¡Nuestro equipo cuenta con más de 7,000,000 operadores!

Cada día, trabajamos juntos para mejorar las operaciones. Obtenemos grandes resultados y seguimos adelante.

El reconocimiento de millones de operadores en todo el mundo es el mejor agradecimiento a nuestro trabajo! ¡Usted hizo su elección y haremos todo lo que esté a nuestro alcance para satisfacer sus expectativas!

¡Juntos somos un gran equipo!

InstaSpot. ¡Orgulloso de trabajar para usted!

¡Actor, 6 veces ganador del torneo UFC y un verdadero héroe!

El hombre que se hizo a sí mismo. El hombre que sigue nuestro camino.

El secreto detrás del éxito de Taktarov es el constante movimiento hacia el objetivo.

¡Revele todo los lados de su talento!

Descubra, intente, fracase, ¡pero nunca se rinda!

InstaSpot. ¡Su historia de éxito comienza aquí!

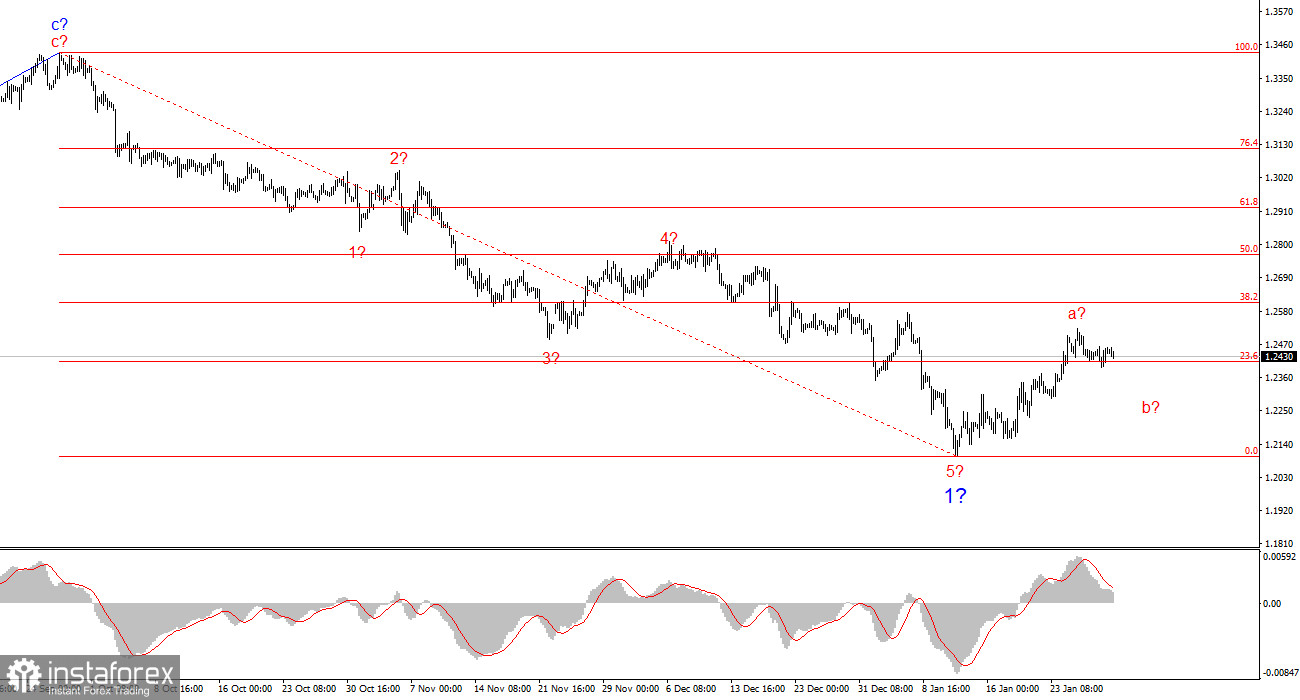

The wave structure of GBP/USD remains somewhat ambiguous but generally clear. Currently, there is a high probability of a long-term downtrend formation. The main question concerns the presumed wave 2 within 1, which appears unconvincing. Conversely, wave 5 looks more definitive, suggesting that the larger wave 1 may be complete. If this assumption is correct, a series of corrective waves is now forming, targeting levels near the 1.28 level.

Since the euro has likely begun forming a corrective structure, it is reasonable to expect the same for the pound. Additionally, it is important to note that the Bank of England is preparing for four rate cuts in 2025, while the Fed does not plan to cut rates by more than 50 basis points. The UK economy continues to disappoint market participants, while the U.S. economy strengthens confidence in the dollar. These factors should discourage mass dollar selling and excessive pound buying.

The GBP/USD pair declined by only 10 basis points by the start of the U.S. session on Thursday, with minimal market activity and low volatility.

Notably, the Federal Reserve's first policy meeting of the year concluded yesterday. While a market reaction was expected, it failed to materialize. Market participants found Powell's statements unremarkable, despite several key insights that should have fueled dollar demand.

Despite these hawkish signals, the market did not react by increasing dollar demand. Instead, GBP/USD continued its corrective wave formation, pushing the pair higher, contradicting the fundamental backdrop. The b wave within 2 appears unconvincing, suggesting that a stronger decline is still possible. However, any downside is likely to be limited, followed by another leg higher, possibly unrelated to economic data.

The wave structure suggests that the GBP/USD downtrend is still in progress, with wave 1 now complete. The market is expected to form a corrective wave or a set of corrective waves, after which selling opportunities may arise. Initial corrective target at 1.26 level. More extended correction at 1.28 level. Currently, the market may be finalizing the first wave within wave 2

On a higher timeframe, the wave structure has evolved, now indicating a downtrend formation. The previous three-wave bullish cycle appears complete. If this assumption holds, the next phase should be a corrective wave 2 or b, followed by an impulsive wave 3 or c, signaling renewed downside momentum.

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

¡Los informes analíticos de InstaSpot lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaSpot, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Club InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.