- Mercados bursátiles

Mercado bursátil eal 15 de abril: los índices SP500 y NASDAQ frenan su crecimiento activo

Al término de la última sesión regular, los índices bursátiles estadounidenses cerraron al alza. El S&P 500 subió un 0,79% y el Nasdaq 100 aumentó un 0,64%. El Dow JonesAutor: Jakub Novak

10:57 2025-04-15 UTC+2

0

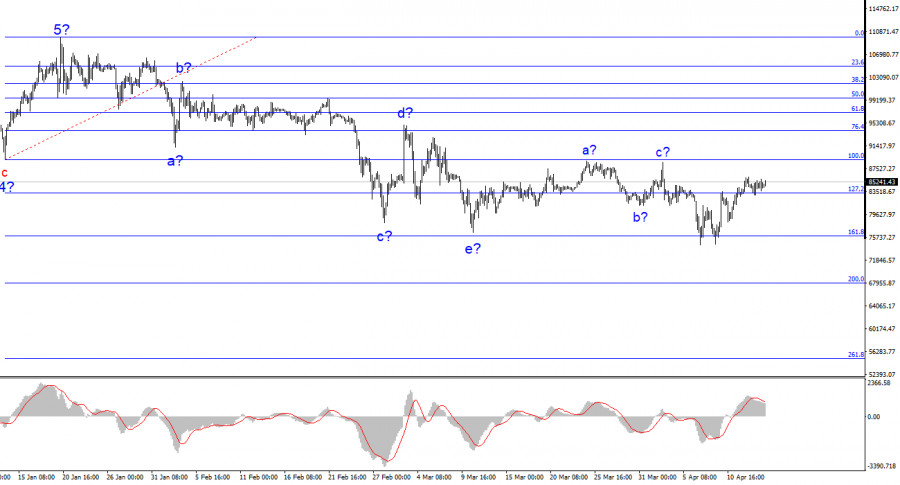

El conteo de ondas del gráfico de 4 horas para el par BTC/USD es completamente claro. Después de completar una fase alcista compuesta por cinco ondas completas, comenzó la formaciónAutor: Chin Zhao

08:06 2025-04-15 UTC+2

0

El Bitcoin se está recuperando, pero su potencial de crecimiento es limitado. Últimamente ha habido pocas noticias del mundo de las criptomonedas, y Donald Trump continúa imponiendo sanciones, arancelesAutor: Paolo Greco

07:13 2025-04-15 UTC+2

0

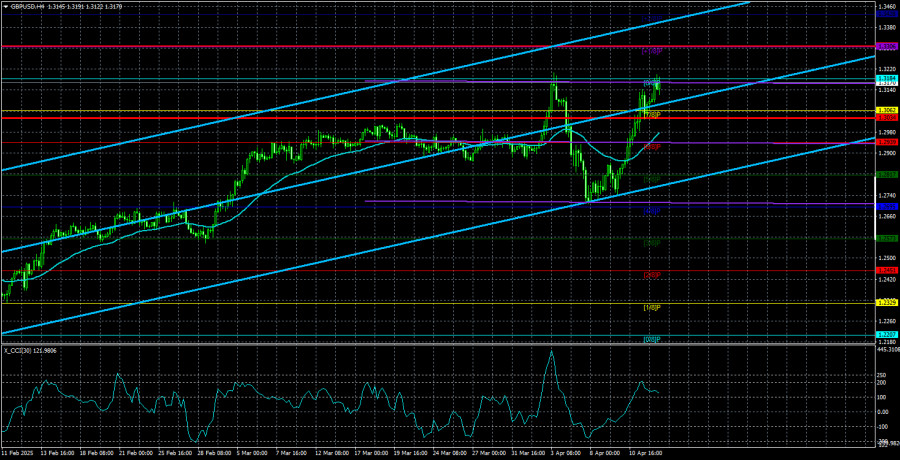

- El par GBP/USD también continuó su movimiento ascendente el lunes

Autor: Paolo Greco

07:13 2025-04-15 UTC+2

6

Análisis FundamentalAnálisis del par EUR/USD. El 15 de abril. ¿Quién y dónde encontró un motivo para el optimismo?

El par EUR/USD continuó su movimiento ascendente durante el lunes. Aunque esta vez no fue muy fuerte, pero ¿qué importa? si el par de todas formas sigue subiendo constantemente. AyerAutor: Paolo Greco

07:13 2025-04-15 UTC+2

6

La libra en el par con el dólar gana impulso activamente debido al debilitamiento de la moneda estadounidense. Un apoyo adicional para la libra británica pueden proporcionar los informes macroeconómicosAutor: Irina Manzenko

11:50 2025-04-14 UTC+2

19

- Noticias analíticas

Superando las previsiones: se pronostica que el oro subirá hasta los $3700. El dólar en desventaja, el euro al alza

El metal amarillo ha ocupado un lugar de honor entre los activos más demandados y no piensa detenerse en lo logrado. El precio del oro sigue creciendo con seguridad, superandoAutor: Larisa Kolesnikova

11:02 2025-04-14 UTC+2

17

El Bitcoin y el Ether mostraron una estabilidad bastante buena durante el fin de semana, preservando las posibilidades de una mayor recuperación. Y aunque desde un punto de vista técnicoAutor: Miroslaw Bawulski

09:17 2025-04-14 UTC+2

15

Mercados bursátilesMercado bursátil el 14 de abril: los índices SP500 y NASDAQ volvieron a crecer en medio de la flexibilización de los aranceles

Tras los resultados de la última sesión regular, los índices bursátiles estadounidenses cerraron con crecimiento. El S&P 500 subió un 1,81%, mientras que el Nasdaq 100 sumó un 2,06%Autor: Jakub Novak

09:17 2025-04-14 UTC+2

21