Popular analytics

Markets Shift Focus to Important Events This and Next Week (Likelihood of Renewed Declines in Bitcoin and USD/JPY)

Crypto market crash not over. Bitcoin and Ethereum might fall deeper

Will the Price of Gold Fall? A Probable Continuation of the Correction in Gold and Silver

An Increase in the PCE Index in Line With Forecasts Could Support US Stocks and Weaken the Dollar (There is a chance for renewed declines in #USDX and GBP/USD)

PCE Data May Significantly Impact Dollar Dynamics by the Weekend (Potential Continuation of Bitcoin and AUD/USD Declines)

PCE Indicator to Draw Attention This Week (There Is a Chance for Continued Local Growth in Gold Prices and the USD/CHF Pair)

Email Subscription

Do you want to receive Forex analytics newsletter to your email?

Subscribe to analytics newsletter and get fresh daily reviews prepared by InstaSpot professional analysts. You can choose which type of analysis and from what analysts you wish to recieve to your email address daily. Be on top of the Forex market events with InstaSpot!

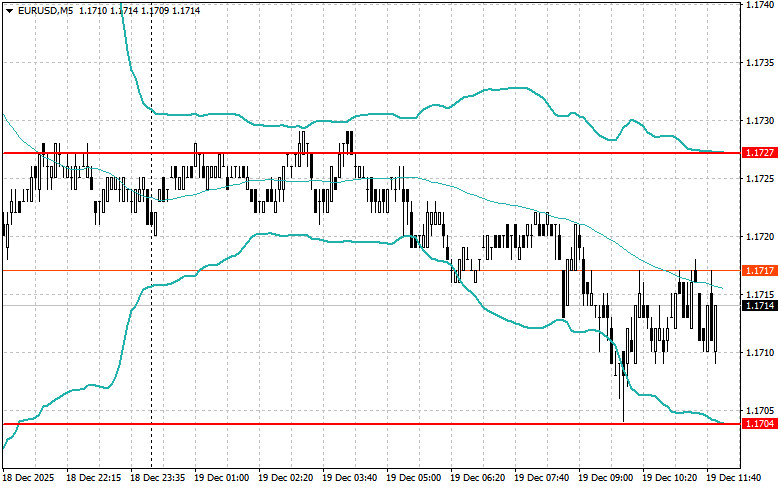

EUR/USD. Will the pair's decline continue?

Markets Expect Further Fed Rate Cuts This Year (GBP/USD and Gold May Resume Growth)

Rising US CPI Won't Stop Rate Cuts in America (Potential Correction Down in #SPX and GBP/USD)

EUR/USD. Negative News for the Dollar Will Support the Pair's Growth

Only a Growth in US Consumer Inflation Above Forecast Will Weigh Negatively on Markets (Could Trigger Renewed Growth in #SPX and Litecoin)

How Will US Inflation Data Affect the Dollar Exchange Rate? (There is a chance of renewed USD/JPY decline and AUD/USD growth)

This Week, Markets Will Focus On Us Inflation Reports (there is a chance for renewed growth of EUR/USD and gold prices)

The Fed Appears to Have No Choice But to Cut Rates (Possible Renewed Growth for Bitcoin and #NDX)

Deterioration in US labor market may be viewed as positive signal

Dollar Strength Likely to Be Limited (EUR/USD May Resume Its Rise After a Brief Decline USD/JPY May Move Lower)

Weak Us Employment Numbers Will Guarantee Fed Rate Cuts (with a likelihood of rising EUR/USD and GBP/USD pairs)

Predstavljamo Vam svakodnevno ažuriranu sekciju analiza, koja se sprovodi od strane profesionalnih analitičara kompanije InstaSpot. Svaki od stručnjaka koji su predstavljeni u ovom odeljku, vrši analitička istraživanja u skladu sa svojom vizijom trenutne situacije na međunarodnom Forex tržištu. Međutim, sve predstavljeno u opisu nije direktna preporuka ili razlog za akciju, jer ona sadrži isključivo analizu trenutne situacije na valutnom tržištu. U određenim slučajevima mišljenja analitičara o promenama trenutne tržišne situacije se mogu razlikovati, ovim putem, preporučujemo Vam da pratite publikacije samo jednog analitičara, koji je po Vašem mišljenju najjasniji i pravilno ocenjuje situaciju na međunarodnom Forex tržištu.