¡La leyenda en el equipo de InstaSpot!

¡Leyenda! ¿Cree que es una retórica grandilocuente? Pero, ¿cómo deberíamos llamar a un hombre, que se convirtió en el primer asiático en ganar el campeonato mundial de ajedrez júnior a los 18 años y en el primer Gran Maestro indio a los 19 años? Ese fue el comienzo de un camino difícil hacia el título de Campeón del Mundo para Viswanathan Anand, el hombre que se convirtió en parte de la historia del ajedrez para siempre. ¡Ahora una leyenda más en el equipo de InstaSpot!

Borussia es uno de los clubes de fútbol con más títulos en Alemania, que ha demostrado repetidamente a los fanáticos: el espíritu de competencia y liderazgo que ciertamente conducirán al éxito. Opere de la misma manera que los profesionales del deporte: con confianza y de forma activa. ¡Mantenga un "pase" del Borussia FC y lidere con InstaSpot!

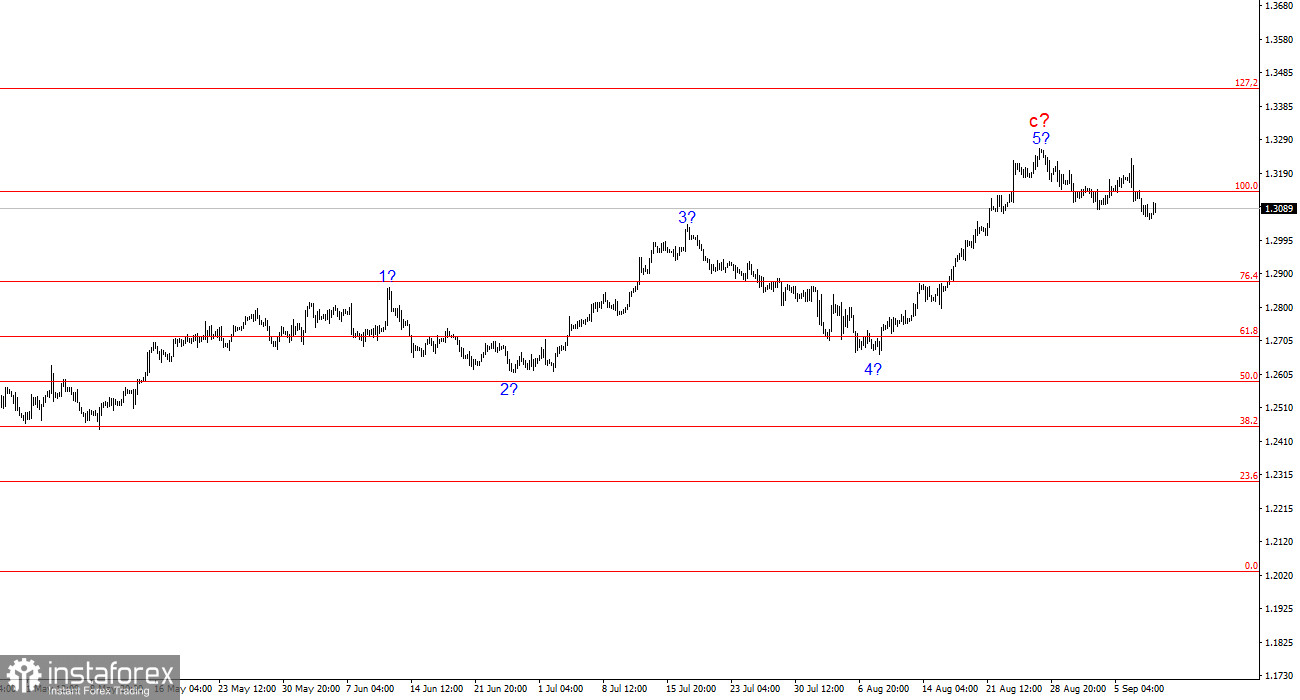

The wave pattern for GBP/USD remains quite complex and highly ambiguous. For a while, the wave picture looked convincing and suggested the formation of a downward wave set with targets below the 1.2300 level. However, in practice, demand for the U.S. dollar increased too significantly for this scenario to play out, and it continues to grow.

Currently, the wave pattern has become very complex. I should remind you that I prefer to use simple wave structures in my analysis, as complex ones often involve too many nuances and ambiguous moments. We recently saw another upward wave, which caused the pair to break out of the triangle. The current upward wave structure, which likely began on April 22, could extend further, as the market seems unlikely to settle until it fully digests the impact of the Fed's rate cuts. A three-wave corrective structure is now emerging, and the recent successful break of the 1.3142 level (equivalent to 100.0% Fibonacci) suggests the market is ready for at least a minor decline.

Sellers are struggling but remain resilient. The GBP/USD rate decreased slightly on Wednesday, which is a small drop. However, I should point out that this decline might not have occurred at all since the U.S. Consumer Price Index (CPI) came in weaker than the market expected. Inflation in August fell to 2.5%, while core inflation remained at 3.2%. In my view, the difference between 2.6% and 2.5% is minimal. However, the market has repeatedly responded by selling the dollar when inflation slows.

Despite this, demand for the U.S. dollar is still growing, which is good news because I expect the pair to continue declining. The five-wave upward structure has completed. Now, we should expect at least three corrective waves. Given the recent U.S. statistics, this seemed unlikely, but the situation is now clearly shifting in favor of the U.S. dollar.

It's worth noting that while the UK statistics yesterday were positive, today's figures were disappointing. Industrial production in the UK fell by 0.8% month-on-month, and GDP in July showed no growth, not even by 0.1%. The market had expected much stronger figures. In my view, the U.S. dollar will continue to strengthen, as I don't see any other path forward. The pound has been rising for too long, and the market has been pricing in the Fed's monetary easing for too long. Now, it seems more logical to take profits on trades opened at the start of the year.

General conclusions.

The wave pattern for GBP/USD still suggests a decline. If the upward section of the trend began on April 22, it has already formed a five-wave structure. Therefore, at the very least, we should now expect a three-wave correction. In my opinion, sales of the pair with targets around the 1.2627 level should be considered. However, sellers have already failed to hold the 1.3142 level once, and the upward wave structure could become endlessly complex with the current news background. Nonetheless, I expect a correction.

On a larger wave scale, the wave pattern has evolved. We can now assume the formation of a complex and extended upward corrective structure. At the moment, this is a three-wave structure, but it could develop into a five-wave structure, which could take several months or more to complete.

Key principles of my analysis:

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

¡Los informes analíticos de InstaSpot lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaSpot, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

Notificaciones

por correo electrónico y mensaje de texto

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.