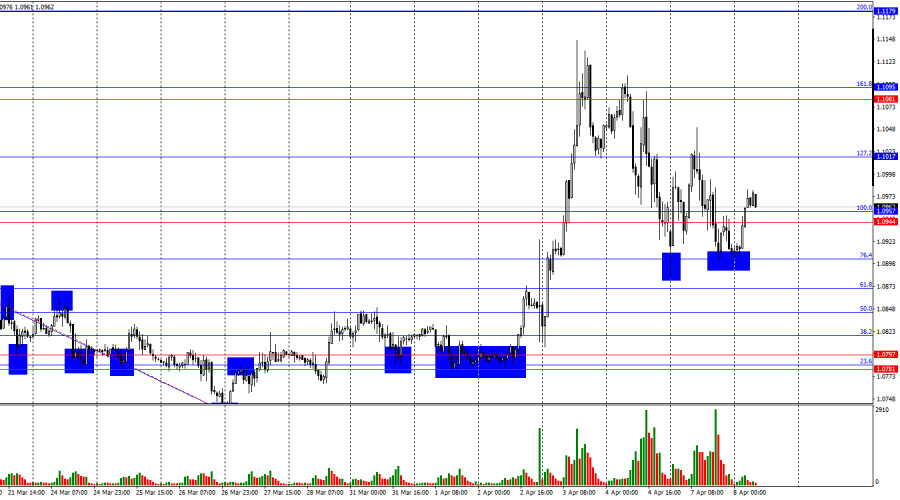

- On Monday, the EUR/USD pair made two rebounds from the 76.4% retracement level, turned in favor of the euro, and consolidated above the 1.0944–1.0957 zone. As a result, the upward

Autor: Samir Klishi

10:57 2025-04-08 UTC+2

16

On the hourly chart, the GBP/USD pair continued its decline on Monday and ended the day near the 1.2709 level. Over just two trading days, the pound dropped by roughlyAutor: Samir Klishi

10:53 2025-04-08 UTC+2

10

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAutor: Sebastian Seliga

10:50 2025-04-08 UTC+2

13

- Technical analysis

Technical Analysis of Intraday Price Movement of Gold Commodity Instrument, Tuesday 08 April 2025.

After the Divergence appeared between the movement of the Gold price with the Stochastic Oscillator indicator on the 4-hour chart and was also confirmed by its price movement whichAutor: Arief Makmur

09:32 2025-04-08 UTC+2

12

Technical analysisTechnical Analysis of Intraday Price Movement of Crude Oil Commodity Instrument, Tuesday 08 April 2025.

With the appearance of Convergence between the daily price movement of the Crude Oil commodity instrument and the Stochastic Oscillator indicator, it confirms that in the next few daysAutor: Arief Makmur

09:32 2025-04-08 UTC+2

32

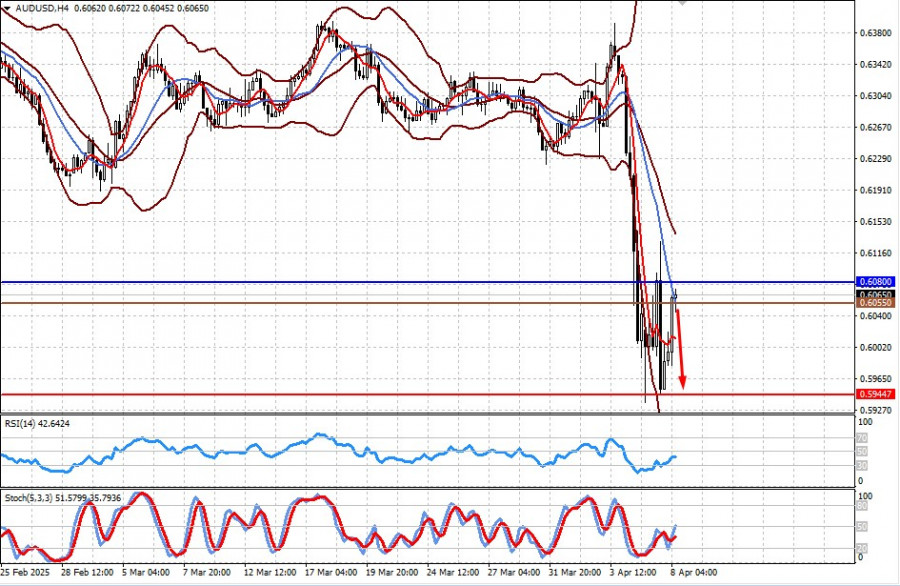

Fundamental analysisWill Tomorrow Be Better Than Yesterday? (There is a risk of renewed decline in AUD/USD and gold prices)

It's easy to stay optimistic and hope that decision-makers act according to your wishes. Why does this occur? And why can it be a trap for investors? The market sell-offAutor: Pati Gani

09:25 2025-04-08 UTC+2

13