- Obchodný plán

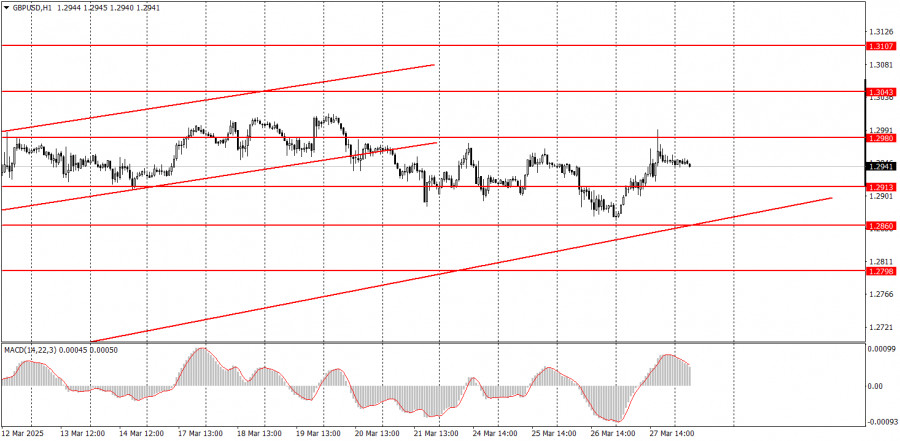

Ako obchodovať s párom GBP/USD 28. marca? Jednoduché tipy a analýza transakcií pre začiatočníkov

Analýza štvrtkových obchodov: 1-hodinový graf páru GBP/USD Vo štvrtok sa pár GBP/USD tiež obchodoval vyššie - a to pomerne výrazne. Napriek zverejneniu pomerne pozitívnej správy o HDP za 4. štvrťrokAutor: Paolo Greco

23:46 2025-03-28 UTC+2

0

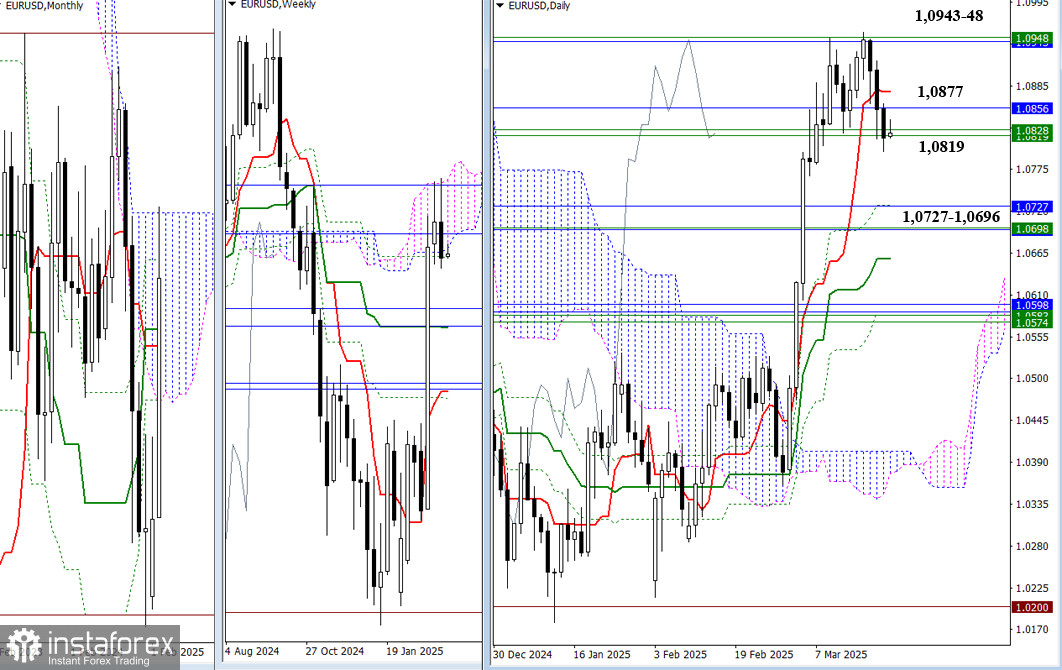

Obchodný plánAko obchodovať s párom EUR/USD 28. marca? Jednoduché tipy a analýza transakcií pre začiatočníkov

Analýza štvrtkových obchodov: 1-hodinový graf páru EUR/USD Menový pár EUR/USD vo štvrtok vzrástol na úroveň 1,0804. Prirodzene, takýto neočakávaný a pomerne silný rast eura (presnejšie povedané, pokles dolára) mohol vyvolaťAutor: Paolo Greco

23:46 2025-03-28 UTC+2

0

Bitcoin a ethereum sa snažia udržať si pozíciu. Ďalší neúspešný pokus bitcoinu udržať sa na úrovni 88 000 USD viedol k jeho výpredaju počas dnešnej ázijskej obchodnej seansy. Ethereum maloAutor: Miroslaw Bawulski

10:56 2025-03-28 UTC+2

0

- Bitcoin v prvej polovici dňa neukázal nič zaujímavé. Iba s ethereom sa dalo trochu obchodovať v rámci jeho bočného kanála, z ktorého sa mu zatiaľ nepodarilo vyjsť. Ponuka bitcoinu

Autor: Miroslaw Bawulski

23:22 2025-03-27 UTC+2

0

Čím vyššie stúpanie, tým väčší pád. Index S&P 500 sa prepadol v reakcii na oznámenie Donalda Trumpa o zavedení 25 % ciel na automobily. Nebudú existovať žiadne výnimky, hoci krajinyAutor: Marek Petkovich

13:01 2025-03-27 UTC+2

0

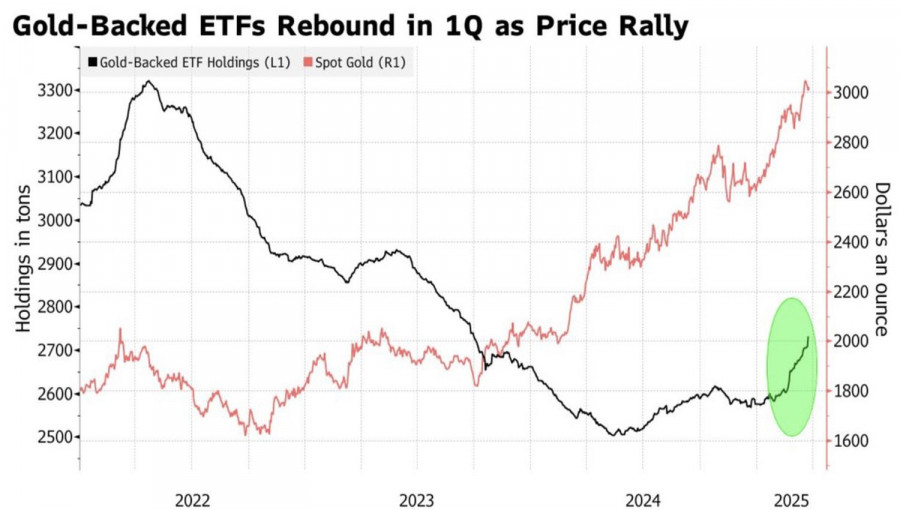

Zlato nebolo po víťazstve Donalda Trumpa v novembrových voľbách favoritom trhu. Keď už bolo jasné, že republikáni zvíťazili s veľkým náskokom, ceny zlata začali v reakcii na to klesať. MnohíAutor: Marek Petkovich

12:59 2025-03-27 UTC+2

0

- Analytické predpovede

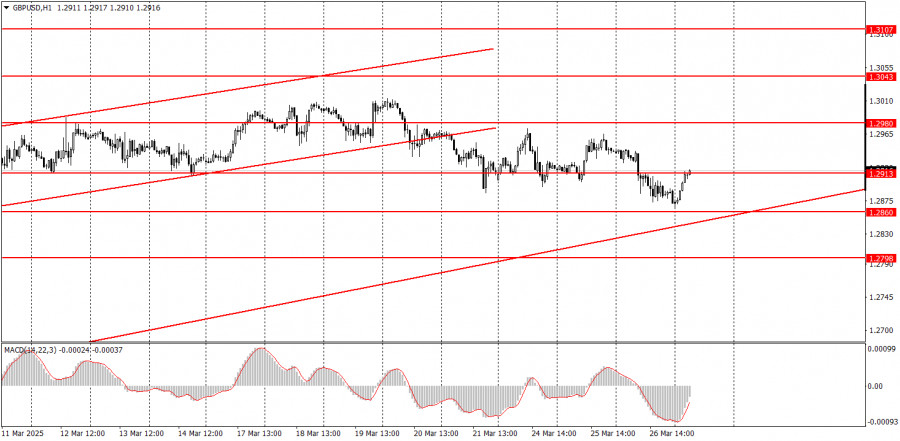

GBP/USD: jednoduché obchodné tipy pre začiatočníkov na 27. marec. Analýza včerajšieho obchodovania na forexovom trhu

The price test at 1.2875 occurred when the MACD indicator moved significantly below the zero line, limiting the pair's downside potential. For this reason, I did not sell the poundAutor: Jakub Novak

12:37 2025-03-27 UTC+2

0

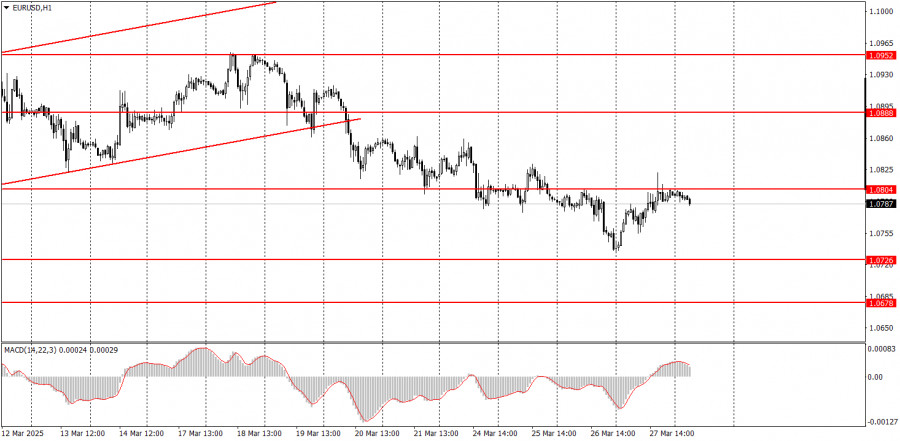

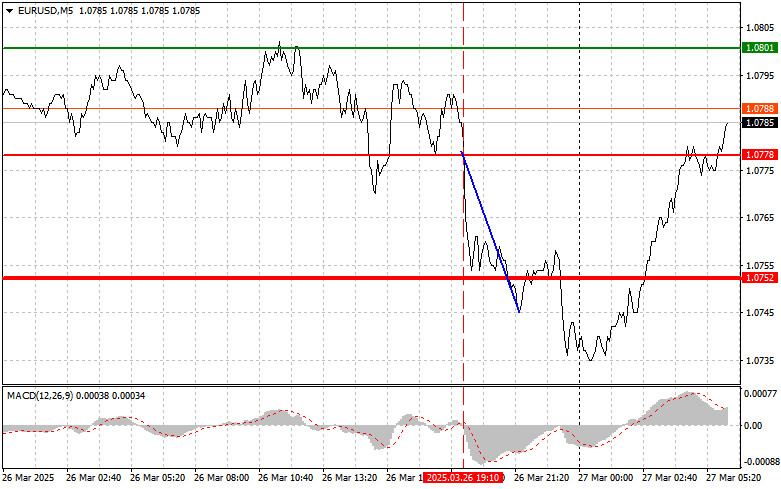

Analytické predpovedeEUR/USD: jednoduché obchodné tipy pre začiatočníkov na 27. marec. Analýza včerajšieho obchodovania na forexovom trhu

The price test at 1.0778 occurred just as the MACD indicator began to move down from the zero line, confirming a valid entry point for selling the euroAutor: Jakub Novak

12:37 2025-03-27 UTC+2

0

Obchodný plánAko obchodovať s párom GBP/USD 27. marca? Jednoduché tipy a analýza transakcií pre začiatočníkov

Analýza stredajších obchodov: 1-hodinový graf páru GBP/USD V stredu pár GBP/USD zaznamenal pohyb nadol, ktorý sa nakoniec prispôsobil makroekonomickému pozadiu. Počas dňa obchodníkov zaujali dve správy. V Spojenom kráľovstve bolaAutor: Paolo Greco

11:42 2025-03-27 UTC+2

0