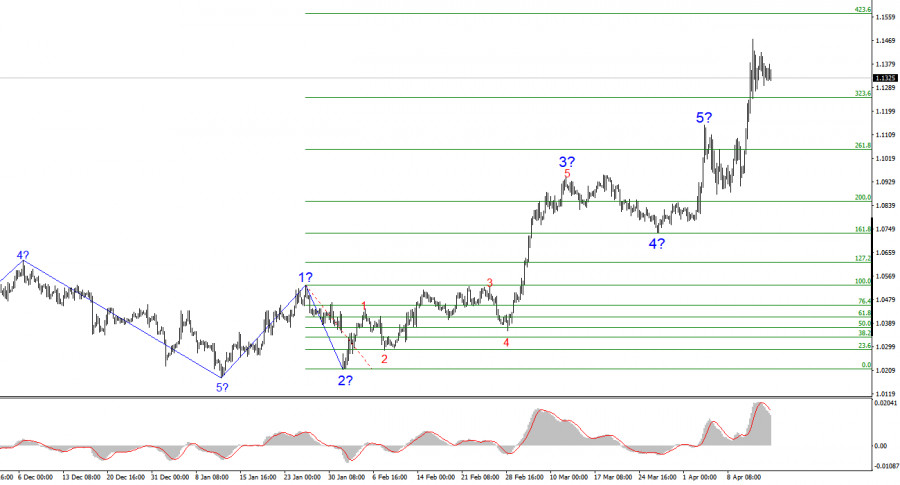

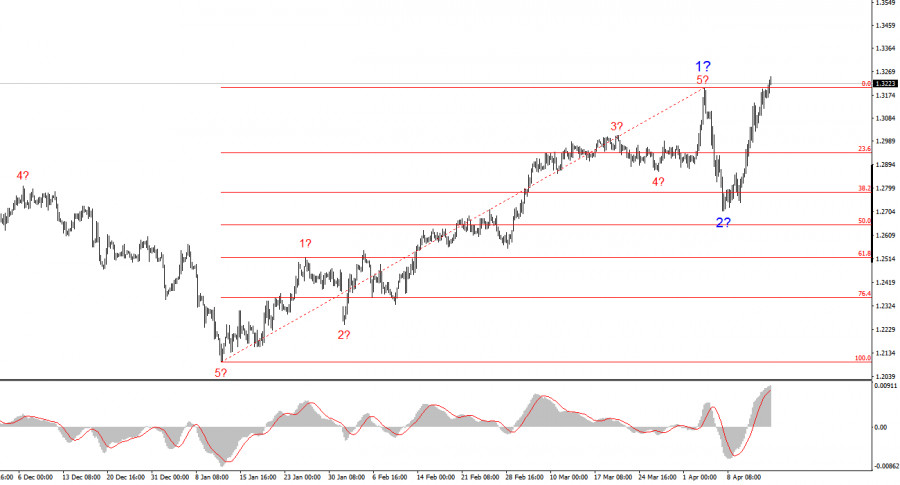

- The wave structure on the 4-hour chart for EUR/USD has shifted into a bullish formation. I believe there's little doubt that this transformation is entirely due to the new U.S

Autor: Chin Zhao

19:03 2025-04-15 UTC+2

15

The wave structure for GBP/USD has also transformed into a bullish, impulsive formation — "thanks" to Donald Trump. The wave pattern is almost identical to that of EUR/USD. Until FebruaryAutor: Chin Zhao

18:56 2025-04-15 UTC+2

10

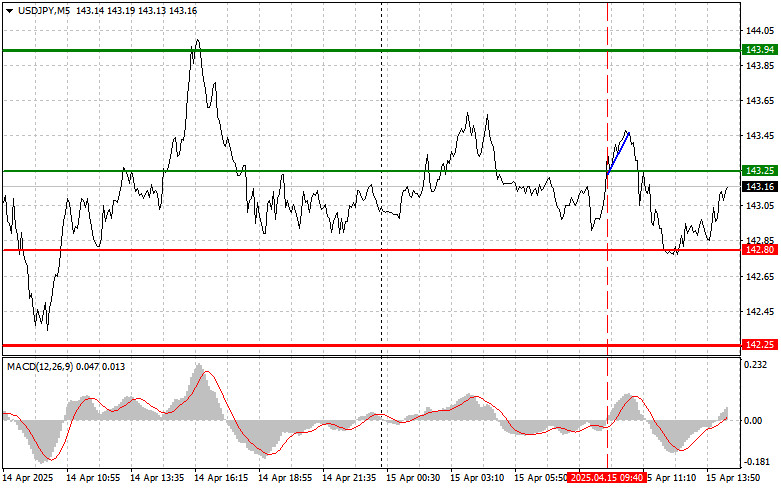

Trade Review and Tips for Trading the Japanese Yen The test of the 143.25 level occurred at a time when the MACD indicator had just started moving up fromAutor: Jakub Novak

18:53 2025-04-15 UTC+2

11

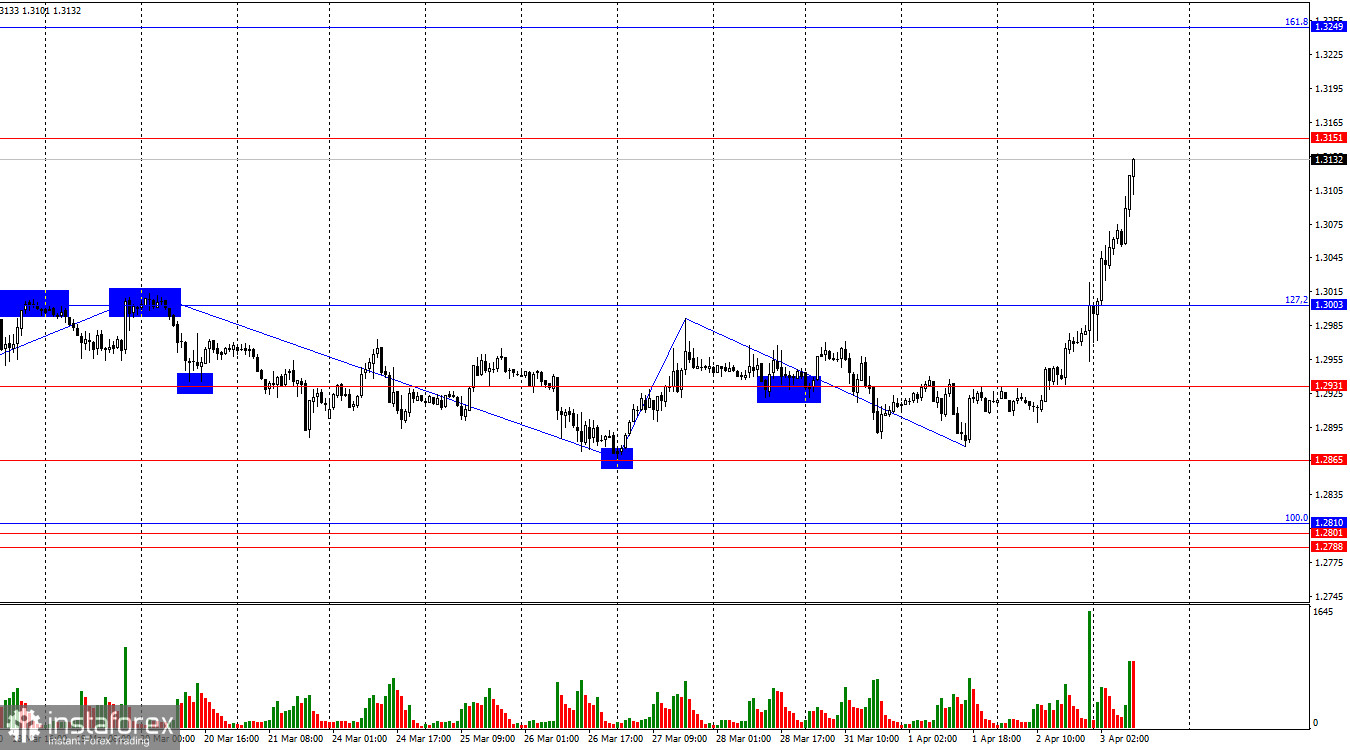

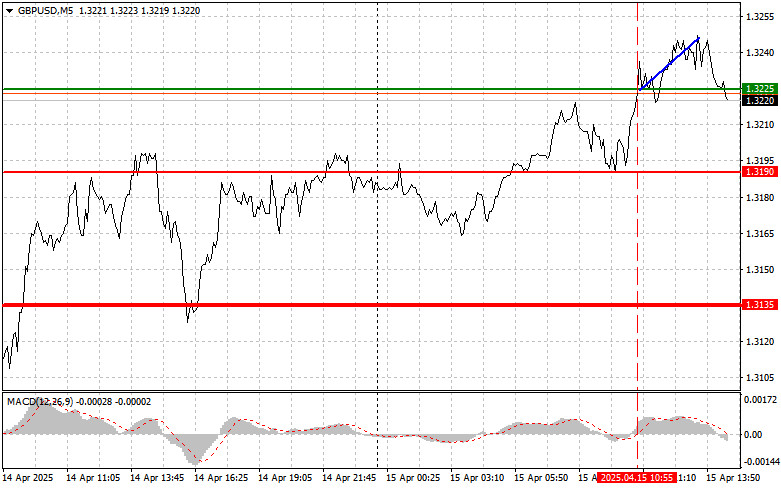

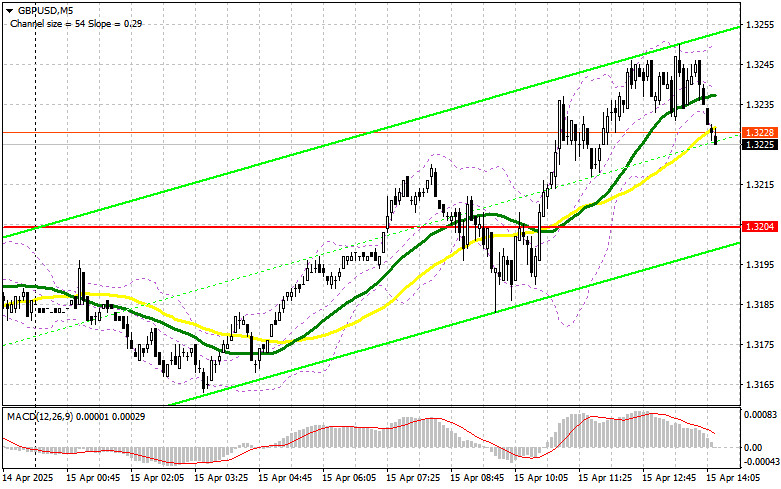

- Trade Review and Tips for Trading the British Pound The test of the 1.3225 level occurred just as the MACD indicator was beginning to rise from the zero mark, confirming

Autor: Jakub Novak

18:51 2025-04-15 UTC+2

8

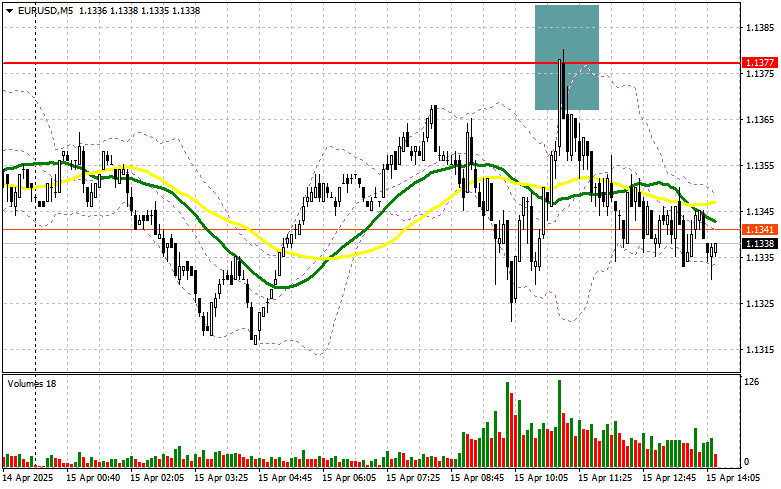

Trade Review and Euro Trading Tips The test of the 1.1336 price level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the downwardAutor: Jakub Novak

18:46 2025-04-15 UTC+2

9

In my morning forecast, I focused on the 1.3204 level and planned to make trading decisions from it. Let's look at the 5-minute chart and see what happened. A breakoutAutor: Miroslaw Bawulski

18:44 2025-04-15 UTC+2

10

- In my morning forecast, I highlighted the 1.1377 level and planned to make trading decisions from there. Let's look at the 5-minute chart and break down what happened. A rise

Autor: Miroslaw Bawulski

18:40 2025-04-15 UTC+2

9

Technical analysisTrading Signals for GOLD (XAU/USD) for April 15-18, 2025: sell below $3,220 (+1/8 Murray - 21 SMA)

Early in the American session, gold is trading around 3,220, showing signs of exhaustion. A further technical correction toward the 21SMA is likely in the coming hoursAutor: Dimitrios Zappas

14:05 2025-04-15 UTC+2

29

Today, gold is rising, trading near the all-time high reached the previous day, amid growing uncertainty surrounding the US-China trade wars. Gold is gaining ground today, remaining closeAutor: Irina Yanina

12:18 2025-04-15 UTC+2

38