- Zlato už druhý deň po sebe priťahuje predajcov, a to aj napriek absencii jasného fundamentálneho impulzu na pokles. S najväčšou pravdepodobnosťou je to dôsledok zmeny obchodnej pozície pred kľúčovou správou

Autor: Irina Yanina

20:01 2025-04-04 UTC+2

2

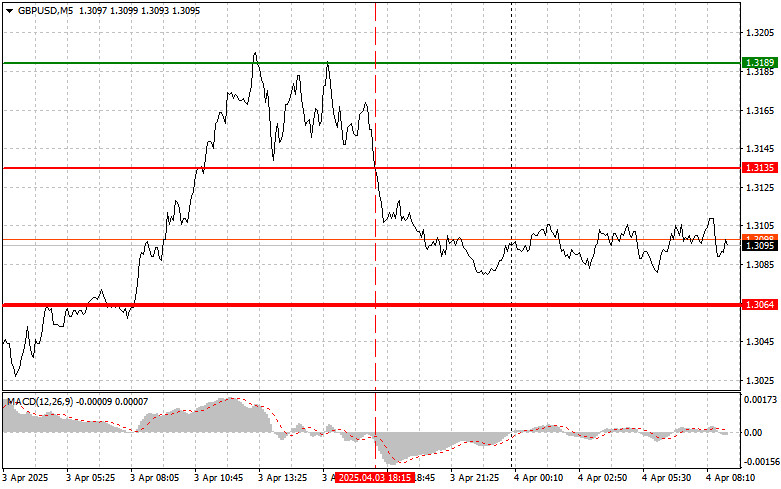

Analytické predpovedeGBP/USD: jednoduché obchodné tipy pre začiatočníkov na 4. apríla. Analýza včerajšieho obchodovania na forexovom trhu

Analýza obchodov a tipy na obchodovanie s britskou librou Cena otestovala úroveň 1,3135, keď indikátor MACD výrazne klesol pod nulu, čo obmedzilo potenciál páru klesať. Z toho dôvodu som libruAutor: Jakub Novak

19:37 2025-04-04 UTC+2

2

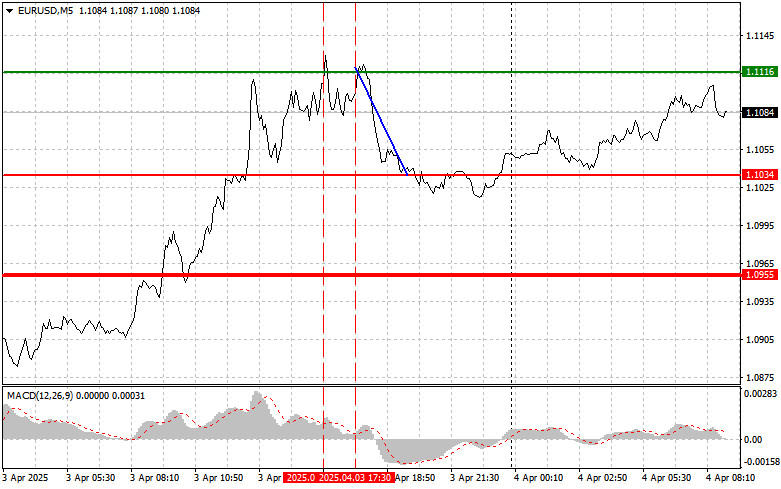

Analytické predpovedeEUR/USD: jednoduché obchodné tipy pre začiatočníkov na 4. apríla. Analýza včerajšieho obchodovania na forexovom trhu

Analýza obchodov a tipy na obchodovanie s eurom Cena otestovala úroveň 1,1116, keď indikátor MACD už výrazne vzrástol nad nulu, čo obmedzilo potenciál páru rásť. Z tohto dôvodu som euroAutor: Jakub Novak

19:37 2025-04-04 UTC+2

3

- Bitcoinu a ethereu sa opäť podarilo odolať výraznému tlaku, ktorý na ne bol včera v druhej polovici dňa vyvíjaný po výraznom výpredaji na americkom akciovom trhu, ktorý je v čoraz

Autor: Miroslaw Bawulski

12:01 2025-04-04 UTC+2

0

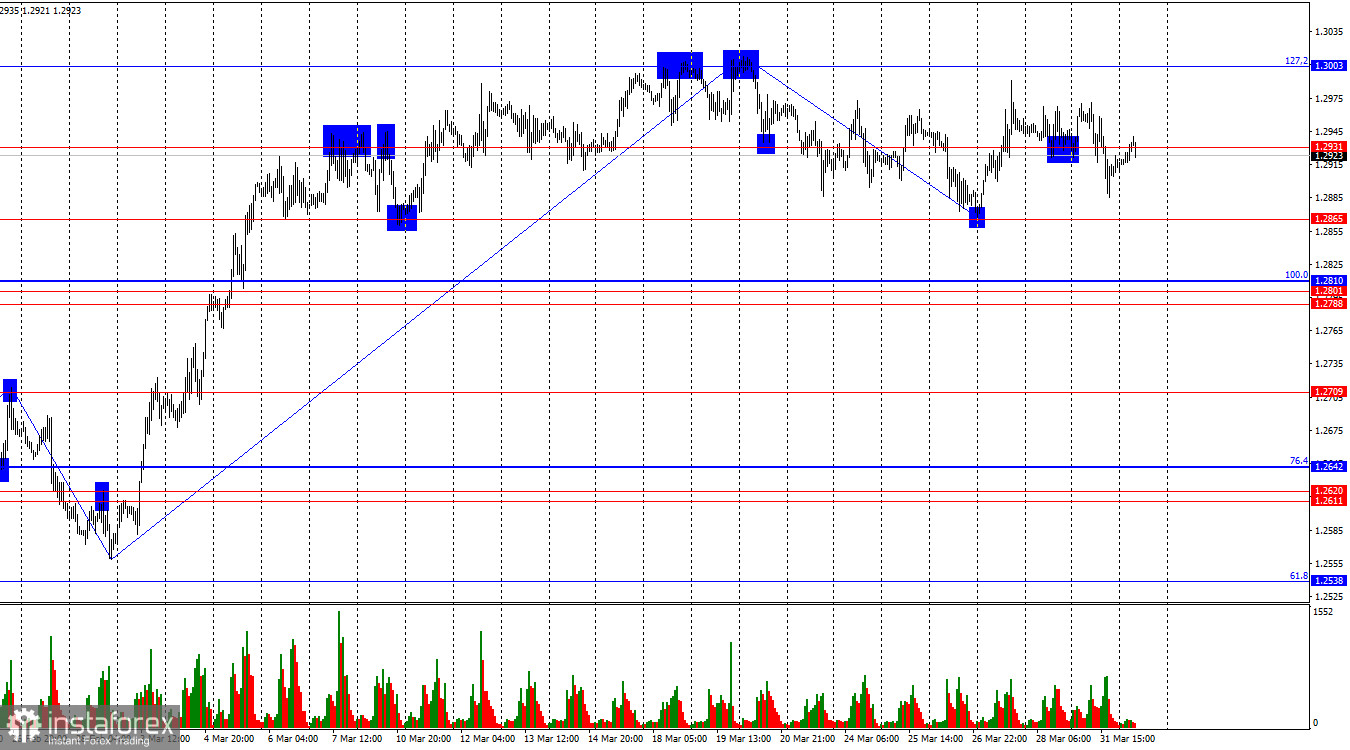

Obchodný plánAko obchodovať s párom GBP/USD 4. apríla? Jednoduché tipy a analýza transakcií pre začiatočníkov

Analýza štvrtkových obchodov: 1-hodinový graf páru GBP/USD Pár GBP/USD vo štvrtok tiež zaznamenal silný pohyb smerom nahor. Všetko, o čom sa hovorí v článkoch týkajúcich sa eura, platí rovnakoAutor: Paolo Greco

11:44 2025-04-04 UTC+2

2

Obchodný plánAko obchodovať s párom EUR/USD 4. apríla? Jednoduché tipy a analýza transakcií pre začiatočníkov

Analýza štvrtkových obchodov: 1-hodinový graf páru EUR/USD Menový pár EUR/USD zaznamenal vo štvrtok silný rast. Táto situácia mala len jeden dôvod: Donald Trump. To už nie je žiadna novinka, keďžeAutor: Paolo Greco

11:43 2025-04-04 UTC+2

3

- Na konci včerajšej riadnej seansy skončili americké akciové indexy v kladnom pásme. Index S&P 500 vzrástol o 0,67 %, Nasdaq 100 o 0,87 % a Dow Jones Industrial Average

Autor: Jakub Novak

15:29 2025-04-03 UTC+2

0

Bitcoin a ethereum rástli ešte pred Trumpovým rozhodnutím a oznámením obchodných ciel, ale po ňom sa tlak na rizikové aktíva výrazne zvýšil. Ťažko povedať, či novo oznámené clá priamo ovplyvňujúAutor: Miroslaw Bawulski

15:28 2025-04-03 UTC+2

0

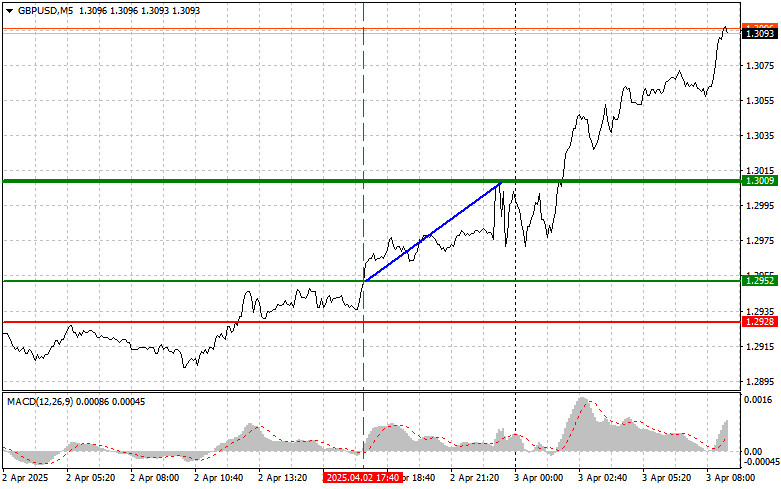

Analytické predpovedeGBP/USD: jednoduché obchodné tipy pre začiatočníkov na 3. apríla. Analýza včerajšieho obchodovania na forexovom trhu

Analýza obchodov a tipy na obchodovanie s britskou librou Cena otestovala úroveň 1,2952, keď indikátor MACD začal rásť z nuly. To bolo potvrdením, že táto úroveň je vhodným vstupným bodomAutor: Jakub Novak

14:31 2025-04-03 UTC+2

2