¡La leyenda en el equipo de InstaSpot!

¡Leyenda! ¿Cree que es una retórica grandilocuente? Pero, ¿cómo deberíamos llamar a un hombre, que se convirtió en el primer asiático en ganar el campeonato mundial de ajedrez júnior a los 18 años y en el primer Gran Maestro indio a los 19 años? Ese fue el comienzo de un camino difícil hacia el título de Campeón del Mundo para Viswanathan Anand, el hombre que se convirtió en parte de la historia del ajedrez para siempre. ¡Ahora una leyenda más en el equipo de InstaSpot!

Borussia es uno de los clubes de fútbol con más títulos en Alemania, que ha demostrado repetidamente a los fanáticos: el espíritu de competencia y liderazgo que ciertamente conducirán al éxito. Opere de la misma manera que los profesionales del deporte: con confianza y de forma activa. ¡Mantenga un "pase" del Borussia FC y lidere con InstaSpot!

There are very few macroeconomic events scheduled for Tuesday, and all of them are of secondary importance. At first glance, Germany's GDP report might seem significant, but this release is actually the third and final estimate for the fourth quarter. While the actual figure may be revised upward, even an improvement to -0.1% would still indicate economic contraction. Given the current state of the German economy, it is unlikely that there will be robust growth figures. Therefore, this report is not expected to provide support for the euro. In the UK, the EU, and the U.S., there are no notable economic reports planned, not even secondary ones.

On Tuesday, several key events will take place, including speeches from representatives of the European Central Bank and the Bank of England, namely Huw Pill and Isabel Schnabel, as well as Federal Reserve officials Thomas Barkin and Lorie Logan. However, as we have previously noted, the market currently has no urgent questions regarding monetary policy, as all three central banks have clearly communicated their positions. The only potential change could come from the BoE, which may reassess its stance on interest rates in light of the latest inflation report. It is important to mention that the BoE should now prioritize concerns about economic growth over inflation. Nevertheless, Pill's speech, as the Chief Economist of the BoE, stands out as the most intriguing fundamental event of the day.

On the second trading day of the week, low volatility is the most likely scenario. Fundamental drivers are expected to remain weak, and macroeconomic data is predicted to be even weaker. Currently, the British pound is experiencing a local upward trend, while the euro seems to be rising without solid justification. We anticipate that these local trends will soon come to an end, as there are no strong reasons—particularly for the euro—to sustain its growth.

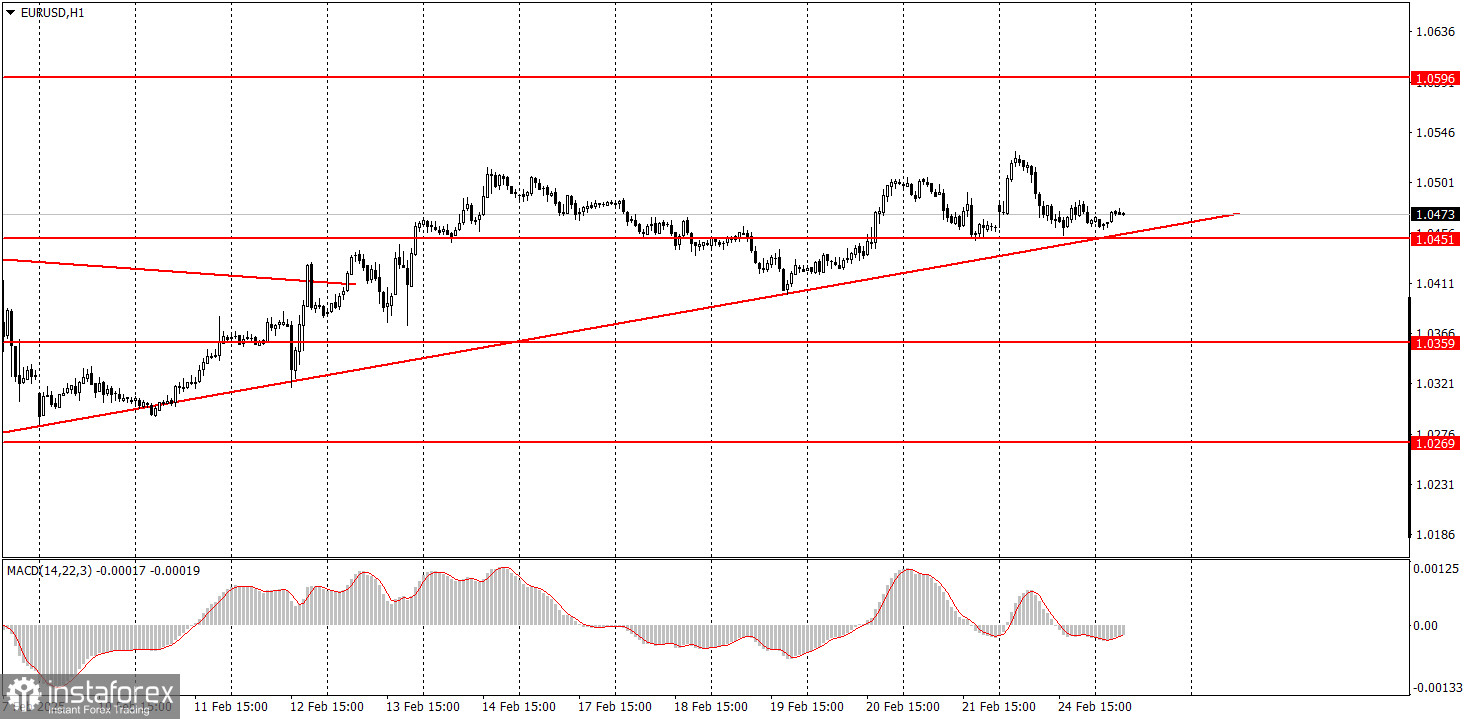

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

¡Los informes analíticos de InstaSpot lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaSpot, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

Ferrari F8 TRIBUTO

de InstaForex

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.