- Bitcoin v prvej polovici dňa neukázal nič zaujímavé. Iba s ethereom sa dalo trochu obchodovať v rámci jeho bočného kanála, z ktorého sa mu zatiaľ nepodarilo vyjsť. Ponuka bitcoinu

Autor: Miroslaw Bawulski

23:22 2025-03-27 UTC+2

0

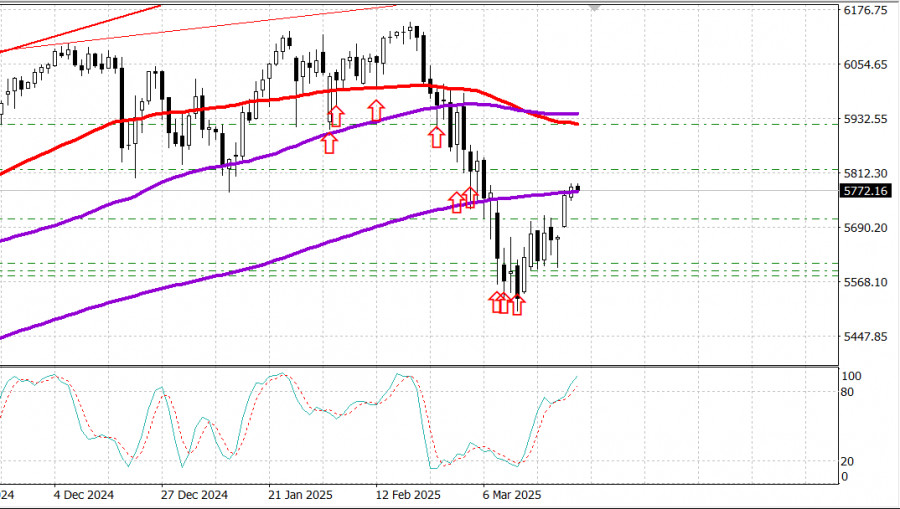

Čím vyššie stúpanie, tým väčší pád. Index S&P 500 sa prepadol v reakcii na oznámenie Donalda Trumpa o zavedení 25 % ciel na automobily. Nebudú existovať žiadne výnimky, hoci krajinyAutor: Marek Petkovich

13:01 2025-03-27 UTC+2

0

Dnešný pohyb zlata je aj naďalej pozitívny, ale presvedčenie o vzostupnom pohybe je naďalej slabé. Neistota na trhu vyvolaná clami Donalda Trumpa, ktoré majú nadobudnúť účinnosť 2. apríla, podporuje cenyAutor: Irina Yanina

23:57 2025-03-26 UTC+2

0

- Analytické predpovede

GBP/USD: jednoduché obchodné tipy pre začiatočníkov na 26. marec (americká seansa)

Analýza obchodov a tipy na obchodovanie s britskou librou The test of the 1.2927 price level occurred just as the MACD indicator began moving downward from the zero line, confirmingAutor: Jakub Novak

23:57 2025-03-26 UTC+2

0

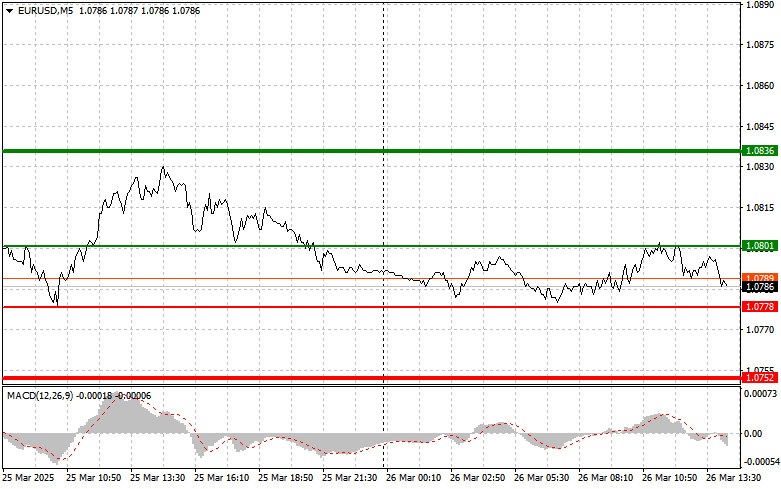

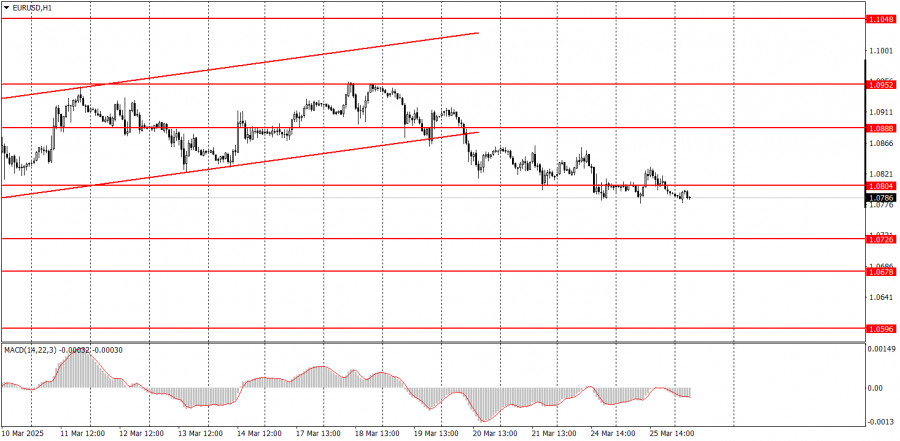

Analytické predpovedeEUR/USD: jednoduché obchodné tipy pre začiatočníkov na 26. marec (americká seansa)

Analýza obchodov a tipy na obchodovanie s eurom Cena v prvej polovici dňa neotestovala žiadne z úrovní, ktoré som uviedol. Nedostatok štatistických údajov z eurozóny mal brzdiaci vplyv na potenciálnyAutor: Jakub Novak

23:57 2025-03-26 UTC+2

0

Bitcoin a ethereum naďalej vykazujú aktívny rast, ale čelia výzvam pri prekonávaní hlavných úrovní rezistencie. Včera bitcoin po dosiahnutí hodnoty 88 400 USD klesol a v súčasnosti sa obchodujeAutor: Miroslaw Bawulski

21:54 2025-03-26 UTC+2

0

- S&P500 Aktuálne informácie o akciovom trhu na 26. marca Prehľad akciových indexov v USA v utorok: * Dow +0 %, NASDAQ +0,5 %, * S&P 500 +0,2 %, * S&P

Autor: Jozef Kovach

19:04 2025-03-26 UTC+2

0

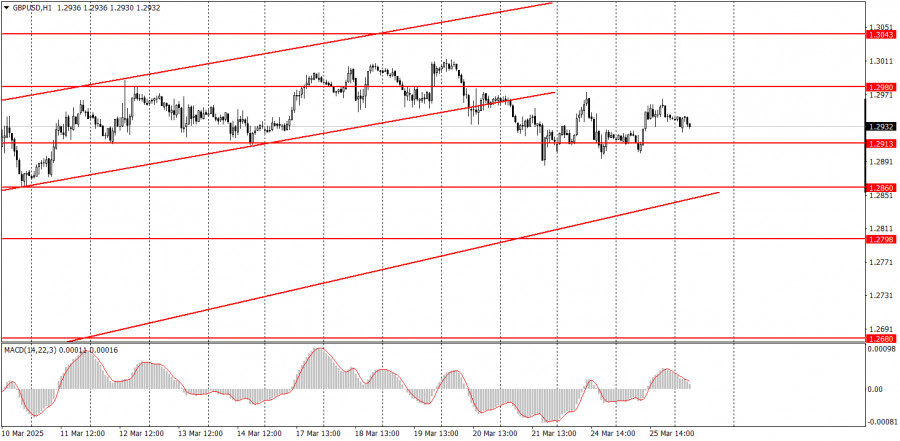

Obchodný plánAko obchodovať s párom GBP/USD 26. marca? Jednoduché tipy a analýza transakcií pre začiatočníkov

Analýza utorkových obchodov: 1-hodinový graf páru GBP/USD V utorok sa pár GBP/USD obchodoval s miernym rastom, ale celkový pohyb v posledných týždňoch čoraz viac pripomína pohyb do strany. Predpokladaný bočnýAutor: Paolo Greco

16:58 2025-03-26 UTC+2

0

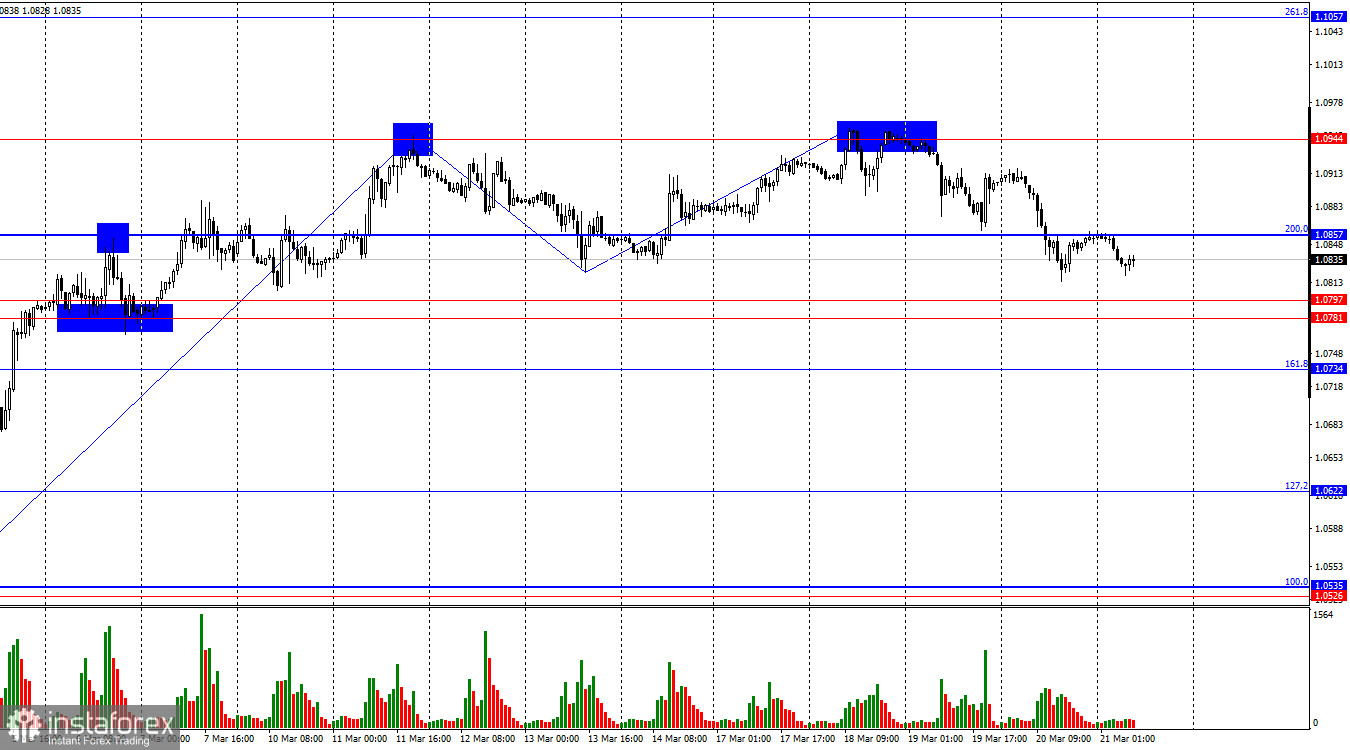

Obchodný plánAko obchodovať s párom EUR/USD 26. marca? Jednoduché tipy a analýza transakcií pre začiatočníkov

Analýza utorkových obchodov: 1-hodinový graf páru EUR/USD V utorok menový pár EUR/USD pokračoval v slabom poklese. Je to viditeľné na grafe akéhokoľvek časového rámca, po silnom a pomerne dlhom rasteAutor: Paolo Greco

16:57 2025-03-26 UTC+2

0