EURAUD (Euro vs Australian Dollar). Výmenný kurz a online grafy.

Currency converter

24 Mar 2025 13:13

(-0.01%)

Uzatváracia cena predchádzajúceho dňa.

Cena na ktorej otvoril daný deň.

Najvyššia cena počas posledného obchodného dňa.

Najnižšia cena počas posledného obchodného dňa

Celková hodnota spoločnosti na akciovom trhu. Vo všeobecnosti sa vypočíta ako násobok počtu akcií v obehu a aktuálnej ceny za jednu akciu.

Počet akcií držaných investormi a majiteľmi spoločnosti, okrem tzv. rozrieďujúcich cenných papierov ako sú neodňateľné RSU a neuplatnené opcie.

EURAUD is a cross rate of the Australian dollar to the European currency.

The Australian dollar is listed among the eight most wide-spread and popular currencies on the international exchange market. Above all, the high base rate of Australia, its stable economy and the political system of the country makes AUD attractive. Another appealing factor is the hands-off policy of the national currency's exchange rate determination propagated by the Australian CB. The Australian dollar rate depends highly on the base rate differences of Australia and the USA and on the economic indicators of the country.

The Australian dollar is considered a commodity currency.

Australia is the world's leader of the gold output and also a great oil and minerals exporting country. The central item of the Australian export is agricultural goods. Moreover, the Australian currency is sensitive to the price changes of minerals and agricultural commodities. The main trade partners of Australia are situated in Southeast Asia; the biggest one is China.

The high profitability of the Australian dollar makes it one of the most appealing currencies for trading.

The euro takes the second place by the trading volume on the forex market after the US dollar. About 40% of deals on the market are made with the euro. This currency is the most suitable for conservative traders who are interested in large volumes and high speed trading, and don't want to depend on the US dollar rate.

Pozrite si tiež

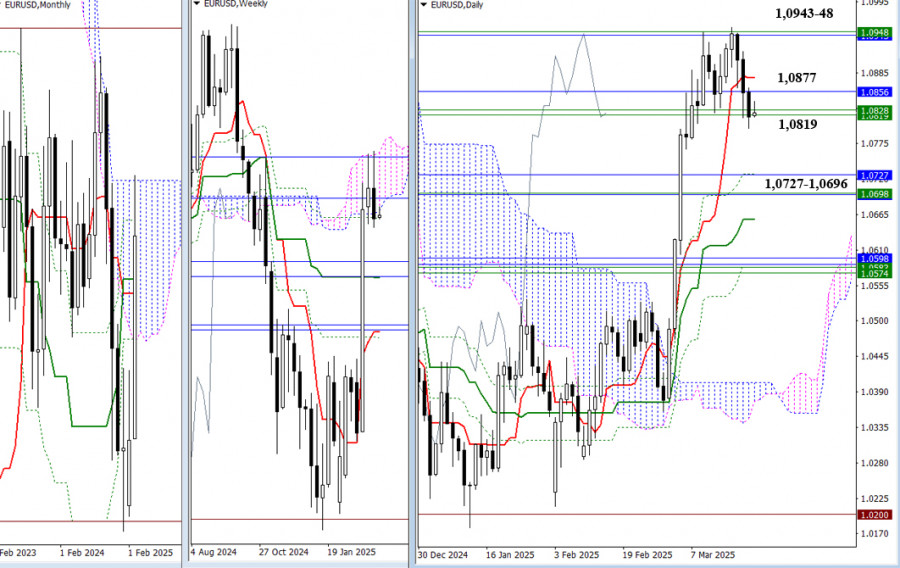

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946�1.0825) and monthly levels (1.0943�1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend th.

Autor: Evangelos Poulakis

08:55 2025-03-24 UTC+2

913

Fundamental analysisWhat to Pay Attention to on March 24? A Breakdown of Fundamental Events for Beginners

Eight macroeconomic events are scheduled for MondayAutor: Paolo Greco

07:08 2025-03-24 UTC+2

778

Technical analysisTechnical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAutor: Arief Makmur

08:09 2025-03-24 UTC+2

778

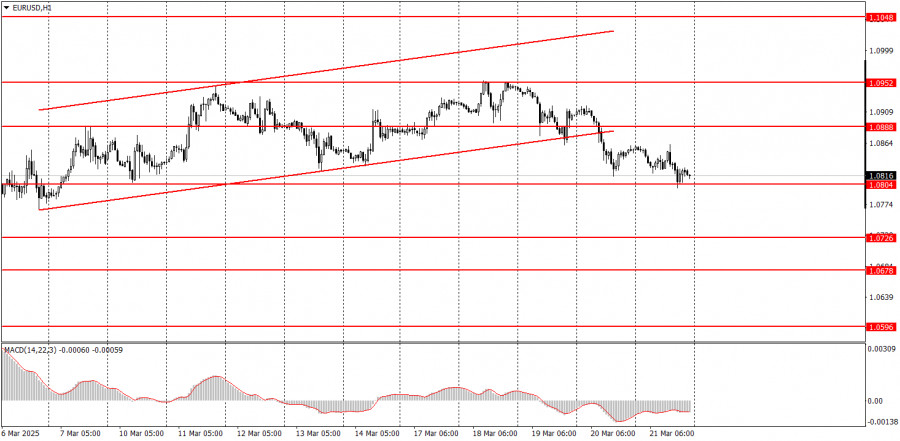

- The upcoming week's economic calendar is packed with important fundamental events. Macroeconomic reports will either help EUR/USD sellers consolidate within the 1.07 range or enable buyers to hold above the 1.0800 target.

Autor: Irina Manzenko

07:52 2025-03-24 UTC+2

763

Technical analysisTechnical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAutor: Arief Makmur

08:09 2025-03-24 UTC+2

763

Intraday Strategies for Beginner Traders on March 24Autor: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

703

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Autor: Irina Yanina

11:25 2025-03-24 UTC+2

688

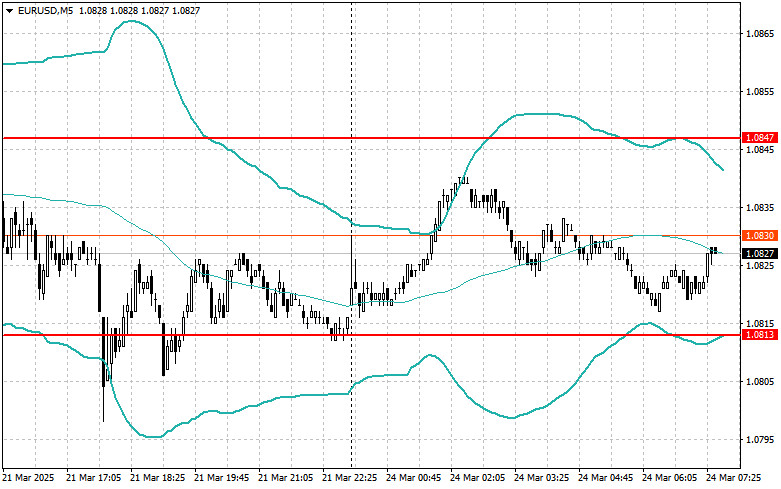

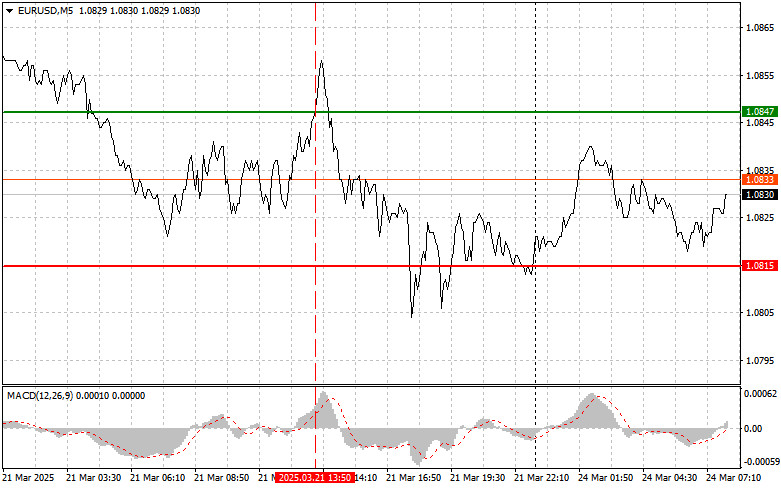

Typ analýzyEUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAutor: Jakub Novak

09:12 2025-03-24 UTC+2

688

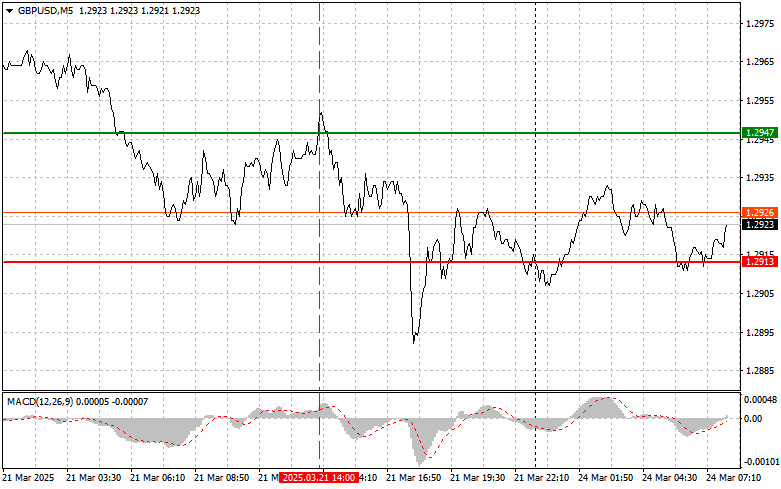

Typ analýzyGBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAutor: Jakub Novak

09:13 2025-03-24 UTC+2

628

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946�1.0825) and monthly levels (1.0943�1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend th.

Autor: Evangelos Poulakis

08:55 2025-03-24 UTC+2

913

- Fundamental analysis

What to Pay Attention to on March 24? A Breakdown of Fundamental Events for Beginners

Eight macroeconomic events are scheduled for MondayAutor: Paolo Greco

07:08 2025-03-24 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAutor: Arief Makmur

08:09 2025-03-24 UTC+2

778

- The upcoming week's economic calendar is packed with important fundamental events. Macroeconomic reports will either help EUR/USD sellers consolidate within the 1.07 range or enable buyers to hold above the 1.0800 target.

Autor: Irina Manzenko

07:52 2025-03-24 UTC+2

763

- Technical analysis

Technical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAutor: Arief Makmur

08:09 2025-03-24 UTC+2

763

- Intraday Strategies for Beginner Traders on March 24

Autor: Miroslaw Bawulski

08:22 2025-03-24 UTC+2

703

- Today, gold prices remain low but are holding above the psychological level of $3000, which serves as an important support.

Autor: Irina Yanina

11:25 2025-03-24 UTC+2

688

- Typ analýzy

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAutor: Jakub Novak

09:12 2025-03-24 UTC+2

688

- Typ analýzy

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on March 24. Review of Yesterday's Forex TradesAutor: Jakub Novak

09:13 2025-03-24 UTC+2

628