¡Nuestro equipo cuenta con más de 7,000,000 operadores!

Cada día, trabajamos juntos para mejorar las operaciones. Obtenemos grandes resultados y seguimos adelante.

El reconocimiento de millones de operadores en todo el mundo es el mejor agradecimiento a nuestro trabajo! ¡Usted hizo su elección y haremos todo lo que esté a nuestro alcance para satisfacer sus expectativas!

¡Juntos somos un gran equipo!

InstaSpot. ¡Orgulloso de trabajar para usted!

¡Actor, 6 veces ganador del torneo UFC y un verdadero héroe!

El hombre que se hizo a sí mismo. El hombre que sigue nuestro camino.

El secreto detrás del éxito de Taktarov es el constante movimiento hacia el objetivo.

¡Revele todo los lados de su talento!

Descubra, intente, fracase, ¡pero nunca se rinda!

InstaSpot. ¡Su historia de éxito comienza aquí!

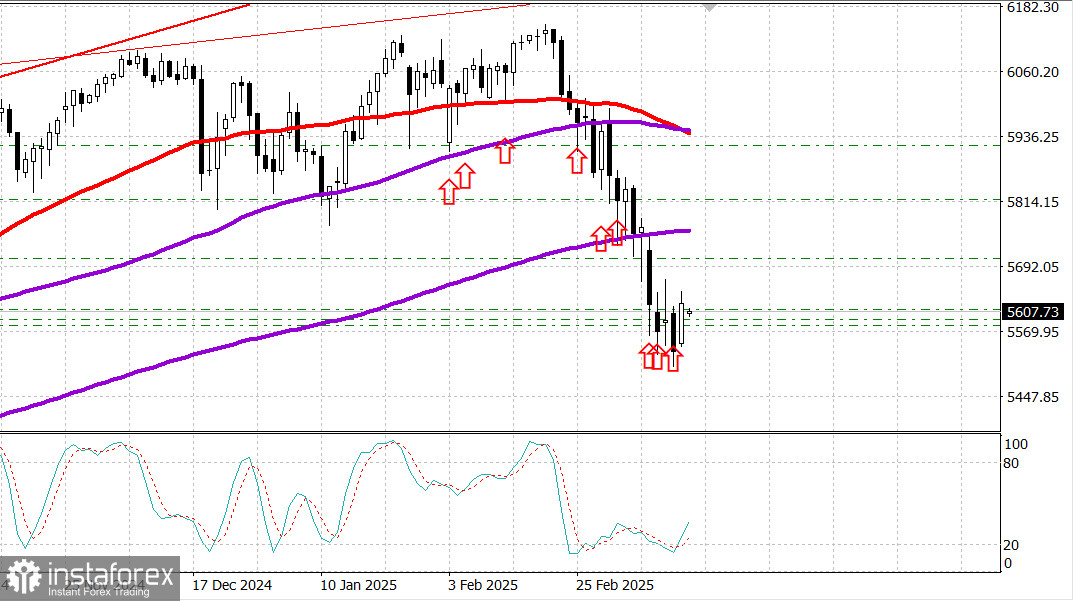

S&P 500

Market review on March 17

US Market: strong support formed for S&P 500

Major US indexes on Friday:

Dow +1.7%, Nasdaq +2.6%, S&P 500 +2.1%, S&P 500 is at 5,638, the range is 5,500–6,000.

The stock market showed strong growth at the end of the week, recovering after a recent decline.

The S&P 500 rose by 2.1%, the Dow Jones Industrial Average gained 674 points (+1.7%), and the Nasdaq Composite increased by 2.6%.

The positive price movement was largely driven by a "buy-the-dip" mentality after significant losses in recent sessions.

The main factors attracting buyers were:

Lower risk of a government shutdown, which became a buying trigger after Democratic Senator Chuck Schumer announced he would vote to maintain government funding despite opposition from most of his party.

Easing trade tensions between the US and Canada, following reports of a productive meeting between Ontario Premier Ford and US Trade Representative Tai.

Speculation about new stimulus measures in China, with expectations that the country will soon introduce financial incentives to boost domestic consumption.

On Thursday, the S&P 500 closed in correction territory, meaning it was 10% below its February 19 all-time high.

Mega-cap stocks provided strong support to indexes

Growth in the mega-cap sector played a key role in supporting the indexes.

NVIDIA (NVDA 121.67, +6.09, +5.3%) and Tesla (TSLA 249.98, +9.30, +3.9%) stood out in this sector. Even Ulta Beauty (ULTA 357.48, +43.01, +13.7%) and DocuSign (DOCU 85.76, +11.06, +14.8%), traded significantly higher amid the broad rally despite issuing disappointing forecasts.

ULTA cited consumer uncertainty and provided weak annual forecasts, while DOCU projected first-quarter and full-year revenue below consensus estimates.

The market largely ignored the weak economic report.

On Friday morning, the preliminary University of Michigan Consumer Sentiment Index for March dropped to 57.9 points (consensus 65.6 points) from February's final reading of 64.7 points, marking the third consecutive decline. A year ago, the index stood at 79.4 points.

However, some concerns remained, as gold prices traded above $3,001.00 per ounce, reflecting ongoing demand for safe-haven assets.

Elsewhere, the 10-year Treasury yield rose by 3 basis points to 4.31%, while the 2-year Treasury yield increased by 7 basis points to 4.02%.

Year-to-date performance:

Dow Jones Industrial Average: -2.5%

S&P 500: -4.1%

S&P Midcap 400: -6.2%

Nasdaq Composite: -8.1%

Russell 2000: -8.3%

Economic data overview:

March University of Michigan Consumer Sentiment Index (preliminary): 57.9 points (consensus 65.6 points), previous 64.7 points.

The key takeaway from the report is that weakening sentiment affected all demographic groups—across age, income, wealth, political views, and regions—driven by inflation concerns and policy uncertainty.

Looking ahead to Monday, market participants will receive the following data:

Empire State Manufacturing Index for March (forecast 5.7)

Retail Sales for February (forecast -0.9%)

Retail Sales Excluding Autos for February (forecast -0.4%) at 8:30 AM ET

January Business Inventories for January (forecast -0.2%)

NAHB Housing Market Index for March (forecast 42) at 10:00 AM ET

Energy:

Brent crude is trading at $71.20. Oil climbed above $71 amid a sharp reversal in the US market.

Conclusion:

It is important to note the US market's unusual behavior on Friday. Despite a highly negative consumer sentiment report—a key economic indicator—the market posted a sharp rally after a prior downtrend. This suggests that selling pressure has likely been exhausted, allowing for further gains. However, the US economy is showing clear signs of weakening, and the market is likely transitioning into a prolonged consolidation phase. It is wise to hold long positions from support levels.

Mikhail Makarov

More analytical articles:

https://www.instaforthtex.com/ru/forex_analysis/?x=mmakarov

https://www.instaspot.com/ru/forex_analysis/?x=mmakarov

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

¡Los informes analíticos de InstaSpot lo mantendrá bien informado de las tendencias del mercado! Al ser un cliente de InstaSpot, se le proporciona una gran cantidad de servicios gratuitos para una operación eficiente.

cuentas PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.