Naš tim čini više od 7.000.000 trgovaca!

Svakog dana zajedno radimo na unapređenju trgovanja. Ostvarujemo vrhunske rezultate i krećemo se samo napred.

Priznatost od strane miliona trgovaca širom sveta najbolje pokazuje koliko se naš rad ceni! Napravili ste svoj izbor i mi ćemo učiniti sve što je neophodno da zadovoljimo vaša očekivanja!

Zajedno činimo sjajan tim!

InstaSpot. Sa ponosom radi za Vas!

Glumac, šampion UFC turnira i pravi heroj!

Čovek koji je ostvario sebe. Čovek koji hoda uz nas.

Tajna uspeha Taktarova jeste stalno kretanje ka svom cilju.

Otkrijte sve strane svog talenta!

Istražuj, pokušaj, padni - ali se nikad ne zaustavljaj!

InstaSpot. Priča Vašeg uspeha započinje ovde!

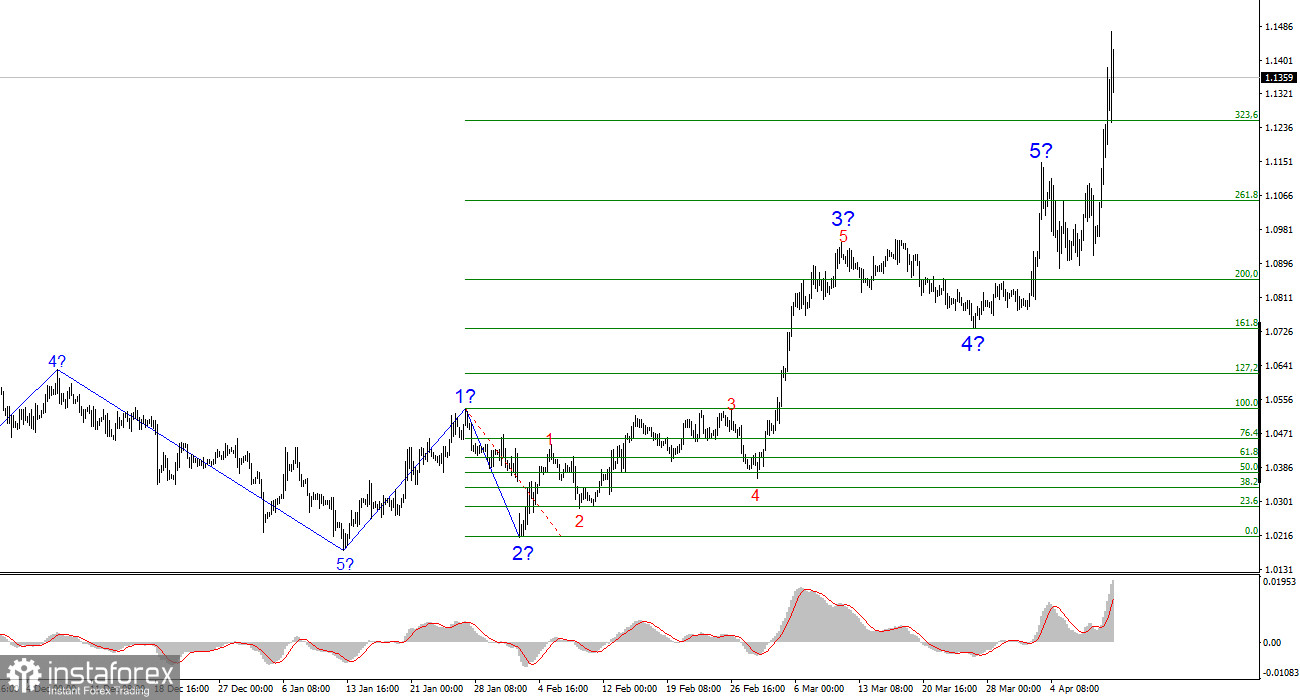

The wave structure on the 4-hour EUR/USD chart has transformed into a bullish one. I believe there's no doubt that this transformation occurred solely due to the United States' new trade policy. Until February 28 — when the sharp decline of the U.S. dollar began — the entire wave structure looked like a clear bearish trend, with corrective wave 2 under construction. However, Donald Trump's weekly announcements of various tariffs had their effect. Demand for the U.S. currency began to fall rapidly, and now the entire trend segment originating on January 13 has formed a five-wave impulsive pattern.

Based on this, we should now expect the formation of corrective wave 2 of a new bullish trend segment, potentially consisting of three waves. After that, the U.S. currency may continue to decline — unless Donald Trump completely reverses his adopted trade policy. We've witnessed a case where the news backdrop reshaped the wave structure.

The EUR/USD rate climbed 250 basis points on Thursday and added another 170 today. I believe none of my readers are questioning why the dollar lost another 400–500 points over two days. The reason is simple: Donald Trump, who on Wednesday shifted from anger to grace and introduced a grace period for all countries previously targeted by tariffs, immediately raised tariffs on China. First to 125%, then to 145%. I suspected China wouldn't stay silent — and indeed, today Beijing announced a tariff hike on all American goods to 125%. And I suspect this is just a response to Trump's initial tariff increase.

Moreover, in China, some stores have begun applying a 104% surcharge on any goods for American customers. While these are currently isolated incidents, the trend is clear — and I've previously mentioned it. The world is beginning to turn against the United States and Donald Trump personally. American goods are being boycotted in many countries, and the "don't buy American" movement is gaining momentum. Of course, the whole world won't stop buying U.S. products, but even a 20–30% drop in demand would be a significant blow to an economy that's not expecting anything positive in the near future. So what questions can there still be about EUR/USD's movements over the past two days? The wave structure is developing in such a way that corrective waves now have to be hunted for on the charts.

Based on the EUR/USD analysis, I conclude that the pair continues to build a new bullish trend segment. Donald Trump's actions reversed the bearish trend. Therefore, in the near term, the wave structure will depend entirely on the U.S. President's stance and actions. This should be kept in mind at all times. According to classic wave analysis, we should expect the formation of a corrective set of waves, typically three. However, wave 2 may already be complete. If this assumption is correct, the formation of wave 3 in the bullish trend segment has already begun — with potential targets reaching as high as the 1.25 level.

On the higher wave scale, the structure has shifted into a bullish phase. A long-term upward wave cycle is likely ahead — but the news flow from Donald Trump personally is capable of flipping everything upside down again.

Key Principles of My Analysis:

*Analiza tržišta koja se ovde nalazi namenjena je boljem razumevanju tržišta i ne pruža instrukcije za vršenje trgovanja.

Uz InstaSpot-ove analitičke preglede uvek ćete biti u toku sa tržišnim trendovima! Klijentima InstaSpot-a su dostupni mnogobrojni besplatni servisi za uspešno trgovanje.

Forex grafikon

Internet-verzija

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.