¡Nuestro equipo cuenta con más de 7,000,000 operadores!

Cada día, trabajamos juntos para mejorar las operaciones. Obtenemos grandes resultados y seguimos adelante.

El reconocimiento de millones de operadores en todo el mundo es el mejor agradecimiento a nuestro trabajo! ¡Usted hizo su elección y haremos todo lo que esté a nuestro alcance para satisfacer sus expectativas!

¡Juntos somos un gran equipo!

InstaSpot. ¡Orgulloso de trabajar para usted!

¡Actor, 6 veces ganador del torneo UFC y un verdadero héroe!

El hombre que se hizo a sí mismo. El hombre que sigue nuestro camino.

El secreto detrás del éxito de Taktarov es el constante movimiento hacia el objetivo.

¡Revele todo los lados de su talento!

Descubra, intente, fracase, ¡pero nunca se rinda!

InstaSpot. ¡Su historia de éxito comienza aquí!

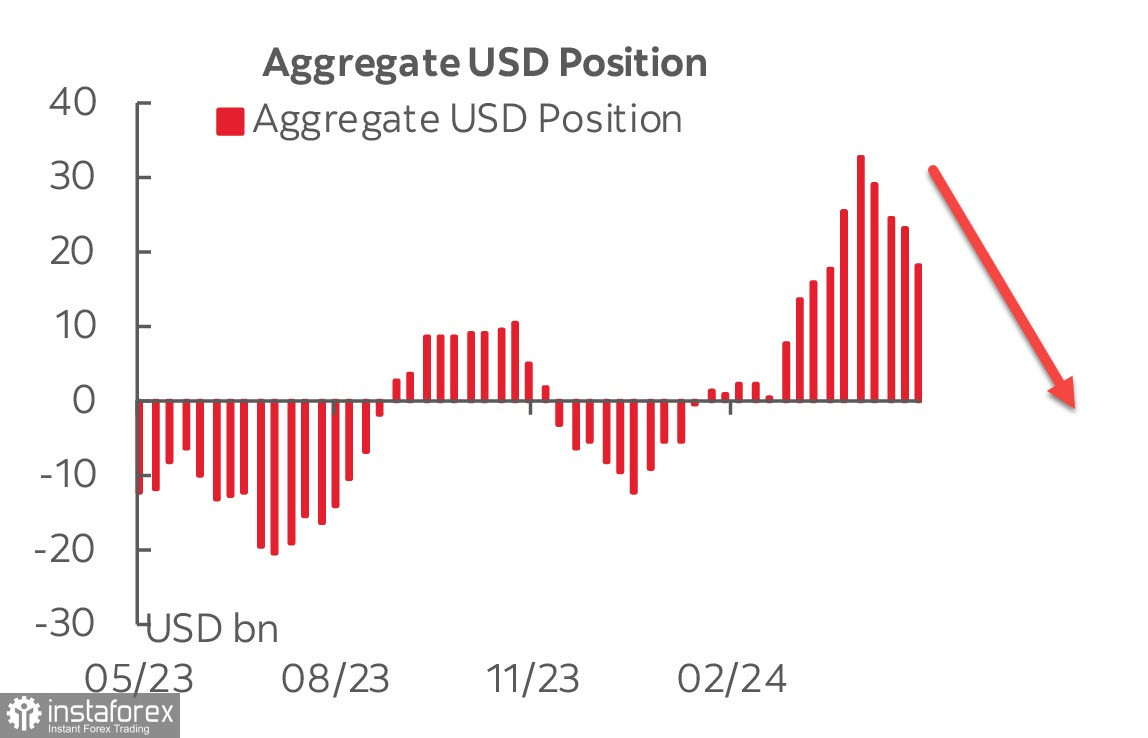

The latest CFTC report brought no surprises—the net speculative long position in the U.S. dollar has been declining for the fourth consecutive week.

The greenback lost almost $5 billion, bringing the total bullish bias down to $18.3 billion. The biggest surprise was the pace of recovery in long positions for the euro (+$3.3 billion) and the British pound (+$1.66 billion). There was also a notable increase in demand for gold, with a weekly growth in long positions of +$7.4 billion, bringing the total to $55.6 billion. The rising demand for gold is an indirect sign of declining interest in the dollar.

The main driver of changes in demand for the dollar is the Federal Reserve's interest rate forecast, which directly impacts yield. The likelihood that the Fed will decide to lower rates this summer is decreasing, and CME futures have already started to shift the rate cut forecast from September to November.

The obvious explanation for this is the belief that the economy is not cooling as much as the Fed would like. Last week's data suggests that economic growth is stable while inflation is easing very slowly. Weekly jobless claims show that companies are not increasing the pace of layoffs, growth in the services sector and manufacturing (PMI from S&P Global) is above forecasts, and inflation is easing at a very slow pace.

Furthermore, the situation is not as straightforward. According to official estimates from the Bureau of Labor Statistics, inflation has sharply decreased from its peak of 9% in mid-2022. It currently stands at 3.4%, which roughly corresponds to the level seen over a quarter-century from 1983 to 2008. However, inflation is calculated on a one-year interval, and if we take a longer period, such as from the beginning of President Biden's term, the picture looks quite alarming.

Fed Chairman Jerome Powell and his colleagues have emphasized the need for more evidence that inflation is on a sustainable path to the 2% target before it decides to lower the key interest rate, which has been at its highest level in two decades since July. Is it on this path? If we look at the annual rate, the decline has clearly stalled in the 3.3-3.5% range. If we consider the four-year rate, there is no progress at all.

The Personal Consumption Expenditures (PCE) price index will be released on Friday, with an expected increase of 2.7% year-on-year and 2.8% for the core index. The PCE report could change the overall perception of inflation dynamics and adjust forecasts. At first glance, higher inflation should support the dollar, as it implies higher yields, but this only works if the economy is growing steadily. Apparently, investors are considering the growing threat of stagflation, the increasing risks as elections approach, and the rising budget deficit, which will require the issuance of $1-1.5 trillion in bonds over the next few months, a task that will be extremely challenging.

The dollar remains under pressure despite higher yields.

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

¡Los informes analíticos de InstaSpot lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaSpot, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.