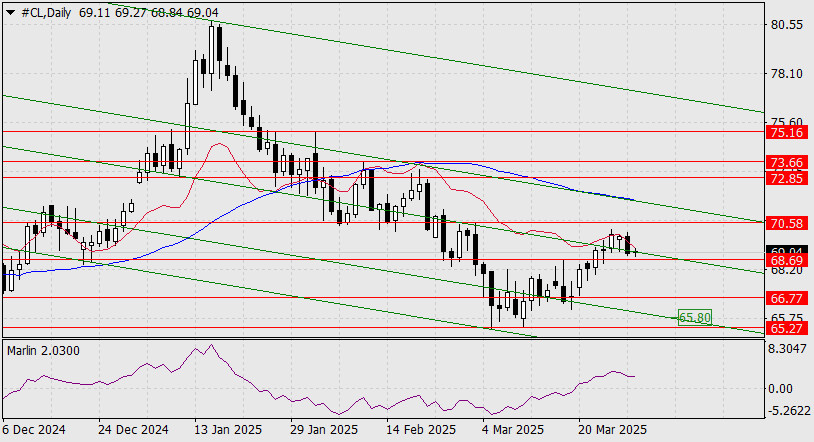

- Ropa (CL) sa držala nad klesajúcou zelenou čiarou cenového kanála len dva dni. Po poklese o 84 centov v piatok cena klesla pod líniu tohto kanála. Teraz musí cena prelomiť

Autor: Laurie Bailey

12:23 2025-03-31 UTC+2

0

Na konci včerajšej obchodnej seansy skončili americké akciové indexy v červených číslach. Index S&P 500 klesol o 0,33 %, Nasdaq 100 o 0,53 % a Dow Jones Industrial AverageAutor: Jakub Novak

23:50 2025-03-28 UTC+2

1

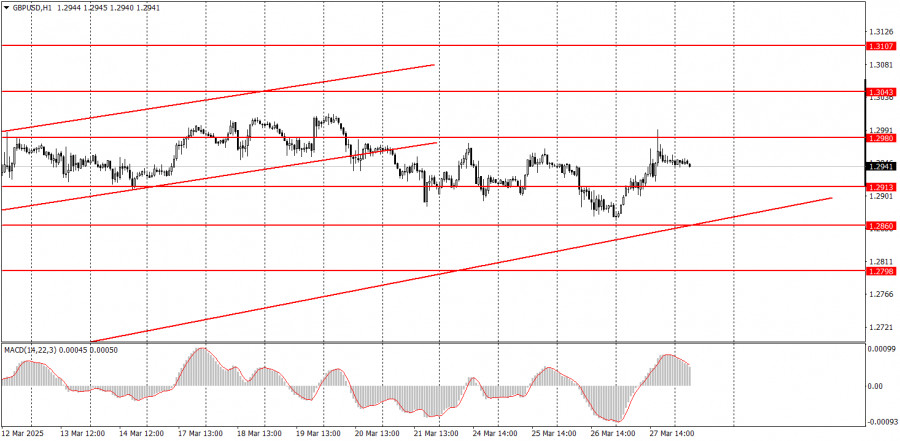

Analytické predpovedeGBPUSD: jednoduché obchodné tipy pre začiatočníkov na 28. marec (americká seansa)

Cena otestovala úroveň 1,2950, keď indikátor MACD začal rásť z nuly, čo bolo potvrdením, že táto úroveň je vhodným vstupným bodom na nákup libry. Avšak potom, čo pár vzrástolAutor: Jakub Novak

23:49 2025-03-28 UTC+2

0

- Analytické predpovede

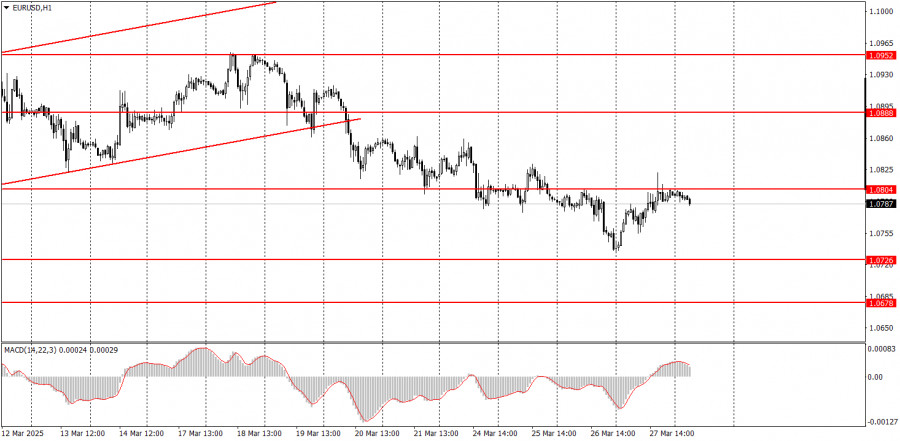

EUR/USD: jednoduché obchodné tipy pre začiatočníkov na 28. marec (americká seansa)

Cena otestovala úroveň 1,0785, keď indikátor MACD klesol výrazne pod nulu, čo obmedzilo potenciál páru klesať . Cena druhýkrát otestovala túto úroveň, keď bol indikátor MACD v prepredanej zóne, takžeAutor: Jakub Novak

23:49 2025-03-28 UTC+2

0

Obchodný plánAko obchodovať s párom GBP/USD 28. marca? Jednoduché tipy a analýza transakcií pre začiatočníkov

Analýza štvrtkových obchodov: 1-hodinový graf páru GBP/USD Vo štvrtok sa pár GBP/USD tiež obchodoval vyššie - a to pomerne výrazne. Napriek zverejneniu pomerne pozitívnej správy o HDP za 4. štvrťrokAutor: Paolo Greco

23:46 2025-03-28 UTC+2

0

Obchodný plánAko obchodovať s párom EUR/USD 28. marca? Jednoduché tipy a analýza transakcií pre začiatočníkov

Analýza štvrtkových obchodov: 1-hodinový graf páru EUR/USD Menový pár EUR/USD vo štvrtok vzrástol na úroveň 1,0804. Prirodzene, takýto neočakávaný a pomerne silný rast eura (presnejšie povedané, pokles dolára) mohol vyvolaťAutor: Paolo Greco

23:46 2025-03-28 UTC+2

0

- Bitcoin a ethereum sa snažia udržať si pozíciu. Ďalší neúspešný pokus bitcoinu udržať sa na úrovni 88 000 USD viedol k jeho výpredaju počas dnešnej ázijskej obchodnej seansy. Ethereum malo

Autor: Miroslaw Bawulski

10:56 2025-03-28 UTC+2

0

Bitcoin v prvej polovici dňa neukázal nič zaujímavé. Iba s ethereom sa dalo trochu obchodovať v rámci jeho bočného kanála, z ktorého sa mu zatiaľ nepodarilo vyjsť. Ponuka bitcoinuAutor: Miroslaw Bawulski

23:22 2025-03-27 UTC+2

1

Čím vyššie stúpanie, tým väčší pád. Index S&P 500 sa prepadol v reakcii na oznámenie Donalda Trumpa o zavedení 25 % ciel na automobily. Nebudú existovať žiadne výnimky, hoci krajinyAutor: Marek Petkovich

13:01 2025-03-27 UTC+2

4