Outlook on January 8:

Analytical overview of major pairs on the H1 TF:

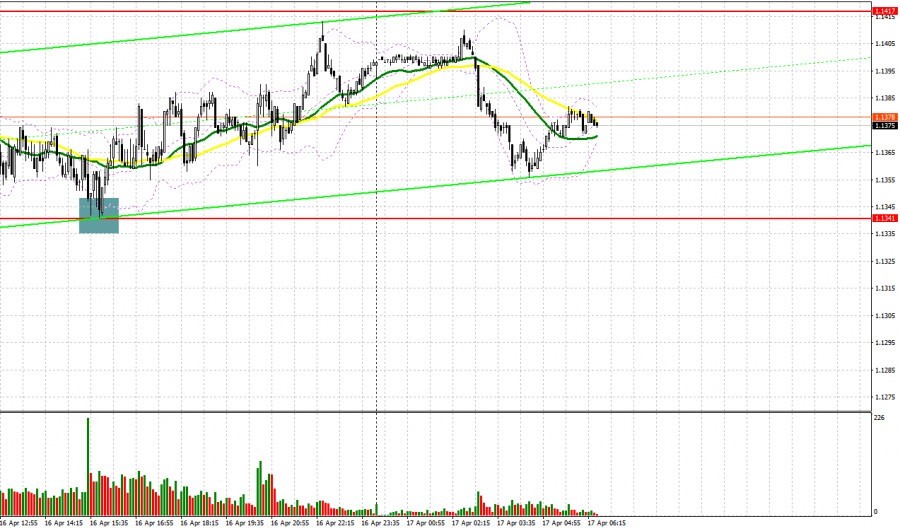

The key levels for the euro/dollar pair are 1.2347, 1.2310, 1.2286, 1.2239, 1.2209, 1.2171 and 1.2142. The price of the pair is forming a potential for the low of January 7. In this case, short-term downward movement is expected in the range of 1.2239 - 1.2209. If the last value breaks down, it will lead to a strong decline towards the target of 1.2171. The next potential target to decline is the level of 1.2142. Upon reaching which, price consolidation and upward pullback can be expected.

Short-term growth, in turn, is possible in the range of 1.2286 - 1.2310. If the last value breaks down, it will encourage the formation of an upward pattern. The first potential upward target is 1.2347.

The main trend is building potential for the January 7 low

Trading recommendations:

Buy: 1.2286 Take profit: 1.2308

Buy: 1.2311 Take profit: 1.2345

Sell: 1.2237 Take profit: 1.2210

Sell: 1.2207 Take profit: 1.2173

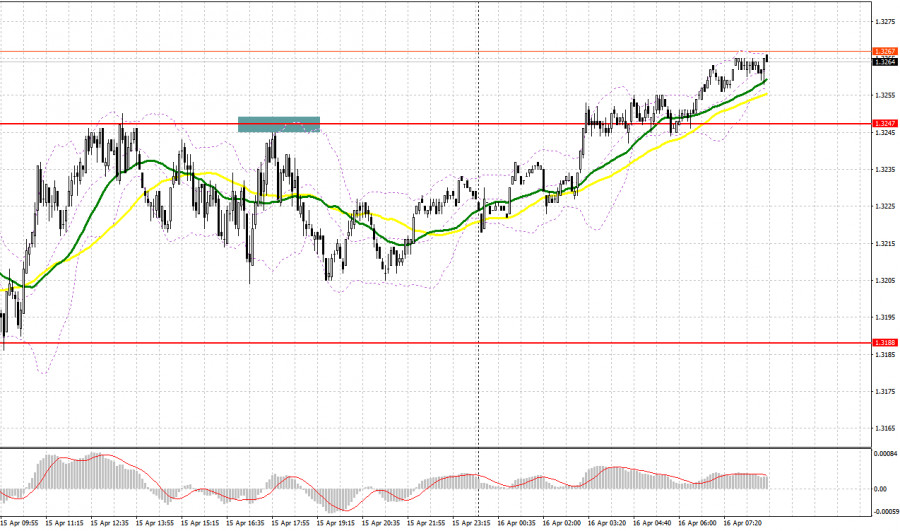

The key levels for the pound/dollar pair are 1.3704, 1.3666, 1.3620, 1.3530, 1.3480, 1.3418 and 1.3376. Following the price's formation of a potential from January 4's downward trend, we expect the downward movement to continue after the breakdown of 1.3530. In this case, the target is 1.3480 and consolidation is near this level. If the target breaks down, it will lead to a strong decline towards the target of 1.3418. The next potential target to decline is the level of 1.3376. After reaching this level, price consolidation and upward pullback can be expected.

Meanwhile, correction is expected to end after the breakdown of 1.3620, with the target of 1.3666. There is consolidation near this level. The price passing this level will encourage the formation of an upward trend. In this case, the first potential upward target is 1.3704.

The main trend is the downward trend from January 4

Trading recommendations:

Buy: 1.3620 Take profit: 1.3662

Buy: 1.3667 Take profit: 1.3704

Sell: 1.3530 Take profit: 1.3482

Sell: 1.3478 Take profit: 1.3420

The key levels for the dollar/franc pair are 0.8966, 0.8933, 0.8909, 0.8876, 0.8842, 0.8824 and 0.8800. Following the upward trend from January 6, we expect the upward movement to continue after the breakdown of 0.8876, with the target of 0.8909. On the other hand, there is a short-term growth and consolidation in the range of 0.8909 - 0.8933. The potential upward target is the level of 0.8966. Upon reaching which, price consolidation and downward pullback are possible.

On another note, short-term decline is possible in the range of 0.8842 - 0.8824. If the last value breaks down, a deep correction will occur. Here, the potential target is 0.8800, which is the key support level for growth.

The main trend is the upward trend from January 6

Trading recommendations:

Buy: 0.8877 Take profit: 0.8909

Buy: 0.8911 Take profit: 0.8931

Sell: 0.8841 Take profit: 0.8825

Sell: 0.8822 Take profit: 0.8800

The key levels for the dollar/yen are 104.84, 104.66, 104.34, 104.13, 103.79, 103.66 and 103.40. Following the development of the upward trend from January 6, we expect a short-term upward movement in the range of 104.13 - 104.34. If the last value breaks down, it should be accompanied by a strong growth towards the next target of 104.66. This will be followed by the potential upward target at 104.84. Upon reaching which, price consolidation and downward pullback are expected.

Short-term decline is expected in the range of 103.79 - 103.66. If the last value breaks down, a deep correction will occur, with the target of 103.45. This is the key support level for the upward trend from January 6.

The main trend is the upward trend from January 6

Trading recommendations:

Buy: 104.14 Take profit: 104.32

Buy: 104.36 Take profit: 104.65

Sell: 103.79 Take profit: 103.66

Sell: 103.64 Take profit: 103.43

The key levels for the USD/CAD pair are 1.2800, 1.2725, 1.2692, 1.2644, 1.2600, 1.2548, 1.2508 and 1.2458. Following the formation of the downward trend from January 4, we expect the downward movement to continue after the breakdown of 1.2644, with the target of 1.2600. There is consolidation near this level. If the target breaks down, it will lead to a strong decline towards the target of 1.2548. Meanwhile, there is a short-term decline and consolidation in the range of 1.2548 - 1.2508. The potential downward target is the level 1.2458. Upon reaching which, an upward pullback is possible.

A short-term growth, on the contrary, is expected in the range of 1.2692 - 1.2725. If the last value breaks down, it will favor the development of an upward trend. In this case, the potential target is 1.2800.

The main trend is the formation of a downward trend from January 4

Trading recommendations:

Buy: 1.2692 Take profit: 1.2725

Buy: 1.2728 Take profit: 1.2800

Sell: 1.2644 Take profit: 1.2602

Sell: 1.2598 Take profit: 1.2548

The key levels for the AUD/USD pair are 0.7696, 0.7921, 0.7884, 0.7832, 0.7770, 0.7736, 0.7697 and 0.7642. Following the local bullish trend from January 4, we expect the upward movement to continue after the breakdown of 0.7832, with a target of 0.7884. At the same time, there is a short-term growth and consolidation in the range of 0.7884 - 0.7921. The potential upward target is the level of 0.7969. If this level is reached, a downward pullback can be expected.

In turn, short-term decline is expected in the range of 0.7770 - 0.7736 If the last value breaks down, a deep correction will occur. The target is 0.7697, which is the key support level for growth from January 4.

The main trend is the local upward trend of January 4

Trading recommendations:

Buy: 0.7832 Take profit: 0.7884

Buy: 0.7886 Take profit: 0.7920

Sell: 0.7734 Take profit: 0.7698

Sell: 0.7695 Take profit: 0.7643

The key levels for the euro/yen pair are 128.82, 128.37, 128.07, 127.62, 127.07, 126.72 and 126.43. Following the development of the upward trend from January 5, we expect the upward movement to continue after the breakdown of 127.62, with the target of 128.07. Moreover, short-term growth and consolidation are observed in the range of 128.07 - 128.37. Here, the next potential upward target is the level of 128.82. Upon reaching which, price consolidation and downward pullback are possible.

On the other hand, short-term decline is expected in the range of 127.07 - 127.72. If the last value breaks down, a deep movement will occur. The target is 126.43, which is the key support level for growth.

The main trend is the upward trend from January 5

Trading recommendations:

Buy: 127.62 Take profit: 128.07

Buy: 128.10 Take profit: 128.35

Sell: 127.05 Take profit: 126.80

Sell: 126.72 Take profit: 126.46

The key levels for the pound/yen pair are 143.04, 142.10, 141.41, 140.32, 139.63 and 138.88. Following the price's local upward trend from January 5 high, we expect a short-term growth and consolidation in the range of 141.41 - 142.10. In this case, the potential upward target is the level of 143.04. Upon reaching which, price consolidation and downward pullback can be expected.

Short-term decline, in turn, is expected in the range of 140.32 - 139.63. The breakdown of the last value will encourage the formation of a potential for a downward trend. In this case, the first target is 138.88.

The main trend is the upward trend from December 21 & the local upward trend from January 5

Trading recommendations:

Buy: 141.43 Take profit: 142.08

Buy: 142.12 Take profit: 143.04

Sell: 140.32 Take profit: 139.80

Sell: 139.61 Take profit: 138.90

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Benefíciese de las recomendaciones de los analistas ahora mismo

Recargue su cuenta de operaciones

Abra una cuenta de operaciones

¡Los informes analíticos de InstaSpot lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaSpot, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.