US stock indices, including S&P 500 and Nasdaq, lose more than 5%

After a sharp sell-off on Wall Street that sent the Nasdaq 100 into its deepest plunge since 2022, markets are beginning to recover. Futures on the S&P 500 rose by 0.3% after an early 1% dip, and US Treasury yields started to climb. However, investors remain on edge as tariff wars, government spending cuts, and geopolitical tensions threaten US economic growth. European stock indices and the Nasdaq 100 also bounced back slightly, but nerves remain as many fear this is just a short-term breather.

Asian markets continued their decline, pushing Hong Kong and China stock indices to five-week lows. In China, however, investors are ramping up investments, with local players buying stocks in anticipation of government stimulus measures. Chinese AI startup DeepSeek sparked a rally in the tech sector, fueling risk appetite among local investors. Against this backdrop, Citigroup downgraded US equities to "neutral," while China was upgraded to "overweight." Meanwhile, in Europe, HSBC upgraded European stocks (excluding the UK). Follow the link for details.

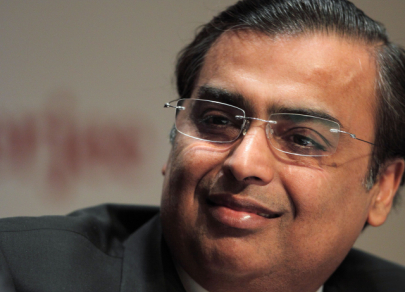

Trump to meet with major company leaders to calm markets amid uncertainty over tariffs and economic outlook

As the US stock market reels from sell-offs and recession fears, Donald Trump is preparing for an emergency meeting with corporate executives. Amid trade wars, tariffs, and growing pessimism, the White House is doing its best to show that the economy is not collapsing but is merely undergoing a "minor correction," as Trump himself believes. The meeting is expected to demonstrate the administration's "rock-solid confidence" in stability and reassure investors that everything is under control (although whether this will work remains uncertain). However, despite upbeat statements, markets continue to tremble under the weight of uncertainty as the trade war with China threatens global economic growth.

The meeting with the Washington-based Business Roundtable will test the resilience of Trump's economic strategy. Attendees include Chuck Robbins (Cisco Systems), Jamie Dimon (JPMorgan Chase), Jane Fraser (Citigroup), and other Wall Street financial magnates. Until recently, Trump's victory inspired optimism among bankers, but now, with tariffs hitting businesses and the economy slowing, even the most loyal executives are beginning to feel nervous. The banking sector is in turbulent waters. Will business leaders be able to restore market stability, or will this meeting be another panicked attempt to prevent the market from spiraling further? Follow the link for details.

US stock market loses $4 trillion in capitalization despite data showing resilient economy and low unemployment

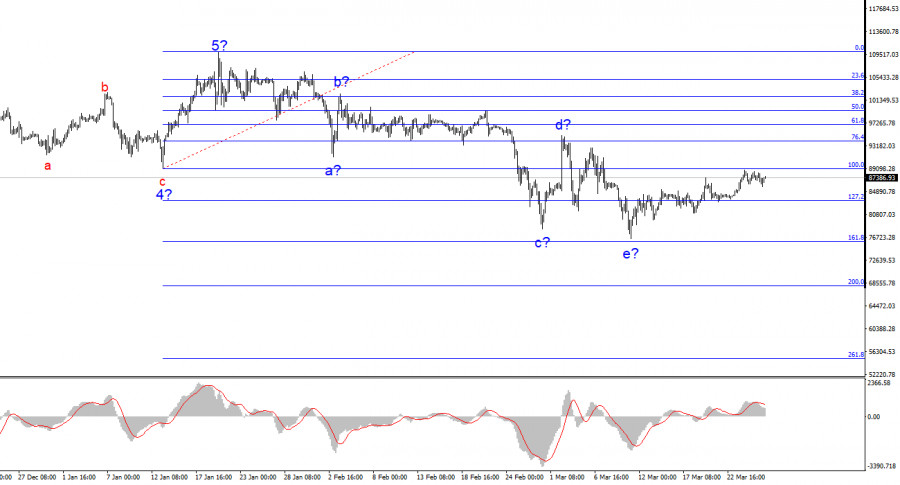

US stock indices went through their worst day in recent memory, losing $4 trillion in capitalization. The Nasdaq plummeted 4%, the S&P 500 dropped 2.7%, and the Dow Jones index fell 2.1%. Moreover, the S&P 500 broke below its 200-day moving average for the first time since November 2023. What caused the crash? Fears of a recession, slowing economic growth, and, of course, Donald Trump's comments suggesting that the United States is going through a "transitional period." In market terms, this means: get ready for even more chaos.

Large companies are not providing much relief either—Tesla (TSLA) lost 15% on weak sales in China and a lowered UBS price target of $225, while Nvidia (NVDA) dropped 5.1%, dragging down the entire tech sector. Microsoft (MSFT) lost 3.3%, and Apple (AAPL) fell 4.9%, confirming that investors are fleeing the mega-cap sector. Among the best performers were Redfin (RDFN), which soared 67.9% thanks to an acquisition by Rocket Companies (RKT), and Expand Energy (EXE), which gained 3.2% after being added to the S&P 500 index. US Treasury bonds became a safe-haven asset, with 10-year yields falling to 4.21% and 2-year yields sliding to 3.90%, marking the lowest since October. Follow the link for details.

Investors concerned about US administration's lack of clarity on potential recession

Donald Trump refused to rule out the possibility of a recession and advised against focusing on the stock market. Investors took this as a clear signal to flee, leading to the biggest sell-off in the NASDAQ 100 since 2022. The Magnificent Seven stocks plummeted by 20% from their December highs, and the VIX fear index soared above 30 for the first time since August. According to Nomura Securities, it is a bad sign if volatility continues to rise gradually rather than sharply—suggesting the market is bracing for a prolonged and painful downturn. Meanwhile, JP Morgan scrapped its S&P 500 forecast of 6,500, hinting that predicting anything is futile amid this uncertainty.

Against this backdrop, Citigroup and HSBC recommend reducing exposure to US equities and seeking opportunities abroad, where countries are focusing on fiscal stimulus rather than trade wars. China and Europe look much more attractive than the US, which still cannot decide whether it is facing a recession or a "transitional period." Meanwhile, recession forecasts in the US are soaring: Goldman Sachs raised the probability of an economic downturn to 20%, Yardeni Research to 35%, JP Morgan to 40%, and Morgan Stanley revised its GDP forecast to 1.5% for 2025 and 1.2% for 2026. It seems that the "transitional period" is going to be prolonged, so, investors, bear this in mind. Follow the link for details.

Tech giants Nvidia and Tesla under pressure, their weak performance reflects current market conditions

Investors are holding their breath: if inflation exceeds expectations, the Fed will remain hawkish and stocks will stay under pressure. Meanwhile, the stock market is in panic mode, with the Nasdaq falling 4% and the S&P 500 down 2.7%. Tesla (-15.4%), Nvidia (-5.1%), and Apple (-4.9%) continue to lose ground, with analysts revising their forecasts. Particular attention is now on Nvidia, which became a symbol of the AI boom but has now dropped 20% since the start of the year. Analysts at Melius Research lowered Nvidia's target price to $170 from $195, citing falling demand for chips and potential regulatory risks. The company's stock has become more affordable. Its P/E ratio has dropped from 81 to 38, but the big question remains: is this the bottom, or is another round of declines ahead?

Meanwhile, the S&P 500 broke below the 5,700 support level, paving the way for another drop to the 5,500 area. The RSI and MACD indicators are signaling oversold conditions, but fundamental factors are still weighing on the market. The key question remains: how much of an impact will inflation have? The upcoming data releases will determine the next move. Investors are pondering whether now is the time to enter the market or wait for it to stabilize. If you are unsure of your strategy, use expert advice from professionals to not just weather the turbulence but to make the most of it. Follow the link for details.

Benefíciese de las recomendaciones de los analistas ahora mismo

Recargue su cuenta de operaciones

Abra una cuenta de operaciones

¡Los informes analíticos de InstaSpot lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaSpot, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.