¡Nuestro equipo cuenta con más de 7,000,000 operadores!

Cada día, trabajamos juntos para mejorar las operaciones. Obtenemos grandes resultados y seguimos adelante.

El reconocimiento de millones de operadores en todo el mundo es el mejor agradecimiento a nuestro trabajo! ¡Usted hizo su elección y haremos todo lo que esté a nuestro alcance para satisfacer sus expectativas!

¡Juntos somos un gran equipo!

InstaSpot. ¡Orgulloso de trabajar para usted!

¡Actor, 6 veces ganador del torneo UFC y un verdadero héroe!

El hombre que se hizo a sí mismo. El hombre que sigue nuestro camino.

El secreto detrás del éxito de Taktarov es el constante movimiento hacia el objetivo.

¡Revele todo los lados de su talento!

Descubra, intente, fracase, ¡pero nunca se rinda!

InstaSpot. ¡Su historia de éxito comienza aquí!

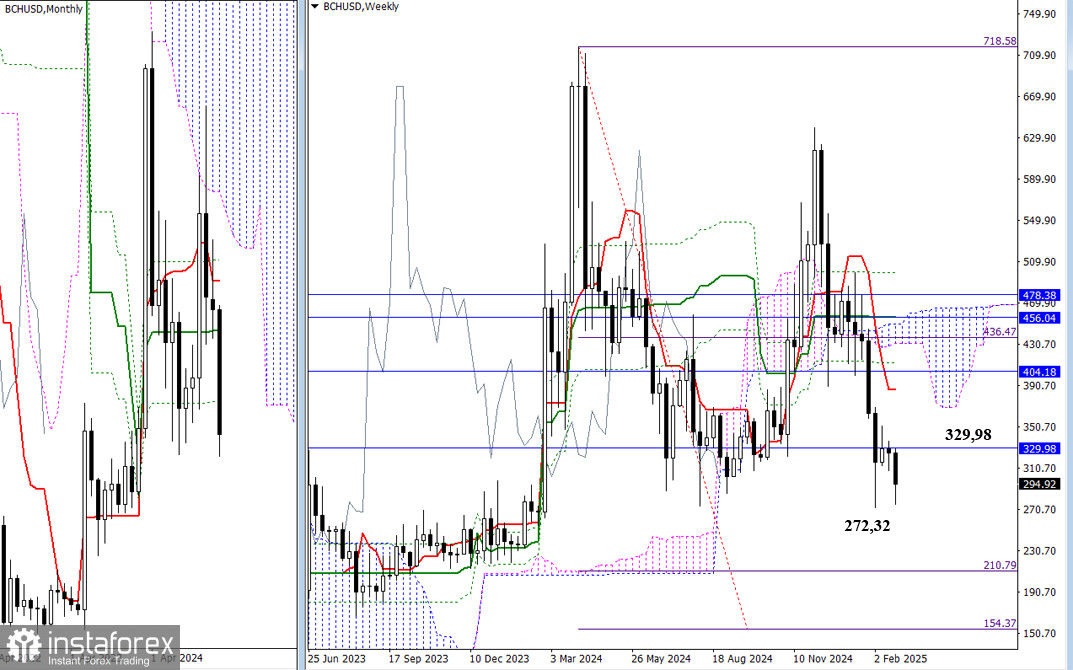

The attempt to update the lowest extremum of 272.32 and restore the downtrend has not yet been achieved by bullish players. Without clear results, no new prospects can be identified. In this part of the chart, the next bearish target is the weekly objective of breaking through the Ichimoku cloud, which ranges from 154.37 to 210.79. If the bears are unsuccessful, the bulls will continue to operate within the influence zone of the final level indicated by the monthly Ichimoku cross at 329.98.

On the daily timeframe, around the monthly boundary of 329.98, there are several daily resistance levels: 304.58, 324.96, 341.22, and 357.47. Any of these levels could contribute to the restoration of bearish positions, while new bullish opportunities will only arise after the daily Ichimoku dead cross is eliminated.

On lower timeframes, the upward correction has gradually led the market to test key reference points. Currently, the market is interacting with the central daily Pivot level at 294.08, and further correction could target the weekly long-term trend level of 307.02. A breakout here might shift the existing balance of power. Additionally, intraday resistance levels for bullish players are found at the classic Pivot levels of 303.90, 309.64, and 319.46. If the corrective rise comes to an end, there will likely be a strengthening of bearish sentiment, particularly if support at the classic Pivot levels of 288.34, 278.52, and 272.78 is broken down.

***

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

¡Los informes analíticos de InstaSpot lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaSpot, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.